The COVID-19 crisis-induced stock market crash induced a lot of investors to dump their stock market holdings. Now they sit on cash, which earns nothing, and wonders whether to get back into the market or maybe find an alternative investment strategy.

With the U.S. economy falling into a deep recession, and conquering the virus remains a government priority, buying stock shares for capital gains is too risky. I have been telling my subscribers to expect another down leg in the bear market for the major stock market indexes.

Investors who have cashed out of the market have two basic choices. Choice one is to keep the money in cash and hope to time when stock prices will get on a more secure positive trend. The problem with this approach is that timing the market is always a challenge. Will you get back in too late and miss a lot of the gains as stock prices rally off the bottom? Or, will your timing not work out, and you get back into stocks just before the market rolls over into another down leg?

How Investors Are Using $25k Now to “Buy” $28,762 In Extra Annual Income for Retirement [ad]

The COVID-19 crisis is unprecedented. At this point, it is almost impossible to tell how individual companies will be affected by the shut-in of the economy. Most will survive, but no one can predict when they will get back to business levels that were experienced before the crisis.

I think you get my point that investing in the stock market now is more of a guess than an educated decision. Don’t despair: I have an alternative to leaving your money in cash to earn pennies in interest.

The preferred stock sits in the capital stack between common stock shares and corporate debt. Like bonds, preferred shares pay a fixed rate of cash return. In the case of preferreds, the payments are dividends instead of interest, but the concept is the same. Like commons stock shares, preferred shares do not have a maturity date. Preferreds are perpetual securities.

Companies issue preferred shares with a $25 par value and a pre-determined coupon rate. For example, a preferred with an 8% coupon will pay a $0.50 dividend every quarter. Two dollars a year divided by the par value gives an 8% yield. Just like common stock shares do, preferred shares trade on the stock exchanges.

Most of the time, when the economy and business conditions are normal, most preferreds will trade close to the $25 par value. Preferred shares are usually callable at par, so they don’t trade much above the $25 level.

However, when there is an across the board stock market crash like we recently experienced, preferred share prices will fall right along with common stocks. That has happened with this bear market and gives us the current opportunity. You can buy selected preferreds with now trading below $20. When the economy gets back on track, you can have confidence these shares will climb back up to $25. At the same time, the preferred dividends will be paid.

Consider an 8% coupon rate preferred priced at $20. The yield from $2.00 in annual dividends is 10%. A share price increase back to $25 gives a 20% capital gain. It is a good bet this hypothetical preferred stock could produce a 30% total return between now and the end of the year.

I’ve recently created a whole section of my Dividend Hunter portfolio to contain just preferred shares. There are about nine of them that I’m recommending my readers add to their portfolios to continue getting income during this bear market and pick up some nice share price gains when the economy and market recover. Click here for more about the Dividend Hunter and to get access to the new preferred shares portfolio and how you can make$3,764 in extra income if you take action this week.

When selecting preferred stocks, the primary focus is whether the issuing company will stay in business. A good indicator is that some level of common stock dividend continues.

Recently, RLJ Lodging Trust (RLJ), cut the common shares dividend from $0.33 down to a penny. That one cent dividend tells you the 10% yield on the RLJ Lodging Trust Preferred A (RLD.PA) is secure.

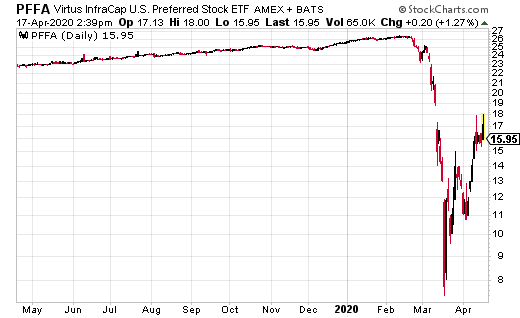

Preferred shares have fallen across the entire preferred universe. As a result, a preferred stock ETF is another way to play the potential for this type of investment.

The Virtus InfraCap U.S. Preferred Stock ETF (PFFA) has fallen from $26 to $16 per share. You can count on the 11% yield and expect the PFFA share price to recover into the mid $20s.