Plug Power (PLUG) leapt higher in trading Tuesday, approaching levels the stock last saw in 2014, as the company announced the completion of two acquisitions and raised financial targets going forward.

PLUG said it had completed acquisitions of United Hydrogen Group, Inc. and Giner ELX.

In a press release, the company said these acquisitions “enhance Plug Power’s position in the hydrogen industry with capabilities in generation, liquefaction and distribution of hydrogen fuel complementing its industry-leading position in the design, construction, and operation of customer-facing hydrogen fueling stations.”

The addition of the two acquisitions will also give a boost to PLUG’s revenue, as the company raised its 2024 revenue target from $1 billion to $1.2 billion. Plug Power also raised both operating income projections, from $170 million to $210 million, and adjusted EBITDA projections, from $200 million to $250 million.

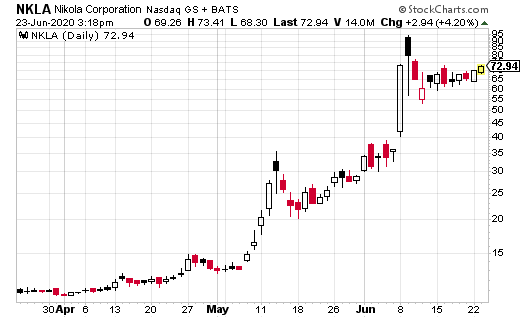

In addition to the recent acquisitions, PLUG has announced a plan with Lightning Systems to develop hydrogen-powered commercial trucks. Nikola Corporation (NKLA) has recently experienced eye-popping gains after coming public as a provider of hydrogen and electric based tractor trailers.

Related: NKLA Share Price Surges After IPO

Of the two acquisitions, Plug Power said United Hydrogen is the largest privately held merchant hydrogen producer in North America. United Hydrogen produces 6.4 tons of hydrogen each day, and the post-acquisition plan is to grow that capacity to 10 tons per day.

Giner ELX brings a strong European sales channel, as well as “one of the world’s largest, most efficient and cost-effective PEM hydrogen generators; grid-level renewable energy storage solutions, and on-site hydrogen generation systems for fuel cell vehicle refueling stations…”

Commenting on the two acquisitions, Andy Marsh, Plug Power CEO said, “Every decision we make is with an eye to the future, not the past. This closely aligns with the efforts that companies like United Hydrogen and Giner ELX have made to secure broad participation in the hydrogen economy, and to achieve the objectives of a clean environment and reduced dependence on foreign oil.”

Related: 3 Clean Air Stocks Doing Well During the Pandemic

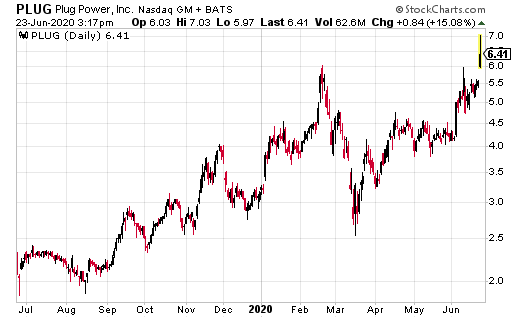

Plug Power stock dropped substantially in the market selloff in March. PLUG stock dropped from $6 to an intraday low of $2.53. The stock was recovering, and had traded up to $6, before the positive news sent the stock higher to touch $7.

CEO Marsh says Plug Power’s mission is to “build the modern clean hydrogen economy.”

Steven Adams’s personal position in Plug Power: none.