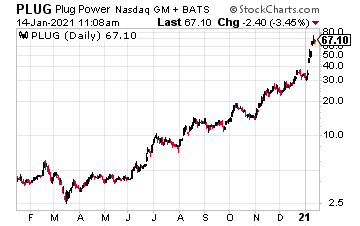

Plug Power (PLUG) gapped higher from $30 to the mid-$60s over the last few weeks.

For one, Goldman Sachs called green hydrogen a “once in a lifetime opportunity,” says Barron’s. Two, French automaker Renault just signed a memorandum of understanding to launch a 50-50 venture with PLUG in France by the end of 2021. They’ll target over 30% share of the fuel-cell powered light commercial vehicle market in Europe, says MarketWatch.

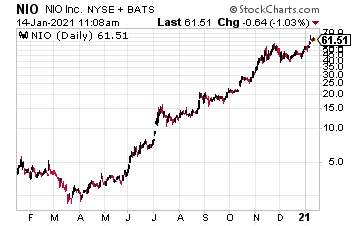

Nio Inc. (NIO) is still accelerating to new highs.

All thanks to an explosive electric vehicle market, a new unveil, and record deliveries.

Nio just unveiled a new EV luxury sedan, and a longer-range battery. In fact, it just launched its “first autonomous driving model, the NIO ET7, a smart electric flagship sedan. The ET7 has a pre-subsidy price from RMB 448,000 or RMB 378,000 with BaaS (Battery as a Service).”

Better, recent deliveries were explosive. For December and 2020 full-year delivery results. NIO delivered 7,007 vehicles in December, increasing by 32.4% month-over-month, setting a new record for five consecutive months, and by 121% year-over-year. For the full year, NIO delivered 43,728 vehicles in 2020, representing a year-on-year increase of 112.6%.

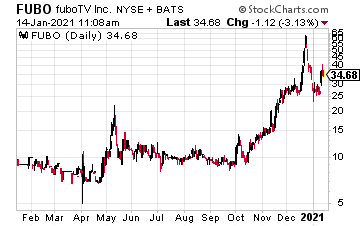

FuboTV Inc. (FUBO) was up about 9% earlier this week.

All on news it executed a binding letter of intent to acquire sports betting and interactive gaming company Vigtory. It also expects to launch a sportsbook this year.

“We believe online sports wagering is a highly complementary business to our sports-first live TV streaming platform,” said David Gandler, co-founder and CEO, fuboTV, as quoted in a company press release. “We don’t see wagering as simply an add-on product to fuboTV. Instead, we believe there is a real flywheel opportunity with streaming video content and interactivity. Our free to play gaming experience, which will be available to all consumers, will build further scale to fuboTV, essentially acting as another lead generator for driving subscribers to our streaming video platform and, ultimately, our sportsbook.”

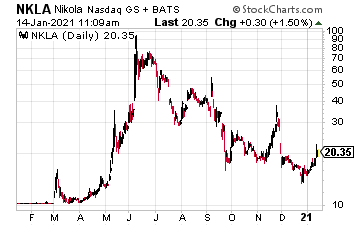

Nikola Corporation (NKLA) is up 14% after securing an electric rate schedule with the Arizona Public Service Company. This, according to a company press release, “makes possible the accelerated development of hydrogen-based fueling solutions for the transportation industry.”

Nikola President of Energy and Commercial, Pablo Koziner added, “Through this agreement, Nikola is assured a reliable and competitively priced source of electricity that will allow us to commence the development of hydrogen production facilities to serve the fueling needs of our truck customers. The agreement sets an important precedent in showcasing that innovative operational solutions can be developed for the economic production of hydrogen that maximize benefits to all stakeholders.”

At time of this writing, Ian Cooper did not hold a position in any of the stocks mentioned.