2021 is off to a bewildering start. While the world is mostly focused on what’s going on in Washington, the stock market has also been charting its own tortuous course. Stocks tend to be forward-looking, but it’s always interesting when there seems to be a major disconnect between what happens in the financial markets and the rest of the reality.

Photo Courtesy of FuelCell Energy

One notable development so far has been the explosive rise of fuel cell stocks. That’s not to say hydrogen fuel cell companies were left in the cold last year. However, we’re in the midst of a massive surge in investments in this industry.

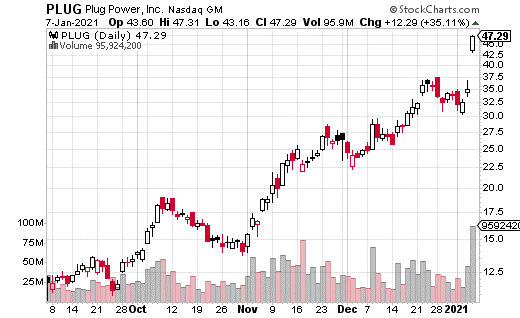

The surge was sparked by Plug Power (PLUG). The company announced that SK Group out of Korea would be taking a $1.5 billion stake. At $15 billion in market cap, that’s a huge deal for the de facto leader in the fuel cell space.

PLUG was up over 30% on the news, but it carried several others in the industry higher. Bloom Energy (BE) jumped 10% the same day and FuelCell Energy (FCEL) over 20%. Investors are certainly taking the PLUG deal as a boon for the industry as a whole.

But should investors be aggressive in buying fuel cell stocks? Let’s look at the pros and cons.

In the age of climate change concerns, carbon-based emissions are the biggest of those concerns. Hydrogen fuel-cells release water vapor (aka steam), so there’s no carbon involved. What’s more, there is essentially an infinite supply of hydrogen. That is, it’s absolutely a renewable energy source.

On the other side of things, the technology to collect and store hydrogen at a commercial level is still quite expensive. It’s not economically viable at this point and could be years before it becomes so. Who’s to say that by the time commercial fuel cells become achievable, there won’t be other/better means of providing clean fuel?

Of course, there are more pros and cons to fuel cells, but those are the primary arguments from either side. Regardless, it seems that the industry has run ahead of itself. The fuel cell companies don’t expect to be consistently profitable for years, yet their valuations are in the multi-billions.

If you like the idea of investing in a potential game-changing industry like fuel cells but are concerned about the risk, you may want to consider options. For example, on the day PLUG was up over 30%, over 150,000 puts traded on the name.

Puts make money (if you own them) if the stock goes down. Several traders who held the shares may have been protecting their gains by purchasing puts as a hedge.

It’s also possible that some traders were betting on PLUG pulling back after the big spike. In fact, a trader even purchased a block of over 2,500 1-day puts. That is, the puts expired the next day. With the stock at $46, these 45-strike puts were bought for $1.50. If the stock drops back down in the next day, this trade could have a substantial payoff.

The bottom line is using options on fuel cell stocks can be a really smart way to implement your trading strategies, regardless of your industry view.