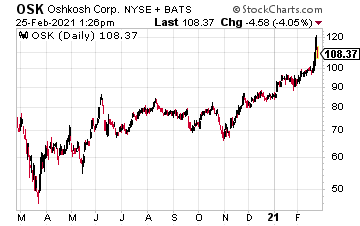

The USPS just awarded Oshkosh (OSK) $482 million to help modernize its fleet of delivery vehicles. On the news, OSK was up $5.84 a share.

According to USPS, “Under the contract’s initial $482 million investment, Oshkosh Defense will finalize the production design of the Next Generation Delivery Vehicle (NGDV) — a purpose-built, right-hand-drive vehicle for mail and package delivery — and will assemble 50,000 to 165,000 of them over 10 years.

The vehicles will be equipped with either fuel-efficient internal combustion engines or battery electric powertrains and can be retrofitted to keep pace with advances in electric vehicle technologies. The initial investment includes plant tooling and build-out for the U.S. manufacturing facility where final vehicle assembly will occur.”

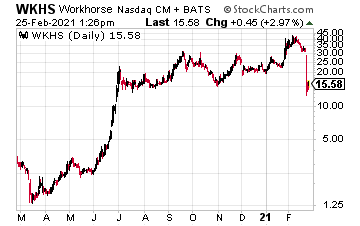

As a result of this decision, shares of Workhorse Group (WKHS) did pull back. The stock ran higher in recent months not only on the EV story, but on anticipation of it potentially winning this contract from USPS.

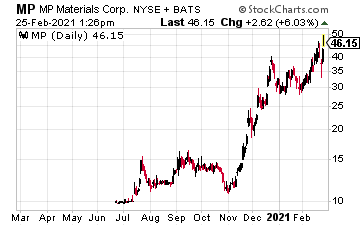

MP Materials (MP) is still racing higher as demand for rare earth intensifies, especially after China announced tougher regulations over the rare earth industry. “The new rules would give Beijing greater control over the supply of materials that have become vital for high-tech manufacturing around the world. China accounts for more than 60% of global rare-earth production, and its exports sank to a five-year low in 2020,” as reported by Nikkei Asia.

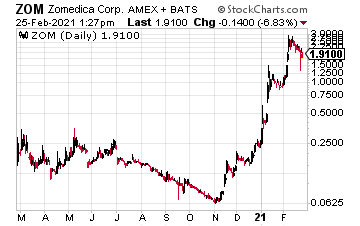

Zomedica Corp. (ZOM) is also pushing higher as it nears its March 2021 product launch date.

According to CEO Robert Cohen, “We are approaching our planned March 30th commercial launch of TRUFORMA™, our point-of-care diagnostic platform. Commercialization plans remain on track and we are beginning to build inventory. As our sales effort begins, we intend to implement a controlled release phase wherein we slowly begin the sale of the TRUFORMA instrument and at least three assays in a limited geographic area in order to test our distribution system to be sure that it performs as we anticipate in these challenged times.”

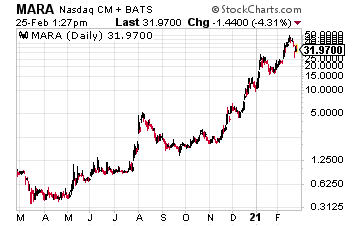

Marathon Patent Group (MARA) is gaining lost ground after cryptocurrencies plummeted on negative comments from Elon Musk, Janet Yellen, and Bill Gates. However, it appears the pullback may be over in miners and in cryptocurrencies. In fact, with plenty of retail and institutional interest, and news that Square Inc. just bought $170 million worth of Bitcoin we could see many crypto-related trades regain lost ground.

In addition, MicroStrategy said it bought another $1 billion worth of Bitcoin. According to CNBC, “MicroStrategy CEO Michael Saylor has become a leading advocate for bitcoin, calling on other companies to buy the digital token as an investment. On Tuesday, he told CNBC he believes bitcoin will one day have a market value of $100 trillion.”

At the time of this writing, Ian Cooper did not hold a position in any of the stocks mentioned.