August 27th, 2019

Options Floor Trader Pro

Vol. 1 Issue 15

Stocks have been quite volatile lately with every day seeming to add to the ongoing China trade war saga. It’s time to get defensive. We made nearly 200% on our silver trade, so now it’s time to see what we can do with gold.

The Trade

Macro conditions have worsened for the global economy with the trade war escalating and negative interest rates becoming even more pronounced in some areas of the world. While the US is still doing okay economically, this is probably not the best time to be loading up on aggressive growth stocks.

I’m not a big fan of gold as an investment vehicle, but it does attract a lot of investors seeking a safe-haven. We saw not that long ago with silver that precious metals do well when conditions are volatile and uncertain.

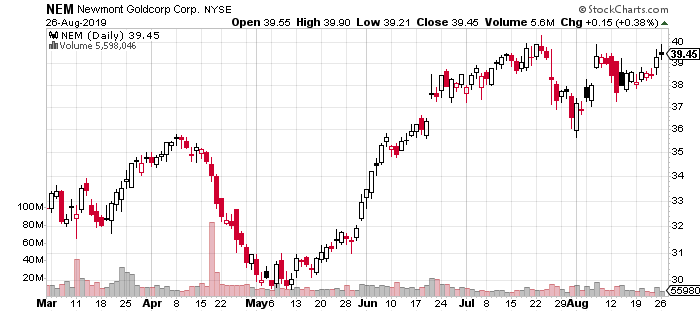

The price of gold has already had a big run this year, with gold futures up a robust 20% year-to-date. However, the same can’t be said for all the gold miners out there. In fact, Newmont Mining (NEM), one of the biggest gold miners in the world, is underperforming gold overall.

While NEM is up 16% this year, it’s still lagging gold by several percentage points. What’s more, the company is the only gold miner in the S&P 500! In other words, it should be quite a bit safer than a less-proven mining company. Newmont has also streamlined their business to the point that any increase in the price of gold should go directly to the company’s bottom line.

I believe the stock has room to move higher, especially given current market conditions. It should serve as one of the few true defensive stocks in the S&P 500.

Trade Recommendation:

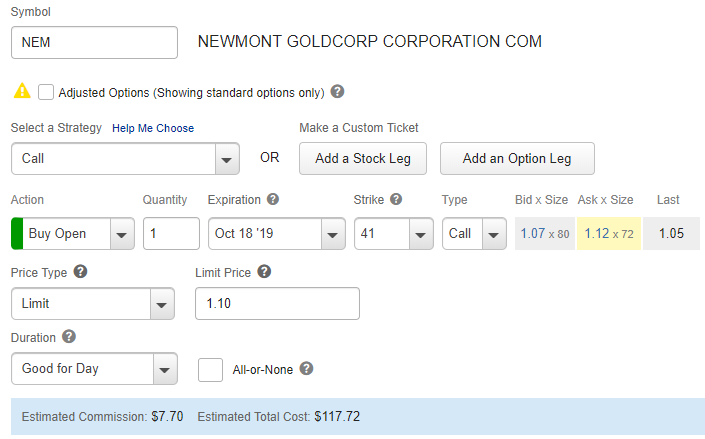

Buy to open Newmont Mining (NEM) October 18th 41 Call for a price of $1.10 (current bid/ask midpoint).

NEM is currently trading at $39.22. Buy the 41 call up to $1.35, but remember that lower is better when buying options.

At expiration (in 52 days) our breakeven point is $42.10. I’m looking for a move to $44 or higher in the next couple months. The most we can lose on the trade is whatever you pay for the premium ($110 per contract at the current price). Every dollar above the breakeven point is worth $100 to us at expiration per contact owned. However, if NEM moves higher quickly, it will change the math (in our favor).

Remember, try to get filled at the midpoint of the bid/ask spread and then move the price up from there. Also don’t forget to follow the steps in the checklist, and especially double check all the trade details before you send your order in (step #10). The price may change quite a bit due to market conditions so be sure to check the bid/ask spread before you enter your order. Keep in mind, I may send extra trade alerts that don’t coincide with the date of one of our biweekly issues.

Trade Screenshot:

Chart:

Open Trade Review:

Teucrium Soybean ETF (SOYB) November 15th 16 Call

Buy price: $0.55

Current price: $0.25

Days to expiration: 80

We’re getting closer to the release of key harvest data. Until that time, we’re in wait and see mode for this position.

Teucrium Corn ETF (CORN) November 15th 17 Call

Buy price: $1.20

Current price: $0.20

Days to expiration: 80

Same as soybeans – we are waiting for harvest data which should start trickling in starting in September. Until that time, we are just sitting on this position.

iShares US Real Estate ETF (IYR) September 20th 87 Put

Buy price: $1.09

Current price: $0.41

Days to expiration: 24

IYR has come down a bit with the market selloff, but probably needs a catalyst to drop down below our 87 strike in the next few weeks. Regardless, I feel strongly that real estate will take a hit in the coming weeks and this is a prime position to be rolled out in the next issue.

Sprint (S) November 15th 8 Call

Buy price: $0.60

Current price: $0.13

Days to expiration: 80

Same deal as before – the share price of Sprint has dropped in line with the overall market selling off. Investors haven’t soured on the merger, the recent down move is simply market related. We have plenty of time for buyers to realize the benefits of the coming merger which should be a very good thing for S.

Invesco CurrenyShares Euro Trust ETF (FXE) November 15th 8 Call

Buy price: $1.20

Current price: $1.55

Days to expiration: 115

FXE has been a solid winner since day one. The US economy, while likely approaching a recession, is still in better shape than what’s going on in the Eurozone. What’s more, the positive interest rates in the US are a major source of investment cash flow, drawing it away from the negative rate-laden Euro region. We have months left on this trade to watch it develop.

Discussion Topic: The VIX

The market has been far more volatile than normal, especially for this time of year. That makes it a perfect time to review the market’s primary volatility measurement – the VIX. These days, the VIX is front page news and an ever-present quote on CNBC or whatever financial media you follow.

So what is the VIX?

The VIX is a measure of market volatility, which is priced using the implied volatility of options on the S&P 500. All that means is that when options get more expensive, this VIX goes up and vice versa. Keep in mind, options prices go up as demand rises. This typically happens when investors are worried about the market selling off. As such, the VIX is often referred to as the market’s fear gauge.

The VIX itself is not tradable – it’s just an index. However, VIX futures and options are heavily traded, especially among institutions and funds. Since regular investors don’t want to deal with futures trading, most of us use the ETF/ETN products instead to trade volatility.

The most heavily traded ETP (exchange traded product) is the iPath S&P 500 VIX Short-term Futures ETN (VXX) VXX simply holds the first two futures months of VIX, meaning it’s an excellent measurement of short-term volatility. Buying shares of VXX or calls on it can be a good way to hedge your portfolio. Conversely, if you think volatility is going down, shorting VXX or buying puts is an easy way to “sell” volatility. (We do occasionally trade VXX in this service!)

You don’t need to be an expert on the VIX or volatility to trade options, but it’s not a bad idea to understand the basics. Keeping an eye on the level of the VIX over time can be a good habit to get into as it may let you know when the big funds and institutions start worrying about a potential selloff in stocks.

The VIX is currently trading around 19.25. That’s considered moderately high for those who normally follow the volatility index. Over 20 is generally when investors need to be extra cautious about a steep selloff. What’s more, one month ago the VIX was trading at just around 12. Obviously, a lot has changed in the markets over the last month.