It’s not hyperbole to say that this is as crazy as the financial markets ever get. There may have been more shocking news items in 2008 (Lehman going bankrupt), but the huge daily swings we have seen in stocks and other asset classes are unprecedented.

A market that has frequent, huge swings in prices is considered to be a high volatility market. This is most easily measured by looking at the Cboe’s S&P 500 Implied Volatility Index, or the VIX. The VIX is often called the market’s fear gauge because it tends to go up when investors are worried about a selloff in stocks.

In a nutshell, the VIX measures what S&P 500 options traders expect to happen to market volatility. If options traders are buying a bunch of index options, they expect movement and vice versa. The more option buying that takes place (especially on the put side), the higher the VIX goes.

As I write this, the VIX is at 75. That’s nearly as high as it has ever been. We’re talking collapse of Lehman levels. If the VIX was around in its current form in 1987, it would have been this high or higher. In other words, this is essentially a crash-level VIX.

For reference, in 2017 the VIX never spent more than a day above 15! Usually, over 20 considered to be a volatile market, and over 30 to be extreme. Just to reiterate, we’re at 75 right now, and it’s been as high as 85 over the past week (albeit briefly).

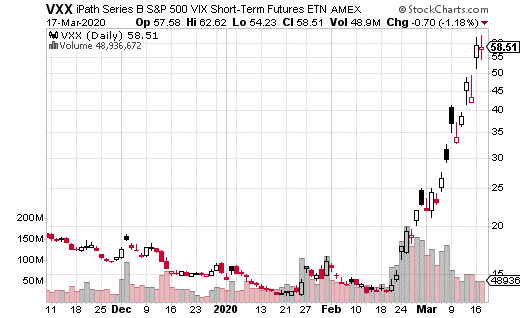

The VIX itself is an index and is not tradable. Instead, most traders use VIX futures, futures options, or ETF/ETN products. The most popular VIX-related product is the iPath S&P 500 VIX Short-term Futures ETN (VXX).

VXX is widely popular, especially in times of high market stress. It tracks some combination of the first two VIX futures months. In other words, it tracks short-term volatility, which is generally where most of the action happens.

Just this week, I came across a trade that makes money if volatility stays elevated through August. This trade involved selling August VXX 25 puts for $2.70, with the stock trading right around $60. That may seem like a lot of premium to get for something so far out of the money, but keep in mind, volatility can move quickly in either direction.

Still, given the government’s time frame for COVID-19, we could easily be looking at suppressed economic activity through the summer. If you are selling cash-secured puts, you’d need to have available $2,500 per option you sell in your brokerage account ($100 x the strike price x number of options).

Assuming you collect $270, the yield on that trade is $270/$2,500 or 10.8% over a 5-month period. That’s not bad! Of course, if volatility collapses, you could end up getting assigned on the shares at $25 per share. However, it wouldn’t be the worst thing to own VXX this year at $25 (if it gets there) given the potential time horizon for COVID-19 and the upcoming election in November.