Well-known cybersecurity company McAfee (MCFE) has been around for decades and trades on the major stock exchanges. However, new investors might not know that more than a decade ago, Intel (INTC) bought the company for $7.7 billion in a surprise deal.

In September 2016, Intel decided to sell a majority stake in McAfee to private equity firm TPG for $4.2 billion. This led to chatter that McAfee would go public again, but it would take another four years before this became a reality.

In October 2020, McAfee priced its initial public offering at $20 per share, below the midpoint of the company’s estimated $19 to $22 range. Shares opened at $18.60 on their first day of trading and touched an intraday high of $19.50, but closed down 6.5% at $18.70.

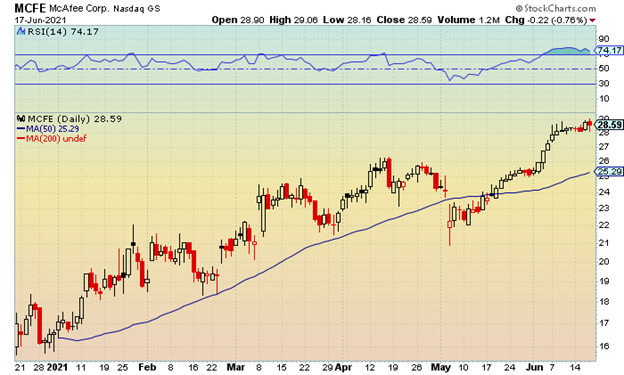

Coming into 2021, shares were below $17 but have recently rallied to a fresh 52-week peak north of $29. The run-up has been warranted as the company has done a nice job of growing its main cybersecurity software business through price increases, new partner programs and good retention rates.

McAfee focuses on both consumers and businesses through its cybersecurity technologies, which help users stay ahead of the ongoing threats of attacks, viruses, and malware. According to the company’s CEO, Peter Leav, there are roughly 8,600 threats every minute as well as a 70% increase in mobile malware attempted attacks.

The coronavirus pandemic added more fuel to the fire, and the ongoing increase in cybercrime, with employees around the world working from home on often less-secure networks. The recent cyberattacks in the oil and meat industries are prime examples.

The company has reported solid results since going public, with its most recent update in early May revealing earnings of $0.18 per share on revenue of $442 million. However, this was below analysts’ expectations by $0.11 per share. In the previous two quarters, the company topped forecasts by $0.07 per share and missed by a penny, respectively.

For the current quarter, earnings are expected to come in at $0.18 per share on sales of $434 million. For 2021 overall, earnings are expected to reach $0.80 per share on revenue of $1.79 billion.

There are currently seven analysts that cover McAfee, with five buy ratings and two hold recommendations. Two analysts recently upgraded the price target, one to $30 and the other to $32.

The chart shows shares are slightly overbought with RSI (relative strength index) above the 70 level. Near-term resistance is at $29–$29.25, with the 52-week peak at $29.06. A close above the latter would signal a push towards the $30 level. Current support is at $28.25–$28, with a close below the latter leading to additional selling pressure. The previous breakout level was in the $26.25 area from mid-April.

Patient investors might want to wait for a pullback with aggressive trades possibly selling deep in-the-money calls at current levels. The company pays an annual dividend of $0.46 per share for a yield of 1.6%.