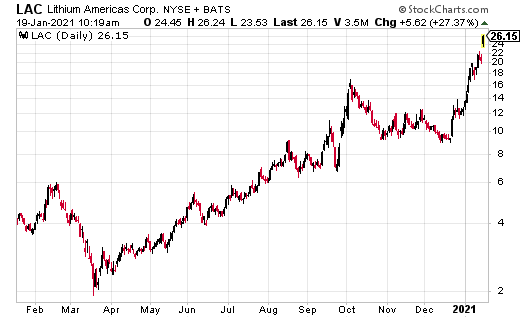

Lithium Americas Corp. (LAC)

Thanks to an accelerating electric vehicle boom, lithium stocks – like Lithium Americas (LAC) are racing higher. In fact, since Sept. 2020, LAC ran from a low of $7 to $20.53. From here, LAC stock could see higher highs after the U.S. Bureau of Land Management (BLM) gave final approval for the company’s Thacker Pass lithium mine in Nevada.

LAC is now seeking financing for the project, which could start producing lithium by October 2022. Helping quite a bit, EV sales are growing much faster than anyone expected.

According to a new study from the Boston Consulting Group, by 2025, EVs could account for a third of all auto sales. By 2030, EVs could surpass internal combustion engine vehicles with a market share of 51%.

Plus, experts now predict that by 2040, electric cars will make up 58% of the light vehicle market. In addition, according Resource World, “A recent report by Global Market Insights, Inc. concluded that the global lithium ion battery market is set to surpass US $60 billion by 2024 with a global market of 534,000 tonnes of lithium carbonate by 2025.”

Even better for the EV market, under a Biden Administration, we could see even more EVs on the roads, which will require even more lithium supply.

As noted on his Administration’s site:

“There are now one million electric vehicles on the road in the United States. But a key barrier to further deployment of these greenhouse-gas reducing vehicles is the lack of charging stations and coordination across all levels of government. As President, Biden will work with our nation’s governors and mayors to support the deployment of more than 500,000 new public charging outlets by the end of 2030.”

However, for the EV boom to continue, automakers must have far more lithium supply.

At time of this writing, Ian Cooper does not hold a position in the LAC stock.