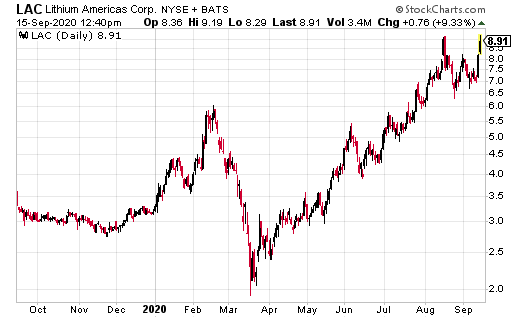

Since March 2020, shares of LAC have run from a low of $1.92 to $7.66 – and could potentially turn higher. All on expectations of higher lithium prices, with demand outweighing supply.

And all thanks to electric vehicle (EV) sales that are growing much faster than anyone expected. In fact, according to a new study from the Boston Consulting Group, by 2025, EVs could account for a third of all auto sales. By 2030, EVs could surpass internal combustion engine vehicles with a market share of 51%. That could lead to a sizable spike in demand with lithium used in EV batteries.

Plus, experts now predict that by 2040, electric cars will make up 58% of the light vehicle market. In addition, according Resource World, “A recent report by Global Market Insights, Inc. concluded that the global lithium ion battery market is set to surpass US $60 billion by 2024 with a global market of 534,000 tonnes of lithium carbonate by 2025.”

Plus, over the last few weeks, Lithium Americas completed its transaction with Ganfeng Lithium Co., Ltd. in respect of their joint venture company, Minera Exar S.A. Minera Exar owns 100% of the Caucharí-Olaroz lithium project currently under development in Jujuy, Argentina.

Have You Downloaded Your Free Copy of “Beginner’s Options Guide?” Click here [ad]

“The Transaction with Ganfeng Lithium further strengthens our long-term partnership in Argentina as we work together to bring Caucharí-Olaroz into production,” commented Jon Evans, President and CEO. “With an additional US$40 million in cash on our balance sheet and over US$200 million in available capital to fund our share of Caucharí-Olaroz, Lithium Americas remains in a strong financial position as we advance both of our projects.”

“Caucharí-Olaroz is approximately 50% complete and represents one of the few large-scale lithium operations currently in development globally. We are coordinating closely with the Province of Jujuy to ensure we operate responsibly and safely as we gradually restart construction activities. The health and safety of our workers and the communities close to the project is our top priority.”

Earnings are Fueling Upside

Lithium Americas posted a second quarter loss of seven cents a share. However, that fell within the range analysts were looking for.

The better news is that Lithium Americas is moving forward with two projects that could generate solid revenue, and hopefully a profit. Those include the Cauchari-Olaroz project in Argentina, and the Thacker Pass project in Reno, Nevada.

“With respect to the Thacker Pass lithium project in Nevada, we continue to make significant progress with the recent release of the draft Environmental Impact Statement by the Bureau of Land Management,” added Evans.

Ian Cooper’s Personal Position in LAC: None