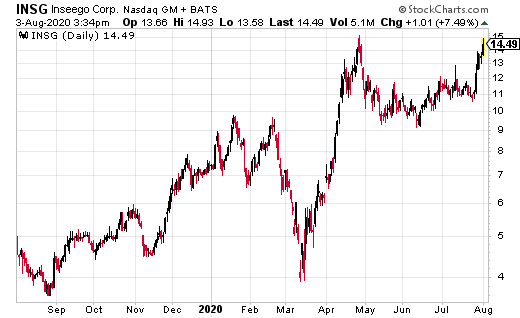

Inseego Corp. (INSG) has become of one of the most explosive 5G stocks on the market.

Over the last week, INSG ran from a low of $10.53 to $13.80.

All thanks to a report on Seeking Alpha that predicted “blow-out” second quarter earnings when the company releases earnings this week. Not only did the author note INSG has seen a big boost in demand for 5G devices as more people work from home, he believes INSG could see strong EPS growth over the next two to three years.

INSG is expected to post earnings on Wednesday, August 5 after the closing bell.

Better, the company is increasing production of 4G and 5G hotspots in response to a “record increases in demand for reliable, secure home Internet access,” says the company.

“We’re seeing unprecedented demand for our wireless mobile broadband devices, spurred by the dramatic change in how we are living, working and learning from home. Our hotspots provide instant access to broadband connectivity and unlock all the applications used not only at home but also on the go, with outstanding performance, bullet-proof security and reliable connections to corporate networks, learning resources, healthcare providers, friends and families,” said Inseego Chairman and CEO Dan Mondor.

In addition, the company now expects for first quarter revenue to exceed consensus estimates of $52 million. It also sees second quarter revenue in a range of $75 million to $85 million. Plus, the company expects to ship mobile broadband products to all three of the largest US domestic mobile network operators in the second quarter. And, it expects to see increased gross margins in IoT & Mobile Solutions based on the ongoing cost reduction initiatives and volume leverage, as noted by the company.

As of this writing, Ian Cooper does not have a position in shares of INSG.