Shares of Inovio Pharmaceuticals (INO) were crushed earlier this week. All on news the U.S. FDA placed its Phase 2/3 clinical trials of INO on partial clinical hold. Now, hopes the company can begin its Phase 2/3 study this month are completely off the table.

However, the good news is the FDA’s decision was “not due to the occurrence of any adverse events” in its Phase 1 study. While it’s not entirely clear why the FDA acted, Inovio has said the agency “has additional questions” about the Phase 2/3 study. After topping out at a high of $18.69, the stock sunk to a recent low of $11.31.

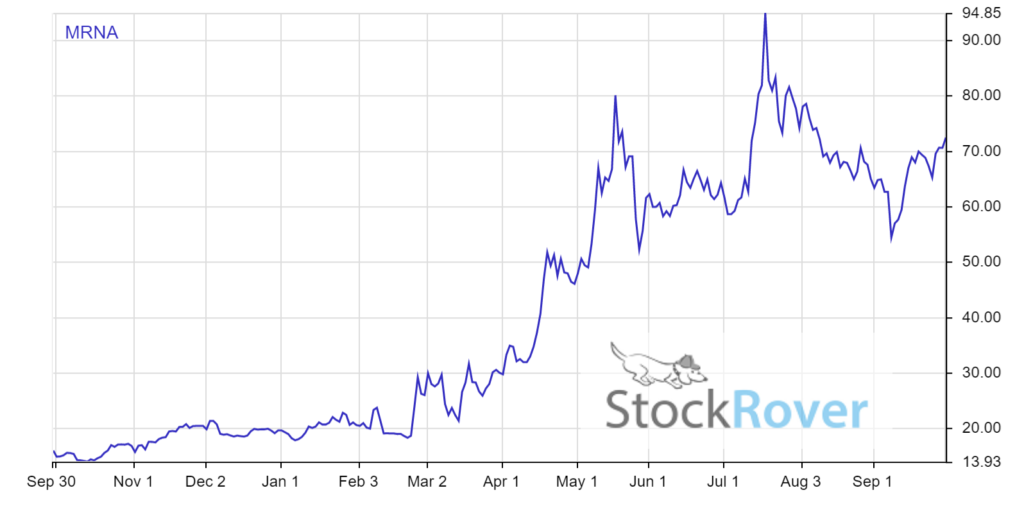

Shares of Moderna Inc. (MRNA) pushed higher after noting its early-stage study data suggests its COVID-19 vaccine can generate neutralizing antibodies in elderly adults, as reported by MarketWatch. The study was published in The New England Journal of Medicine.

“Given the increased morbidity and mortality of COVID-19 in older and elderly adults, these data give us optimism in demonstrating mRNA-1273’s protection in this population, which is being evaluated in the Phase 3 COVE study,” said al Zaks, M.D., Ph.D., Chief Medical Officer.

Shares of Regeneron Pharmaceuticals (REGN) rocketed $25 higher after saying its “experimental two-antibody cocktail reduced viral levels and improved symptoms in non-hospitalized patients with mild-to-moderate Covid-19,” according to NBC News. “Results for the first 275 trial patients showed the greatest effect in patients who had not mounted their own immune response prior to treatment, suggesting that REGN-COV2 could provide a therapeutic substitute for the naturally-occurring immune response.”

Shares of Piedmont Lithium (PLL) were up more than 340% earlier this week before pulling back on profit taking. The stock shot higher after signing a deal with Tesla to help secure lithium supply. “The deal is for five years of lithium-ore supply with an extension for another five years. Deliveries are expected to start in 2022,” according to Barron’s.

At time of this writing, Ian Cooper does not hold a position in any of the stocks mentioned.