As communities and individuals are forced to social distance, raising anxiety, and removing many of the social outlets that are key to physical and mental health, Humana (HUM) is raising awareness of the social determinants of health.

The company believes social determinants, along with health or clinical factors, should play an increasingly important role in its risk adjustment models used for HUM customers. The current COVID-19 environment has placed a spotlight on the importance of social determinants, according to Humana.

Commenting on an article authored by HUM representatives, and printed by the National Quality Forum (NQF), Humana Chief Medical Officer, William Shrank, MD, said, “The COVID-19 crisis has underscored the inter-relatedness of social context and physical health”.

Data gathered by HUM in recent months has indicated social isolation is an increasingly important determinant of health. This factor, combined with other determinants, such as age, is a good indicator of risk.

Shrank stated, “Our proactive outreach to our COVID-19-positive and highest risk members has uncovered high rates of social isolation and considerable barriers to accessing healthy food, which put them at higher risk for bad outcomes.”

Humana is arguing a combination of social and clinical risk is a better indicator of overall health, than the more heavily weighted clinical risk model used today. Shrank went on to say, “Given the associations between social risk and clinical risk, it stands to reason that risk adjustment for payment models should incorporate the breadth of patient characteristics that predict the need for health care services.”

The authors of the article believe the importance of clinical factors has become overly important to the risk adjustment model, and does not provide an accurate justification for risk pricing.

They emphasized this point, stating, “We believe the consternation that surrounds accounting for social factors in risk-adjustment models is too myopic; it should make us uncomfortable with the integrity of the concept of clinical risk and should highlight the need to better characterize differences between these ideas.”

Related: Humana Eases Claims Requirements

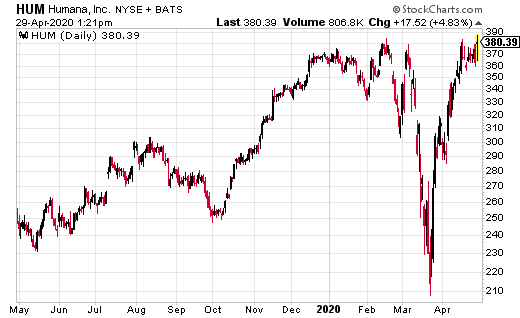

Humana’s stock has performed exceptionally well in the current environment. After a sharp downturn, to under $220 at the recent market lows, the stock has rebounded strongly and currently trades at levels it had reached prior to the COVID-19 onset.

The company has a PE of 18.60 and currently pays a dividend of $2.50, or 0.67%. Humana reports earnings today.

Steven Adams’s personal position in Humana: none.