Some of the best options trading opportunities can be found in wildly oversold stocks.

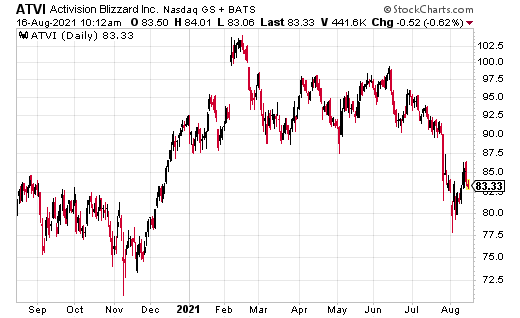

Look at Activision Blizzard (ATVI), for example.

ATVI gapped from a high of $91.40 to a low of $78 on fears of litigation and a potential Chinese crackdown on video games.

To me, that pullback was overkill—especially at a time when the video game industry is surging.

We could also tell ATVI was severely oversold by looking at relative strength (RSI), moving average convergence divergence (MACD) indicator, and Williams’ %R, which is calculated based on price over several periods. In fact, the last time these three indicators became as oversold as they are now, ATVI ran from a low of about $45 to a high of nearly $105.

With the latest pullback, let’s say we believe the stock could refill its bearish gap and get to around $91 from a current price of $84. If I were to buy 100 shares of ATVI at $83.75, it would cost me $8,375. Then, if ATVI ran to $91, I stand to make $725, or 9%.

However, with options, I could potentially make much more.

If I were to have picked up the ATVI September 17, 2021 82.50 call option, which last traded at $3, the cost of that one option contract would be $3 x 100 shares in the contract, which would be $300. Let’s also use that option’s current delta of $0.540, which would tell us that for every $1 move higher in the price of the underlying ATVI stock, the option price will increase by $0.54.

Using that current delta, should ATVI move to $91 from $84, the option could gain about $3.78 of value, or $0.54 x $7. Adding $3.78 to my option buy price of $3 now gives me an options price of $6.78. That means I could see a return of about 126%.

Or, to give you the TL;DR version: With the stock, I could make up to 9%; however, using options leverage, I could make up to 126%—and spend far less doing so.