The wealth destruction this year experienced by investors who held the hot stocks of 2021 has been brutal. A recent Wall Street Journal email noted how investors have now changed strategies in response – better late than never.

But if you really want to see long-term success in the rising-interest rate, high inflation, expensive-commodity era that’s coming…

You need to look at this dividend-focused investment strategy.

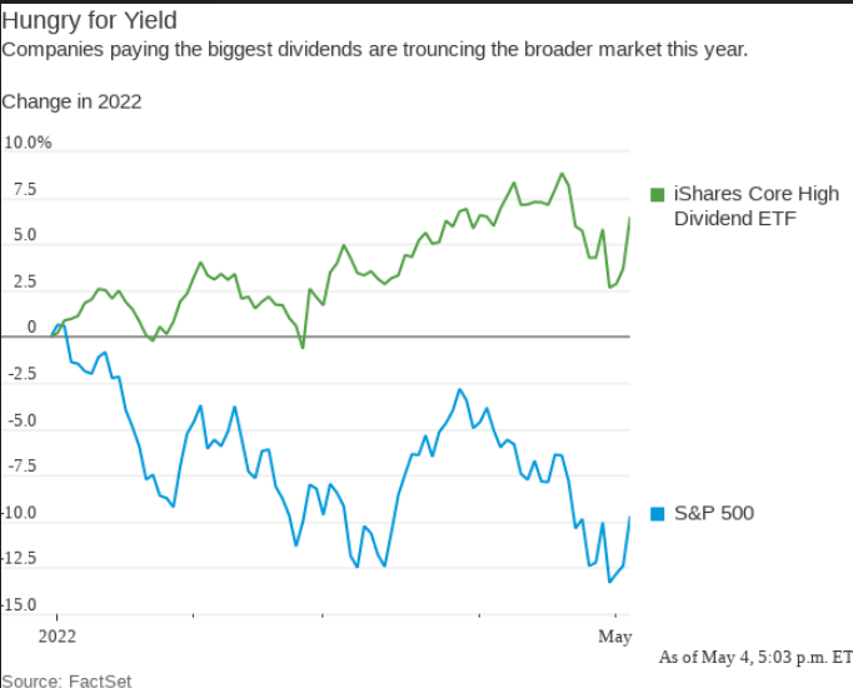

Shares of companies paying big dividends to investors have trounced practically everything else this year.

The iShares Core High Dividend exchange-traded fund, which tracks 75 such stocks, is up 6.4% this year. That puts the fund far ahead of the S&P 500, which is down 9.8% in 2022.

The fund includes stocks like Exxon Mobil, which has a dividend yield of 3.8%; Johnson & Johnson, which has a yield of 2.5%; and Coca-Cola with a yield of 2.7%. All three are beating the market for the year.

The Journal didn’t include the fact that the fund (ticker: HDV) has been a long-term winner for investors. In 2021, the fund returned a not-to-shabby 20.0%. The fund has averaged a 10.3% average annual total return for the past decade. With the compound growth and dividends reinvested, an account would have grown by 180% over the decade.

You have to love the power of compounding and dividend reinvestment!

But as a dividend-focused investor, you can easily outperform an index fund, even one as successful as HDV. The fund has a current yield of 3.28%. The Stable Dividends category from my Dividend Hunter service has an average yield of 7.5%, and generates dividend growth similar to what the ETF will produce.

To see how you can join The Dividend Hunter and get full access to its full portfolio today, at a special price, click here.

One of the stocks you’ll find on that list, with a current yield of 6.1%, is EPR Properties (EPR). Even better, the company grows dividends by 6% to 8% every year.

If you have bailed out on growth stocks because of the recent market losses, you can get back onto a positive investment returns slope by shifting to a dividend and income-focused strategy. There’s no better time to start than now. You’ll be happy you did.