Wow, what a week!

For those whose portfolios are simply filled with long stocks, this has been a disastrous time.

But for those who are swimming in cash, this is a great opportunity to make even more money by selling some options to take in the lofty premiums being priced into options due to fear in the market.

Credit spreads are a great way to do this.

For this week’s trade, I’m focusing on selling put spreads. It’s another risk-controlled way to take advantage of extremely high volatility.

I’ll make it simple and just focus on Apple (AAPL).

At the time the below trade idea was conceived, AAPL was trading around 146.50. The strikes below are set based on that level. If, at the time of publication, AAPL has moved significantly then adjust the strikes to the short put strike being somewhere near 4-5% below the current stock price.

Trade

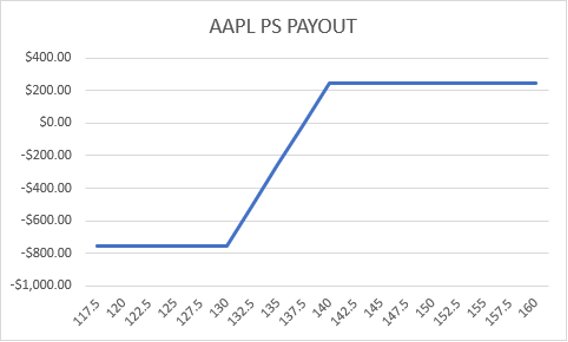

Sell AAPL 6/17 expiration 140/130 put spread @ $2.45.

If you sell a 1 lot (100 shares), you will collect $245 upfront. You will realize all of this as profit if the stock settles above the 140 level at June expiration.

The current stock level is 4.5% above 140. With a $2.45 of premium collected, the break-even on this trade is at 137.55 (-6.1% from here).

While it is certainly possible that AAPL stock could trade through the 140 strike (AAPL has sold off 12% in a week), you are stopped out on the downside at the 130 strike. In other words, you could lose $755 if the stock goes all the way down to 130 by the expiration date. That level would be another 11.2% on top of the 12% from the past week. That would be a historic move lower in the name.

Cash is king when the market unraveling. If you are prudent and tactical with your trade ideas, you can make some money while others are in panic mode.

As always, actively manage your trades to lock in profits and eliminate worst-case scenarios.