While volatile stocks may be more exciting to trade, most investors are looking for consistency in their portfolios. Whether the goal is steady growth or consistent income, boring may be better in the long term.

As fun as it may be to trade stocks like GameStop (GME) or the latest buzzworthy IPO like Coinbase (COIN), those generally aren’t viable long-term holdings. In the case of GME, we don’t even know if the company will be around in a couple of years. For COIN, it’s nearly impossible to value a company that is so closely tied to cryptocurrencies.

Long-term investors are looking for income like reliable dividends, like what you may get from Proctor & Gamble (PG). Even in this environment of lofty valuations and high-flying stocks, investors can still get a safe 2.3% yield by owning PG. When it comes to paying dividends, the company is about as safe as it gets.

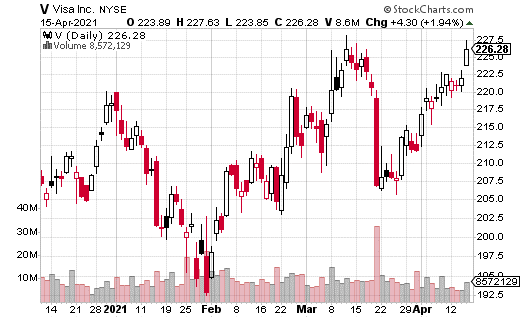

What about a company like Visa (V)? It’s also likely a safe company to own for the long run, similar to PG. Unlike PG, V may have more growth potential, and its dividend yield is just 0.58%. Still, many investors want to own Visa for the long term. Credit services is a safe industry, and Visa has generally shown consistent growth.

At the same time, investors may be hesitant to own V with such a low dividend yield. In this situation, using a covered call can be an excellent way to produce a much higher yield from V without increasing risk.

For instance, an institution or fund just made a massive in-the-money covered call trade on V. The trader purchased 2.3 million shares of Visa for $226.38 while simultaneously selling 23,000 of the May 21 215 calls for $13.50. The amount of premium collected on this trade was $31.1 million.

You may be wondering why the trader would use in-the-money calls. Also, how can a strategy like this boost yield?

The thing about an in-the-money call is, with about 35 days left to expiration it still has some time value remaining. If $226.38 is the stock’s closing price at expiration, a 215 call would be worth $11.38. That’s the intrinsic value.

However, the trader received $13.50 for those options because there are 35 days left until expiration. That’s an additional $2.12 in time premium per option. As long as Visa finishes above $215 at May expiration, the trader will lock in the entire $2.12 as income without losing any money on the stock. This works out to be about a 1% yield for the holding period.

Consider this scenario more carefully: The trader has made a relatively low-risk trade, with a lot of wiggle room to the downside. The premium collected of $2.12 is substantially higher than the $1.28 dividend that Visa pays. But keep in mind, Visa pays that dividend for the entire year, and this trade lasts about 35 days.

Over the course of the full year, this strategy could boost the yield on owning Visa by roughly 10%—an excellent yield in this low-rate environment, but even more attractive when it comes from owning a lower risk (long-term) stock like Visa.