Covered call trading is a commonly used strategy to generate cash flow and help normalize equity returns. A multitude of research suggests a basic covered call trading plan, from a risk-adjusted standpoint, outperforms long equities. However, covered call trading can be used situationally as well.

There are times when short-term overwriting can be a powerful way to improve cash flow or reduce risk. While many investors tend to use covered call trading over the course of months or years, some periods in which situational use of overwriting may be appropriate can be measured in days or weeks.

One scenario that fits the bill may be lie with Apple (AAPL). So far in 2021, the largest company in the world is having another solid year. The stock is up 11% for the year, with low-to-moderate price volatility. Plus, recent earnings were much better than expected.

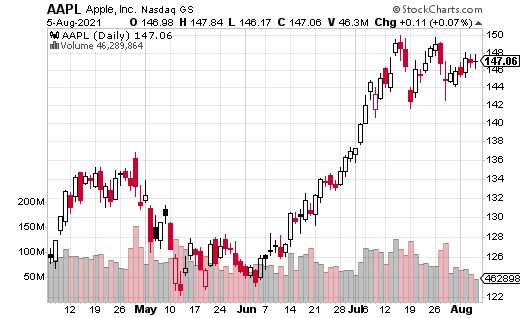

As you can see from the chart, AAPL’s share price has basically gone sideways for the last month. It’s traded in a narrow range from roughly $142 to $150, with most of the action between $144 and $148. Most likely, the market is waiting for the company’s next product show, an event that generally happens in September.

Traditionally, AAPL unveils new products or product upgrades at its fall event. The excitement, or lack thereof, can dictate the stock direction afterward (at least for a short period). So, it’s probably best for shareholders to ignore the stock until September, when the excitement hits.

Or is it?

This situation could present a perfect time to use covered calls. If a shareholder doesn’t believe AAPL will go much above $150 before mid-September, and it’s not likely to drop all that much either, overwriting may be an ideal strategy.

In fact, one strategist seems to have taken this very approach. The trader bought AAPL stock at $147.32 while simultaneously selling the September 17 150 calls for $3.05 (9,350 contracts were sold versus 935,000 shares). The $3.05 collected means the shares are protected down to $144.27, near the bottom of the range. The gains are capped at $150, at the top of the range.

While the trade can make money on stock appreciation up to $150 ($2.68 worth of stock gains), the position was likely placed to generate cash from the call sale. The $3.05 call premium collected amounts to a return of 2.1% over a roughly six-week period.

Using covered calls in this manner is a shrewd way to generate income from an idle asset. If AAPL is going to be range-bound until at least its September show, why not earn 2.1% in six weeks, with what is likely to be a limited amount of risk. AAPL is the largest company in the world for a reason, so it’s going to be a relatively safe equity investment.