Shares of Ford Motor Inc. (F) have been in a nice uptrend since early October and appear to be headed towards $10 and a level last seen in July 2019. The company recently announced an impressive third-quarter with earnings coming in at 65 cents a share on revenue of $37.5 billion. Wall Street was expecting a profit of 16 cents a share on sales just below $33 billion.

The company’s CEO, Jim Farley, said there is huge value to be unlocked in its automotive operations and there will be additional opportunities when Ford starts growing again with products and services. Ford’s automotive business gained one point of market share in the U.S. with its F-Series trucks snapping up 1.7 points of industry share, to over 35%.

Three Wall Street analysts recently raised their Price Targets on the stock from the $7-$8 range to $9. Another analyst upped their Price Target from $10 to $11.

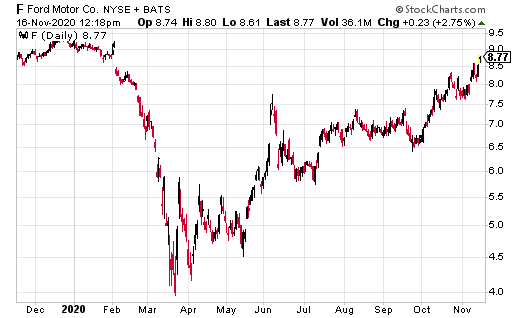

The chart below shows resistance in the $8.50-$8.75 range and levels last seen in early February. There is a good chance a run past $9.00, and possibly towards $10, could come over the next month or two if shares can clear and hold the $8.75 level. The 52-week peak is at $9.57.

A close below the $8 level would be a slightly bearish development and could signal a retest into the prior trading range between $7.60-$8.00 from earlier this month.

With the stock below $10, longer-term traders might consider writing covered calls to collect income over the next six to12 months. Short-term option traders could look into “cheap” options to play a possible breakout before yearend and into January.

The Ford (2021) F January 9 calls (F210115C00009000, $0.30, down $0.02) are currently trading for 30 cents. These options do not expire until January 16th, 2021 so the trade would have six to eight weeks to play out, depending on the technical setup.

If shares are at the $10 level by mid-January, these options would be $1.00 in-the-money and would represent a 233% return from current levels. If shares are at $9.60 on January 15th, the call options would return 100% from current levels as they would technically be worth 60 cents.

If Ford shares are at $9.30, or less, the trade would break even or have a negative return. A close below the $7.50 level in the stock before yearend would be a warning sign to exit the trade and to save the remaining premium.