DDividend Hunter subscribers who followed my advice in April, May, and June 2020 have had the good fortune to see the shares on their dividend stocks they purchased then gain up to 300% since. And it was not just one or two dividend stocks. There are a few dozen dividend stocks on the Dividend Hunter recommendations list that have posted share price gains of 60% into the triple digits.

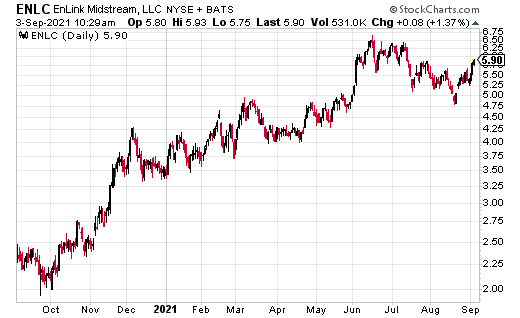

EnLink Midstream (ENLC) has been the poster child of buying when prices get “stupid cheap,” and then enjoying the recovery. Last year, EnLink traded for around $1.00, with a low of $0.76 per share, for at least a month. EnLink was priced at a dollar with a $0.375 annual dividend. As I write this, a few months more than a year after the stock price bottomed, EnLink trades for between $5.00 and $5.50, up 440% for those subscribers buying at $1.00 per share.

Yet I am not telling my subscribers to sell to take those gains on their dividend stocks. I continue to recommend owning and buying shares of EnLink as part of the long-term Dividend Hunter strategy.

The Dividend Hunter strategy is different. I tell subscribers that our goal is to invest in high-yield securities to build a stable and growing income stream. Market crashes, as we saw in 2020, are those “once in a decade” opportunities to buy shares of quality income investments at great prices and yields.

Of course, the challenge becomes winnowing the quality income investments from the wealth-destroying dogs.

I expect EnLink and other Dividend Hunter investments that were on sale last year to remain as long-term holdings paying great dividends. Someone who acquired EnLink shares at $1.00 now has a long-term 37% yield-on-cost.

Had we panic-sold ENLC in March 2020 we would have missed out on a tremendous opportunity for this eye-popping yield. In my upcoming Forever Dividends Masterclass I’ll show how to figure out if you can keep a stock likely to recover or sell one that will stuggle. Watch for an email with details.

For the decade prior to the pandemic-triggered market crash, I used the story of Aircastle Ltd as the lesson of how shares of quality companies should be bought during market crashes. At its bottom, in 2009, Aircastle traded for less than $3.00 per share, even though during that same year, the company generated $4.00 per share in free cash flow.

EnLink Midstream will now be my story stock for the value of buying during crashes when the investing public is selling in fear. We will own the shares, and I will tell the story for years to come.

Buy the way, in early 2020, Aircastle was acquired by another company. From the March 2009 bottom until the buyout offer, the stock posted a total return (share price appreciation plus dividends) of more than 1,000%! With the reinvestment, the total return jumps to 1,440%!