Byrna Technologies (BYRN) is a company that most investors might not know about and an alternative for people who simply don’t like guns to protect themselves. There are many options for purchasing CO2 air pistols versus traditional firearms and BYRN has some unique products worth mentioning.

The company claims to be the best-in-class when it comes to CO2 powered handheld personal security devices. While this can be debated, Byrna is becoming an emerging leader in the non-lethal personal safety device marketplace.

Their most popular product is the Byrna HD (Home Defense) handgun, which is powered by compressed CO2 cartridges. They shoot hard plastic projectiles as well as chemical irritant projectiles such as pepper spray and tear gas.

These types of projectiles won’t kill an intruder, but they can effectively deter, disorient, and disarm would-be attackers at standoff distances up to 60 feet, according to the company’s website. Unlike traditional firearms, the Byrna HD requires no federal permits or federal license to purchase or carry.

I purchased the Byrna HD last year, and although there are no waiting periods or background checks required, the backlog told me demand was high. It is basically a great starter gun, but if you need an air pistol for serious target shooting, you are likely better off going with a pump air pistol for more power and further distance accuracy.

Byrna Technologies recently acquired the assets of Mission Less Lethal, a U.S. manufacturer of .68 caliber, shoulder-fired non-lethal launchers for police and other security professionals. The transaction was done through Kore, who is a recognized as a global leader in the paintball industry, and included Mission’s customer list, order book and other intellectual property assets.

As far as the company’s fundamentals, BYRN has a market capitalization of $380 million and is expected to lose $0.04 per share in 2021 on revenue of $36 million. However, for 2022, the company is expected to earn a profit of $0.76 per share on sales north of $57 million.

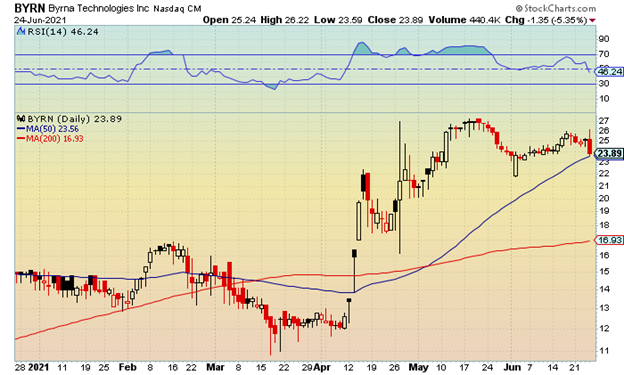

In April, the company did a 1-for-10 reverse stock split but has little coverage on Wall Street. There are two analysts that follow the stock, both giving it a buy rating and setting $26.50 price targets. The current chart shows shares are near their 50- day moving average with the 52-week high north of $27. The all-time high, set in 2006, is at $36.50.

BYRN is expected to announce earnings at the end of June and a beat-and-raise quarter could get more investors excited in the stock. There is also the possibility of greater sales through police departments, which could use safer ways to prevent crime and replace the traditional taser methods.