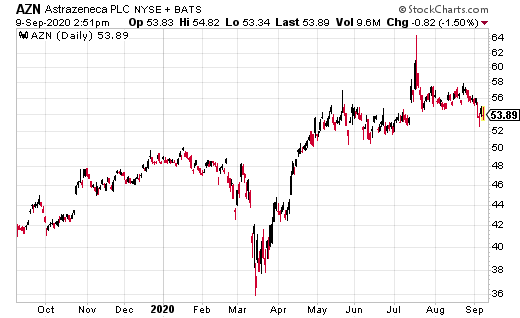

Shares of AstraZeneca PLC (AZN) pulled back earlier this week after the company paused its COVID-19 vaccine trial. That followed an unexplained illness in one of the trial volunteers.

In an emailed statement, AZN said: “As part of the ongoing randomized, controlled global trials of the Oxford coronavirus vaccine, our standard review process was triggered and we voluntarily paused vaccination to allow review of safety data by an independent committee,” as noted by MarketWatch. AZN added it is seeking to expedite the review of the event to minimize the potential impact on trial timeline.

Shares of Nikola Corporation (NKLA) rocketed higher by more than 41% on news of a partnership with General Motors. According to Barron’s, “Under the terms of the agreement, General Motors will engineer and build Nikola’s (NKLA) pickup truck named Badger. GM will take an 11% stake in Nikola and have the right to nominate one person to the board of directors.”

Nio Inc. (NIO) continues to push higher after reporting another month of record sales. For August 2020, NIO completed 3,965 – a year over year increase of just over 104%. That’s also a 12.2% jump month over month. Cumulative deliveries, says the company, are up to 21,667 for the year, an increase of nearly 110% year over year, as well.

Free Download: “The Beginner’s Options Guide for Those With No Time” [ad]

“In August, we achieved our best-ever monthly performance on both deliveries and order growth,” said William Bin Li, founder, chairman, and chief executive officer of NIO. “As we continue to improve the production capacity for all NIO products, our monthly capacity will reach 5,000 units in September to support our future deliveries.

With the closing of our recently announced ADS offering, we have further enhanced our balance sheet and optimized our capital structure to be better prepared for the acceleration of our core technology development, autonomous driving in particular, and the global market expansion in the future.”

Shares of Peloton Interactive (PTON) are also pushing higher. Over the last few days, the company announced it would cut the price of its bike and sell a more premium bike and cheaper treadmill, as reported by Barron’s.

“The company on Wednesday will cut the price of its core bike by $350 to $1,895 and launch a Bike+ for $2,495, which has more premium features, a larger screen and an improved speaker system. Peloton will also sell a cheaper treadmill for $2,495 in 2021—renaming the existing $4,295 product the Peloton Tread+.”

Shares of BigCommerce Holdings Inc. (BIGC) slipped by more than 11% this week after Morgan Stanley initiated coverage with an Underweight rating and a $52 price target.

“BigCommerce provides a powerful [software-as-a-service] e-commerce platform supporting businesses of all sizes across all available channels,” he writes in a research note. “With strong secular positioning and a large $8 billion-plus total addressable market, we see plenty of growth ahead. However, valuation is pricing in our bull case,” they said, as quoted by Barron’s.

At time of this writing, Ian Cooper does not hold a position in any of the stocks mentioned.