“Better-than-expected first-quarter earnings and its $250 million acquisition of an ad-tech company are reason enough to buy the stock,” said the firm, as reported by Barron’s. With that, analyst Ryan Gee upgraded the stock to a buy rating, with a new price target of $13.50.

With regards to earnings, as noted in the company’s press release:

Zynga delivered its best quarterly revenue and bookings performances in the company’s history, driven by an all-time best revenue and bookings quarter for its Social Slots portfolio, in addition to its highest Q1 performances by Empires & Puzzles, Words With Friends, CSR2 and our Casual Cards portfolio.

It also saw record average mobile daily active users of 38 million, up 85% year-over-year, and average mobile monthly active users of 164 million, up 139% year-over-year, primarily driven by our recent additions of Toon Blast, Toy Blast and Rollic’s hyper-casual portfolio.

Zynga is Also Acquiring Ad-Tech Company, Chartboost

Announced on May 5, Zynga announced it would acquire Chartboost – a mobile programmatic advertising and monetization platform with 700 million monthly users and 90 billion monthly advertising auctions.

“Chartboost is one of the most dynamic monetization and discovery platforms in mobile, and we could not be more excited to welcome their talented team to our company,” said Frank Gibeau, Chief Executive Officer of Zynga. “By combining Zynga’s high-quality games portfolio and first-party data with Chartboost’s proven advertising and monetization platform, we will create a new level of audience scale and meaningfully enhance our competitive advantage in the mobile ecosystem,” as quoted in a company press release.

Bank of America analyst Ryan Gee sees this is a positive shift in Zynga’s strategy, “to become a platform that sells mobile advertising—inside games. Currently Zynga is known for publishing mobile videogames. The analyst predicted that this is the first step in a years-long plan to transform the business into a mobile ad powerhouse,” as also noted by Barron’s.

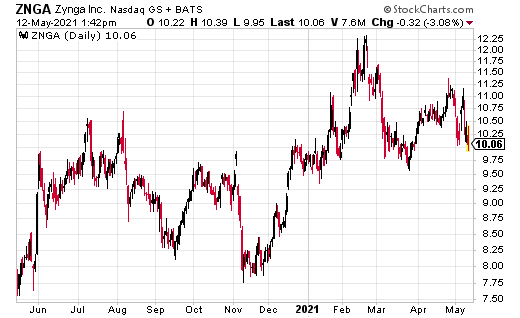

Shares of ZNGA trade at $10.60 at the time of editing.

At the time of this writing, Ian Cooper did not hold a position in Zynga.