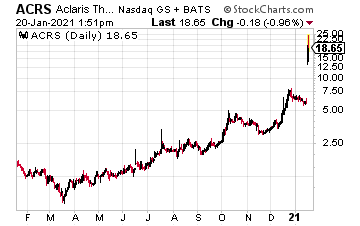

Shares of Aclaris Therapeutics (ACRS) after announcing positive data from a Phase 2a trial of its rheumatoid arthritis treatment. “Aclaris Chief Medical Officer David Gordon said he believes the data supports the hypothesis that MK2 inhibition is an important novel target for treating immuno-inflammatory diseases, and he looks forward to progressing ATI-450 to Phase 2b,” reported MarketWatch.

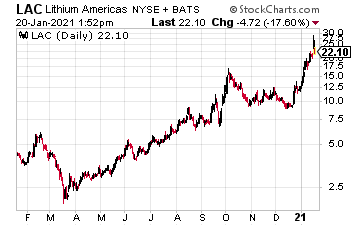

Lithium Americas (LAC) was up 30% after the U.S. Bureau of Land Management (BLM) gave final approval for the company’s Thacker Pass lithium mine in Nevada. The company is now seeking financing for the project, which could start producing lithium by October 2022.

Better, lithium demand doesn’t appear to be slowing. “Per Statista data, lithium demand is expected to more than double to 820,000 tons over the next five years.

Chile’s state mining agency, Cochilco, projects lithium demand to increase to 1.79 million tons per year by 2030. According to Allied Market Research, the global Lithium-ion battery market was valued $36.7 billion in 2019 and is projected to hit $129.3 billion by 2027.”

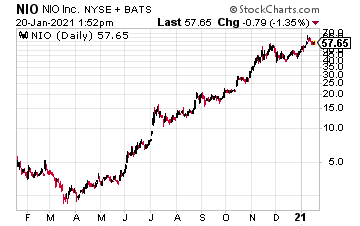

Nio Inc. (NIO) was up again after it announced it closed on a $1.5 billion convertible bond offering. That tells us there’s still a good deal of interest in the company from institutions. In addition, Jefferies analyst Alexious Lee initiated coverage of NIO with a hold rating and a price target of $60 a share.

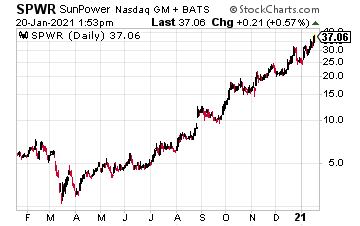

SunPower Corp. (SPWR) was up another 15% with Biden being sworn into office. Remember, according to Rodney Johnson, president of economic research firm HS Dent Publishing, as quoted by Kiplinger, “There will be opportunities. Infrastructure spending, green energy and health care are all Democratic priorities and should do well under a Biden presidency.”

In addition, Biden has already said the U.S. will rejoin the Paris Climate Accord. Plus, Biden mentioned $2 trillion clean energy plan, with hopes for net zero emissions by 2050. That’s all bullish news for solar stocks, like SPWR.

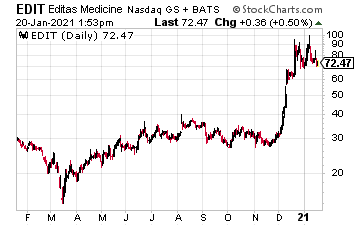

Editas Medicine Inc. (EDIT) fell $4 after announcing it will sell 3,500,000 shares of its common stock in an underwritten public offering. Editas Medicine intends to grant the underwriters a 30-day option to purchase up to an additional 525,000 shares of its common stock.

At time of this writing, Ian Cooper did not hold a position in any of the stocks mentioned.