In November 2020, I added AT&T (T) to my Dividend Hunter recommendations list. At the time, a 7.2% yield with potential for annual dividend increases seemed like too good of a deal to pass up. For the next six months, I looked like a smart stock picker, as the AT&T share price appreciated by 13% and big dividends kept rolling in.

Then on May 17, AT&T announced it would spin off its WarnerMedia assets into a merger with Discovery, Inc (DISCA). AT&T will receive $43 billion in cash, debt securities, and WarnerMedia’s retention of certain debt. After the spinoff, AT&T shareholders will own 71% of the new company, which will be called Warner Bros. Discovery.

The transaction is anticipated to close in mid-2022, subject to approval by Discovery shareholders and customary closing conditions, including receipt of regulatory approvals. No vote is required by AT&T shareholders.

As a result of the transaction, the AT&T dividend will be reduced by 40% to 50%. I have seen one estimate that the new dividend will be $0.29 per share quarterly, compared to the current $0.52 rate.

It appears that AT&T investors are most concerned about the dividend cut and have been unloading their shares—since the spinoff announcement, the stock has dropped to $27.16, compared to $32.25 before it. That works out to a 16% drop in the share value. Year-to-date, AT&T is down 4.6%, so it’s at breakeven for the year when you factor in the dividends earned.

After the announcement, the AT&T share price quickly dropped to less than $29. With the understanding that the current dividend would be paid for at least another year and the expectation that the share price should recover after the initial sell-off, I recommended that my subscribers hang on to their AT&T shares.

I missed the boat on that one. I believed that eventually, the investing public would see some value in the pending spinoff. That hasn’t happened, and I observe that investors are so peeved about the dividend cut that they are not interested in any potential, post-split value. But it’s that very lack of belief in AT&T that has me considering holding on until after the split.

Let’s look at some numbers. A lot of this is hypothetical, based on current knowledge.

First, the current dividend rate will be paid at least three more times. That’s cash coming in at a 7.5% annual yield, based on the current share price.

The Warner Bros. Discovery shares received by AT&T investors are expected to be valued at $7.00 to $8.00 per share. When the transaction occurs, the AT&T share price will drop by that amount (let’s split the difference and call it $7.50 for our calculations), and investors will own Discovery shares worth $7.50 per AT&T share.

I saw a reliable estimate that the post-spin AT&T dividend could be $0.29 per share, or $1.16 annually. Based on current values, AT&T will be worth approximately $20 per share. Apply the new dividend, and the post-spin AT&T shares will yield 5.8%—let’s round up to 6%.

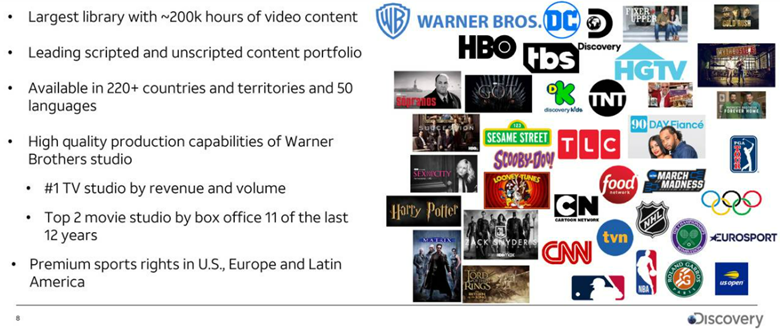

Shareholders will also own $750 of Warner Bros. Discovery per 100 shares they currently own of AT&T. The new media company will possess a lot of valuable content. This graphic is from the spinoff presentation:

The newly merged company will be a content and streaming business with an operations model similar to Netflix and Disney. Adding the $43 billion spinoff value to Discovery’s market cap, you get a post-spin market value of $60 billion. Netflix has a $260 billion market cap, and Disney is valued at $315 billion.

There seems to be significant potential for shares of the new media company to move quickly higher after they start trading on the stock exchange. After seeing investors bailing on AT&T without looking at the post-transaction potential, I want to wait and see what happens, with some of my money still in the game. So unless AT&T goes back up above $30 per share, I will recommend that my subscribers continue to hold AT&T.