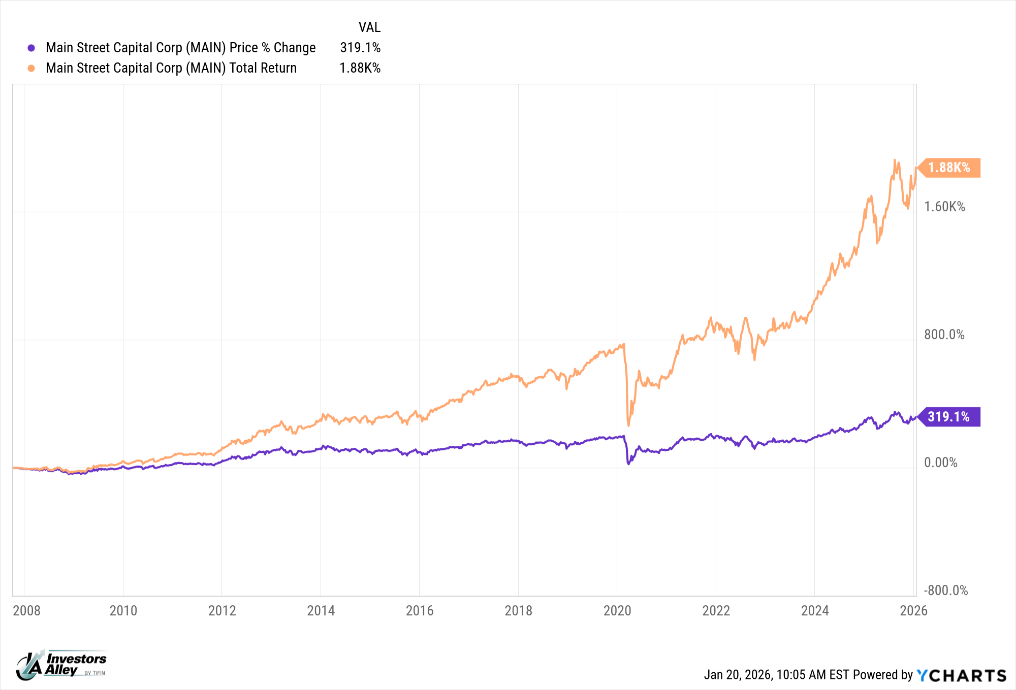

Main Street Capital Corp (MAIN) is arguably the most successful business development company (BDC) for investors. Since its October 2007 IPO, with dividend reinvestment, MAIN has returned 1,900% to investors. That works out to 18% per year, compounded.

MAIN Street Capital outperforms its peer BDCs through a combination of dividend growth, supplemental dividend payments, and steadily increasing NAV.

The challenge with considering MAIN today is that the shares trade for 1.9 times book value. Most BDCs trade close to or below book and sport yields in the high single digits to low double digits. MAIN yields just 5.0% on regular dividends.

While the company will continue to grow its book value and dividend rate, the very high valuation makes it hard to justify buying MAIN shares at the current share price.

Don’t get me wrong, MAIN is a quality stock and I plan to continue holding it – and collecting monthly dividends – just as I have for the past decade.

But what if you had a time machine and could go back to the early days of Main Street Capital to buy shares before investors earned the great returns?

Just about one year ago, on January 30, 2025, the MSC Income Fund (MSIF) listed its shares on the New York Stock Exchange. MSIF is a BDC. It has not been a great first year for the MSIF share price. The shares are down 20% since the listing date. However, the share price stabilized in early November and has risen almost 10% since then.

The MSIF share price action makes it clear that the investing public has not learned that the Main Street Capital team manages the MSC Income Fund. The MSIF investment portfolio mirrors many of the investments in the MAIN portfolio.

In contrast to MAIN, MSIF trades for 83% of book value. MSIF yields 10.6%.

I view MSIF as a mini-MAIN. As the investing public figures this out, look for the MSIF shares to move to a premium to NAV. This BDC could soon trade at $20, up from its current $13.15.

Profit From Trump's War On The Fed

Trump is taking over the Fed right now and this battle creates massive volatility. Tim Plaehn reveals the 3 assets that could soar, giving you the chance to double your money over the next 34 months. Watch the free briefing now.