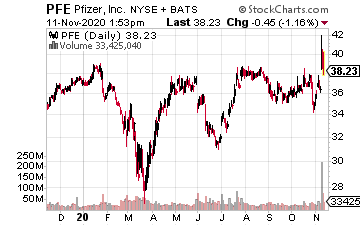

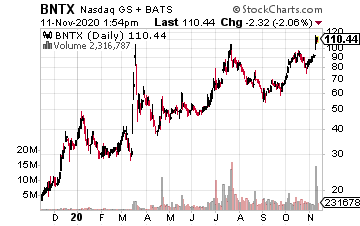

Pfizer (PFE) and BioNTech (BNTX) were explosive earlier this week. All on news PFE just said its COVID-19 vaccine is 90% effective. “Amazing news from Pfizer with 90% efficacy. This hopefully is the beginning of the end of our fight against Covid,” Peter Boockvar, chief investment officer at Bleakley Advisory Group, said, as quoted by CNBC.

As noted by PFE Chairman and CEO Albert Bourla, “It is a great day for science. It is a great day for humanity when you realize your vaccine has 90% effectiveness. That’s overwhelming,” Bourla said on CNBC. “You understand that the hopes of billions of people and millions of businesses and hundreds of governments that were felt on our shoulders, now… I think we can see light at the end of the tunnel.”

Free! 10-Point Checklist for Trading Options [ad]

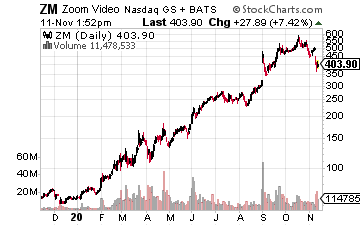

Stay at home stocks, like Zoom Technologies (ZM) began to fall apart on that vaccine news, too. “We’re making the assumption that everything is going to be back to normal tomorrow, and taking back some of the reward that was meted out to the stay-at-home names,” Art Hogan, chief market strategist at National Securities, as quoted by CBS News.

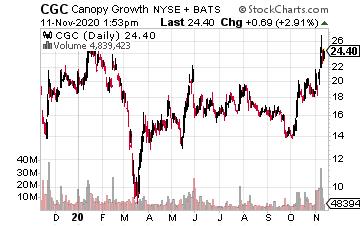

Canopy Growth (CGC) saw higher highs on election night results. For example New Jersey and Arizona voted to approve amendments to legalize the use of green for those above the age of 21. Voters in South Dakota approved it for medical use. Montana voted to legalize, regulate and tax recreational green for adults 21 and older.

Those and 11 other states — Washington, Oregon, California, Nevada, Colorado, Michigan, Illinois, Maine, Vermont, Massachusetts, Alaska, and the District of Columbia already allow legal recreational use. And we have to consider that with Joe Biden in the White House, he could more willing to legalize on a national level.

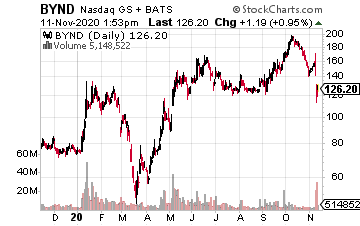

Beyond Meat (BYND) slipped more than $25 a share after COVID-19 took a bit out of earnings. The company posted a loss of $19.3 million, or 31 cents a share, as compared to net income of $4.1 million, or six cents a share year over year. Revenue was up 3% to $94.4 million from $92 million year over year.

“Our financial results reflect a quarter where for the first time since the pandemic began, we experienced the full brunt and unpredictability of COVID-19 on our net revenues and accordingly, throughout our P&L,” Beyond Meat Chief Executive Ethan Brown said, as quoted by MarketWatch.

At time of this writing, Ian Cooper does not hold a position in any of the stocks mentioned.