You know your company has made it when it’s parodied on Saturday Night Live. Recently, Zillow (Z) became the latest company to be parodied on SNL with a funny, already-viral skit—go look it up if you haven’t seen it yet.

More importantly, Z has become even more popular among investors—and its popularity has nothing to do with making it onto SNL.

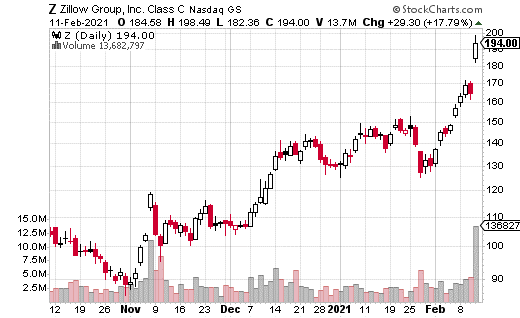

Last week, Zillow announced earnings, crushing expectations. As you may have guessed, the stock soared higher. This year to date, Z shares are already up more than 49% (as of this writing). That’s not bad—especially for a company not being pumped on Reddit.

Zillow came out ahead on almost every important metric. Quarterly revenues were nearly $50 million more than analysts projected. Adjusted EPS came in at $0.41 instead of the $0.27 that was anticipated. These are huge beats.

What’s more, the company expects first-quarter revenue to be nearly $150 million more than the analyst consensus forecast. Adjusted EBITDA is also forecast to be much better than initially thought.

So, what’s driving this unexpected growth?

Despite the massive disruption of the economy by COVID-19, one area that has thrived is real estate. Ultra-low rates have been a boon for those looking for new mortgages or refinancing old ones. Plus, plenty of people are looking to move away from urban areas given all the issues of late.

Not only are more companies expected to continue the work-from-home model, but offices are being downsized or outright closed in major urban centers. Retail businesses are also shuttering in big cities, and there’s some question as to whether those vacancies will be filled once the pandemic eases.

Zillow has benefited from this trend, as the site is extremely popular for viewing and following up on real estate for sale or rent. (The SNL skit jokes that this is a pleasurable pastime for adults these days.)

Well, options traders are also boarding the Zillow train, or so it seems. Over the last 30 days, on average, 70% of the dollars spent on Z options have been considered bullish. That means a lot of call buying and put selling has been going on.

On the day after earnings were announced, with the stock up more than 17% on the day, call trading was about 70% of the options action. That’s also generally a bullish signal, with likely most of the calls purchased.

One trade in particular that stands out from that day is a purchase of a 1,500 block of calls. The trade occurred in January 2022 options and was at the 240 strike with the stock price just under $190. The call buyer paid $26 per option, which amounts to $3.9 million worth of premium.

Make no mistake: this is a big trade. Nearly $4 million spent on $50 out-of-the-money options is no joke. The stock would need to get to $266 by expiration just for the trade to break even. Clearly, this buyer is very bullish on Zillow (unless it’s part of a bigger, multi-part strategy). The options’ price could be reduced if it ends up being part of a call spread, for example.