Utz Brands (UTZ) recently announced Q3 earnings of 26 cents a share on revenue of $248 million versus Wall Street’s forecasts at 11 cents a share on sales of $246 million. The 15-cent beat by UTZ was impressive. Net income checked in at $17.9 million versus $8.5 million in the prior year.

UTZ also recently acquired Truco Enterprises for $480 million, a company it expects to generate approximately $195 million in net sales in fiscal 2020, an increase of approximately 32% compared to the prior year.

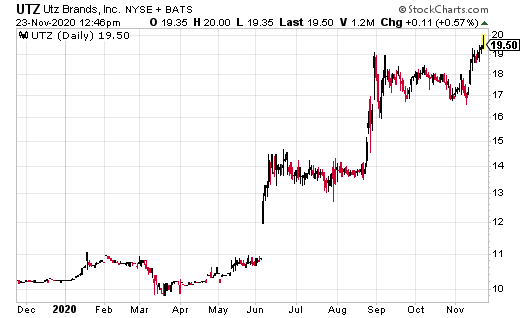

UTZ shares have been in a nice uptrend since this month’s low of $16.60 and have been trading above $19 for five-straight sessions while consolidating from the recent run-up. This level was cleared and held with Thursday’s high reaching $19.49.

Current resistance is at $19.25-$19.50 with a close above the latter signaling a breakout towards higher highs. Continued closes above the latter could signal a near-term breakout towards the $20-$22 area, depending on momentum.

There are options available to trade on UTZ stock, both short-term and longer-term. To give the trade enough time for shares to make a possible run towards the $21.50-$22 area, or 10% higher from current levels, the UTZ January 20 calls (UTZ210115C00020000) look like a nice risk/ reward setup and are currently at 75 cents.

The calls have nearly two months before expiration and would double from current levels if UTZ shares are trading above the $21.50 level by mid-January. They would be at least $1.50 “in-the-money” for a 100% return with an even bigger winner of 200% if shares trade above $22.25.

The risk in the trade would be if shares fall below $18-$17.75 and the 50-day moving average. A close below the latter levels would be a signal to possible cut losses to save the remaining premium as lower lows, or a possible trading range, could ensue afterwards.