This strategy is… Selling Covered Calls.

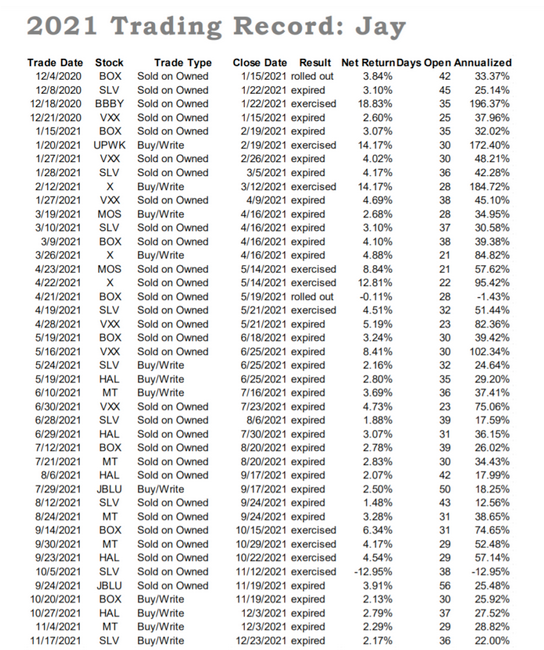

My readers and I enjoyed a 95% win rate on 47 trades last year because covered calls can be incredibly low-risk when done correctly.

Lots of folks have a hard time believing my 95% win rate.

So here’s my full trading record:

If you look close, you’ll notice that we were opening and closing trades just about every week for the entire year…

And this year, we’re approaching a 90% win rate even as the market goes bonkers.

That’s why, if you haven’t had much success trading recently…

I bet it’s because you’re not trying covered calls.

“But Jay, I’m not making any money with covered calls. What gives?” Don’t worry. There’s a good chance it’s not working out for you simply because you’re trading the wrong stock at the wrong time. Here’s the good news: I will reveal how to find the best stocks for trading covered calls right here. (Plus, I will share details on my #1 stock for 2022!)

And you don’t have to take my word for it.

Investopedia says…

“This conservative approach to trading options can produce additional revenue, regardless of whether the stock price rises or falls….”

Fidelity claims…

“….a wide range of investors can benefit from covered calls. From long-term investor to short-term investor, from casual trader to aggressive trader and from growth-oriented risk taker, to income-oriented conservative….”

And TheStreet reports…

“It is important to first understand that selling covered calls has a lot less risk involved than buying calls.”

Here’s how it works…

A Win-Win Scenario with Covered Calls Explained

Let’s say you own 100 shares of an ETF.

And in this hypothetical example, this ETF is trading at $20.

So you decide to sell a covered call at $1 per share…

Meaning, that since an options contract controls 100 shares…

You’d collect a $100 premium for selling this covered call.

( $1 per share x 100 shares = $100 )

With me so far?

The strike price is $25 per share and expires 1 month from now.

What happens next? Two scenarios can play out at the end of that month:

If the stock is higher than $25, you collect income by selling the shares for $25 (a 25% gain)… PLUS, you also get to keep the $100 cash premium that’s yours for selling the contract.

If the stock is $25 or below, you get to keep your 100 shares of SLV, and you keep the $100 premium for selling the contract.

That’s a win-win scenario!

Is it risk-free? Of course not…

But once you get the hang of it, you’d be hard-pressed to find a more reliable strategy than this for collecting extra cash.

How much extra cash? Well, this is where it gets inspiring…

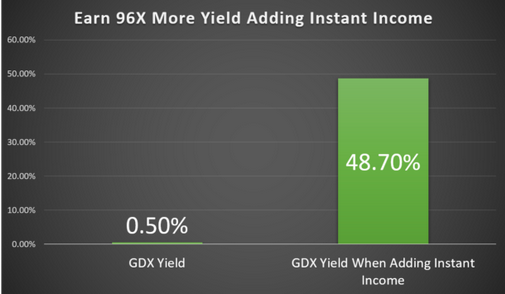

Collect Up To 96x MORE Income Than Dividends

That’s exactly what happened with VanEck Gold Miners ETF (GDX):

The yield shot up by 96x for a total of 48.70%.

Not bad, right?

And these kinds of opportunities are not uncommon…

In fact, there’s a way to spot them as often as once per week.

If you’re interested in learning more…

Then click right here, where I’ll reveal how to determine if a stock is a good candidate for covered calls.

And I’ll even clue you in on my #1 stock for 2022 and beyond!