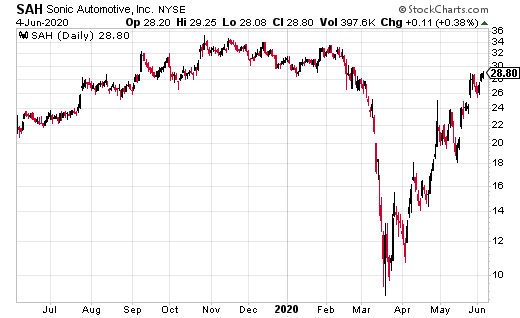

Sonic Automotive (SAH) has moved substantially higher after providing an update to investors on the company’s outlook for 2020. SAH stock has jumped almost 19%, from $24 to around $28.50 as the company gained some clarity in the midst of the COVID-19 crisis.

The company said sales and traffic in its locations have been coming back, basically matching the slowly reopening U.S. economy.

David Smith, SAH’s CEO, said, “Our new and used vehicle sales volume and fixed operations gross profit have performed at or above our expectations and continue to improve week by week.”

Going forward, Smith continued, “We believe the strategic actions we took at the onset of the pandemic have strengthened our business and positioned us to take advantage of opportunities in the second half of 2020 and beyond.”

These 10 Stocks Look to Lead The Continuing Recovery [ad]

Jeff Dyke, Sonic Automotive and EchoPark President, said he believes the company has made strategic moves that will allow it to take advantage of pre-owned automotive market inventory.

Dyke said, “We believe that both our franchised stores and EchoPark stores are well-positioned to capitalize on inventory sourcing opportunities that may impact the pre-owned market in the near term, allowing us to drive incremental sales volume and continue to expand our EchoPark footprint.”

Dyke noted that the company is seeing improving sales continue into May, extending the positive trend seen in late April. New vehicle volume was down less than 20% and pre-owned sales were down less than 15%. EchoPark, the flagship new concept dealerships Sonic has focused on growing, have actually seen a less than 10% decline year-over-year.

The company did note they had enforced strategic pricing options, lowering prices in order to capture additional volume during the COVID-19 health crisis. This helped keep gross profit from moving lower and controlled inventory.

With regard to inventory improvement, Dyke noted, “…with used vehicle inventory days’ supply of 29 days at the franchised stores and 33 days at EchoPark at April 30, 2020, compared to 37 and 44 days at March 31, 2020, respectively, on a trailing one-month sales basis.”

While Sonic Automotive is down a little over 18% from highs it reached at $35 late in 2019, it has recovered much of the losses suffered at the bottom in March due to the COVID-19 crisis. SAH stock traded under $10 at the lows.

Steven Adams’s personal position in Sonic Automotive: none.