Last week was one for the stock market record books. Market indexes exploded higher from Monday into Tuesday. Stocks gave back some of the gains on Wednesday and Thursday. Then the markets closed out the week with a positive day. The interesting part was the magnitude of the moves and the pandemic-related news that triggered the gains and reversals.

On Monday, November 9, the stock market rocketed higher on the news that the Pfizer Inc. (PFE) and BioNTech (BNTX) coronavirus vaccine has shown a 90% effectiveness rate, significantly better results than those put up by the typical vaccine. On that Monday, the S&P 500 traded as high as 3.9% above the Friday close. An end-of-day pullback left the S&P 500 up 1.17% for the Monday.

Forever Dividends Masterclass Taking New Registrations [ad]

Out-of-favor and value stocks did even better. The Alerian MLP Index (AMZ) saw Monday gains of over 11%. In one day. The MSCI US REIT index posted a 4.64% gain for the day. And the out-of-favor sectors continued with positive returns on Tuesday. By the close of that day, the AMZ index was up 12.8% in just two days.

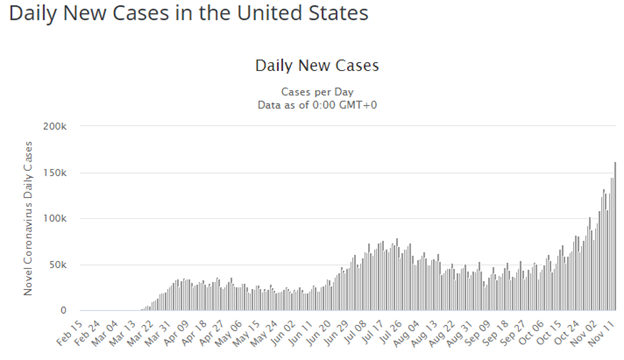

The markets reversed on Wednesday and Thursday. The S&P 500 dropped by 0.2% over the two days. Looking again at the value sectors, the S&P Energy sector lost 4.2% over the same two days. The financial news media blamed the declines on the growing number of positive COVID-19 cases. Those numbers are climbing rapidly, creating a second wave of infections and filling up hospital beds.

Source: worldometer.info

Friday was a positive day for the markets, and overall the week was nicely positive. I don’t closely track shorter-term results, but my brokerage accounts, which are only invested in stocks recommended through my Dividend Hunter and other services, gained 7.4% for the week.

The point of all this is to demonstrate that for the near future, stock market values are likely to swing strongly positive or negative based on the most recent pandemic-related news. Pending vaccine approvals are positive and good for the markets. Continued record new infections and hospitalizations are negatives. For short term traders, it will be tough to time the coronavirus Jekyll and coronavirus Hyde news cycle. But it also present possibilities for options traders.

For my subscribers, the overall trend is very positive, with the shift away from the pandemic-helped growth stocks and into the value sectors that will thrive with the population feeling safer as they are able to get vaccine shots.

A good example comes from our long-suffering investment in the InfraCap MLP ETF (AMZA). The fund shares gained 19% for the week, matching the annual dividend yield.