Global leaders want millions of EVs on the roads by 2030, sending electric vehicle stocks accelerating.

These goals have been set in effort to reduce vehicle emissions. The U.S. for example, wants to cut emissions by as much as 50% by 2030. President Biden signed an executive order that would make half of all new vehicles sold by 2030 electric.

But government goals aren’t the only thing making EV stocks soar. Major automobile manufacturers are making moves of their own that are helping to advance this trend. Ford (F) announced it would pump $11 billion into manufacturing electric vehicles. Over the last two years, it announced an investment of $950 million to build its all-electric 2022 F-1590 Lightning.

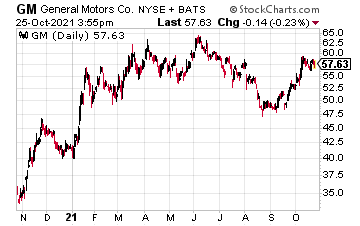

A Major Shift to All EV

General Motors (GM) will shift to all-electric by 2035. According to NBC News, [General Motors CEO Mary] “Barra has frequently touted GM’s plan for ‘an all-electric future,’ recently increasing to 30 the number of pure battery-electric vehicles it will launch by the middle of this decade, but this marks the first time the largest Detroit automaker has set a hard target for completely phasing out gas and diesel engines for all light-duty vehicles, including pickups and SUVs.”

And finally, Tesla just saw its market cap hit $1 trillion for the first time ever—all after Hertz announced it would buy 100,000 electric vehicles. The deal, which could bring in as much as $4.2 billion for Tesla, “is the largest ever purchase of electric vehicles,” says Bloomberg. On the news, Tesla last traded at $994.15.

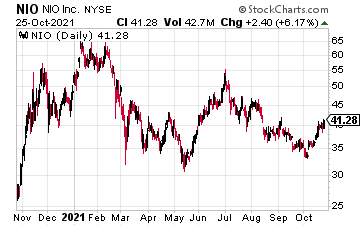

EV Company, NIO is Accelerating Just as Fast

While Tesla could run well above $1,000 per share on the EV boom, if you’re looking for a similar red-hot EV trade, take a look at Nio Inc. (NIO).

Currently priced at $41 per share, Nio is just starting to pivot higher from triple bottom support dating back to March 2020. From here, the stock could test prior resistance around $47.50, and perhaps $55.

Not only is Nio benefiting from the EV boom, but it’s also accelerating on delivery numbers. In September, for example, the company announced it delivered 10,628 vehicles, a year-over-year increase of 125.7%. For the three months ending in September 2021, deliveries jumped to 24,439, a year-over-year increase of 100.2%.

With the EV story showing no signs of slowing, coupled with red-hot delivery numbers, Nio could eventually be the next Tesla, in our opinion.