Gig economy stocks, like LYFT Inc. (LYFT) and Uber (UBER) got a boost earlier this week on the passage of California Prop 22 won. As noted by The Guardian, LYFT and UBER won a major victory to classify drivers as contractors, not employees following the passage of the measure. “The passage of proposition 22 in the home state of many of the gig economy companies is likely to be seen as an example for tech legislation around the US.”

Wedbush analyst Dan Ives, as quoted by MarketWatch on UBER and LYFT said. “Taking a step back, this removes a significant overhang and dark cloud for the likes of Uber and Lyft and ends this ‘head-scratching’ AB5 legislation chapter that was a major threat to the future of the Gig Economy and thousands of drivers throughout California.”

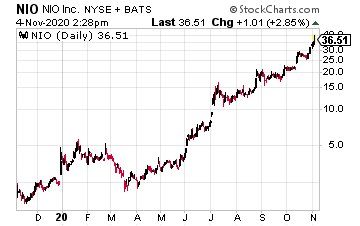

Nio Inc. (NIO) is still accelerating to higher highs. Citigroup analyst Jeff Chung recently upgraded the stock to the equivalent of a buy rating, according to Barron’s, form a hold. He also increased his price target to $33.20 from $18.20. JP Morgan analyst Nick Lai, who believes electric vehicle penetration could quadruple over the next five years, called Nio a “long term winner in the premium space.”

Buy and Hold This Dividend Stock Forever. It Pays 8.4% and Has Raised Dividends Every Year For a Decade [ad]

Record deliveries are sending the stock higher, too. “NIO delivered 5,055 vehicles in October 2020, a new monthly record representing a strong 100.1% year-over-year growth. The deliveries consisted of 2,695 ES6s, the Company’s 5-seater high-performance premium smart electric SUV, 1,477 ES8s, the Company’s 6-seater and 7-seater flagship premium smart electric SUV, and 883 EC6s, the Company’s 5-seater premium electric coupe SUV. NIO delivered 31,430 vehicles in 2020 in total, representing an increase of 111.4% year-over-year. As of October 31, 2020, cumulative deliveries of the ES8, ES6 and EC6 reached 63,343 vehicles.”

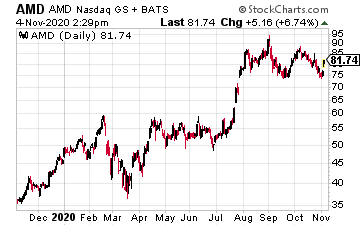

Advanced Micro Devices (AMD) is turning higher after Goldman Sachs upgraded the stock from Neutral to a Buy. They also lifted their price target on AMD from $84 to $96. Analyst Toshiya Hari calls AMD, a “multi-year share gain and expansion story.” In addition, Goldman Sachs added AMD to its Conviction List. Even Bank of America has said its third quarter strength sets the company up for blockbuster growth in a $50 billion processor market, notes Markets Insider. The firm also lifted its price target on AMD from $100 to $110.

Related: AMD Agrees to Buy XLNX After INTC Sells Flash Memory

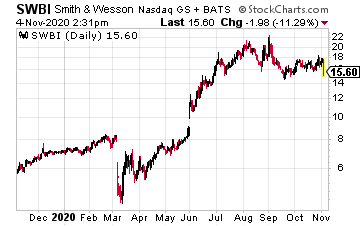

Smith & Wesson (SWBI) ran higher on speculation Biden and running mate Kamala Harris could enact legislation to potentially curb the Second Amendment. Biden has already noted he would ban “assault weapons, ban high capacity magazines and introduce universal background checks in a bid to confront what he called America’s ‘gun violence epidemic,’” as reported by Newsweek. That’s in addition to higher gun sales on fears of unlawfulness with the coronavirus and protests. Plus, according to the FBI, the National Instant Criminal Background Check System (NICS) conducted 14.8 million checks for gun sales this year. In Oct., year over year, firearm background checks soared 60% to 1.769 million.

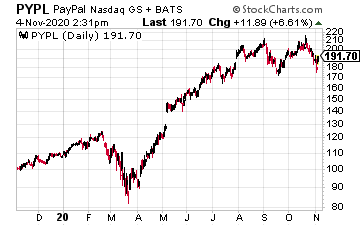

PayPal Holdings (PYPL) is pushing higher on earnings, despite a disappointing outlook. The company posted Q3 EPS of $1.07, up from 76 cents year over year. It was even better than analyst forecasts for 94 cents. GAAP net income came in at $1.02 billion, or 86 cents a share, up from $462 million, or 39 cents year over year. It even raised its EPS forecast for the full fiscal year, anticipating EPS growth of 27% to 28%. That’s up from prior estimated growth of 25%.Revenue soared to $5.46 billion from $4.38 billion. That was also above estimates for $5.42 billion. And it added another 15.2 million new active users to 1.5 million merchants.

While all of that was solid, great news, the PYPL outlook disappointed. All after “PayPal Chief Executive Dan Schulman said in a call with analysts that the company was giving a more prudent estimate for the fourth quarter in part because of uncertainty due to the pandemic and its impact on the global economy, as well as Tuesday’s U.S. presidential election and concerns about social unrest.”

At time of this writing, Ian Cooper does not hold a position in any of the stocks mentioned.