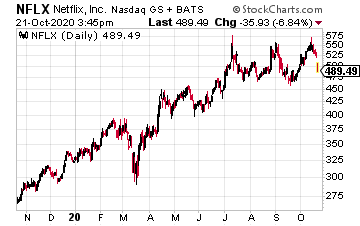

Shares of Netflix Inc. (NFLX) came under pressure this week. after reporting slowing growth in new subscribers, and lower than expected profits.

The company added 2.2 million net memberships in the months ending September 30. That’s down from 6.8 million year over year. That also dropped the company’s total subscribers to 195.2 million, which was lower than expectations for 196.2 million. NFLX also posted diluted EPS of $1.74 on sales of $6.4 billion in revenue. Analysts were looking for $2.13 EPS on $6.38 billion sales.

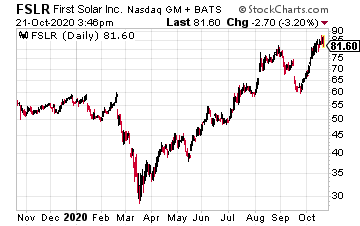

Clean energy stocks like First Solar (FSLR) are running on the idea that Joe Biden could win. While it’s still too soon to call, investors are sending solar stocks higher on that potential news.

Reportedly, Biden has reportedly outlined a $2 trillion sustainable energy infrastructure plan that could make the U.S. carbon free by 2035.

“With increasing investor expectations of not just a potential Biden win but further upside for renewables tied to a Dem sweep at the Senate, we note broader expectations for the solar industry to benefit broadly,” Bank of America strategist Stephen Suttmeier said, as quoted by CNBC. “On a relative price basis we have seen a very bullish rotation for clean energy relative to utilities on an upside breakout from a 9-year big base vs utilities.”

Buy and Hold This Dividend Stock Forever. It Pays 8.4% and Has Raised Dividends Every Year For a Decade [ad]

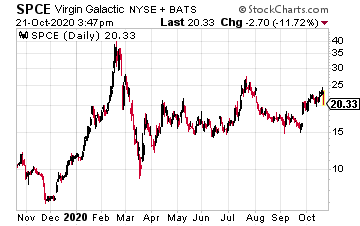

Virgin Galactic (SPCE) stock is taking flight ahead of its Oct. 22 test flight on Space Ship Two.

Susquehanna analysts just told their clients to buy the stock with a price target of $20. Bank of America told clients to buy, too with a target price of $35 a share. Bank of America also sees the industry achieving a valuation of $1.4 trillion over the next decade.

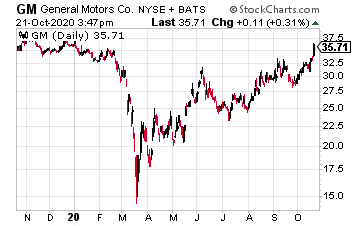

General Motors (GM) is running on its electric vehicle news. The company just announced that its investing $2.2 billion in U.S. manufacturing to increase EV production. Since 2019, the company has committed more than $4.5 billion to prepare for EV production, as noted by CNBC. It’s also planning to unveil about 20 new EVs around the world by 2023, including the GMC Hummer EV.

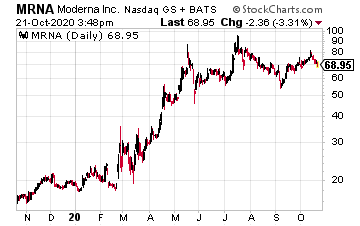

Moderna Inc. (MRNA) is also seeing momentum on news its COVID-19 vaccine could be ready by November. According to CEO Stephane Bancel, the U.S. could authorize emergency use of the company’s vaccine by December. That is, if the company can produce positive interim results in November from its clinical trial.

According to The Wall Street Journal, “The company must “monitor the safety of at least half of the study subjects for two months after vaccination before it can seek an authorization for emergency use.

Moderna was likely to reach that threshold in late November. If Moderna files for an emergency use authorization soon after, the Food and Drug Administration may take a few weeks to review the application before deciding in December.”

At time of this writing, Ian Cooper does not hold a position in any of the stocks mentioned.