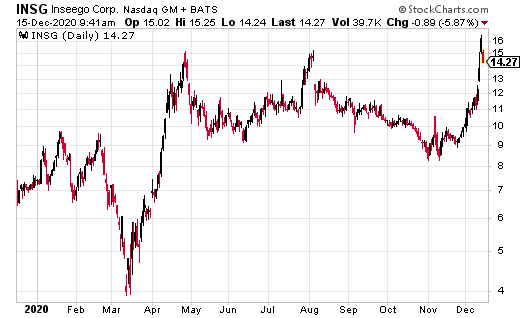

5G stock, Inseego Corporation (INSG) just gapped above triple top resistance to $15.47.

The stock, now up 82% since bottoming out at $8.47 in November, could see higher highs with a good deal of catalysts. For one, T-Mobile just made Inseego’s 5G MiFi M2000 its first hotspot.

“We are extremely proud to be the trusted choice for T-Mobile with their first-ever 5G mobile hotspot, bringing breakthrough performance to over 100 million enterprise and consumer customers on the Un-carrier’s nationwide 5G network. In addition, this launch enables T-Mobile to provide a secure, integrated solution for their enterprise customers with Inseego Connect cloud management software,” said Inseego Chairman and CEO Dan Mondor.

Two, Inseego Corp.’s 5G device is now available in Japan.

According to a recent press release, “The company’s flagship 5G solution is now commercially available in Japan with Sumitomo Corporation’s subsidiary Grape One Ltd., which is spearheading the creation of a local 5G service platform business to deploy new end-to-end solutions for cable television (CATV) companies throughout Japan.

Three, Vodafone Qatar just became the first operator in the region to launch the device, too.

Diego Camberos, COO, Vodafone Qatar, said: “We are 100% 5G Ready and have a reliable GigaFast 5G network across the country, latest 5G devices and Unlimited 5G Plans. The advanced Inseego 5G MiFi M2000 is a perfect addition to our range of 5G devices and is set to be in high demand especially during this winter season when customers are spending more time enjoying the outdoors and want a fast internet connection wherever they go.”

Company Revenue Increased 44% Year over Year

In addition to those recent catalysts, the company also reported third quarter net revenue of $90.2 million, reflecting year-over-year growth of 44%, GAAP operating loss of $3.4 million, GAAP net loss of $5.4 million, GAAP net loss of $0.06 per share, adjusted EBITDA of $7.4 million and non-GAAP net income of $0.01 per share.

“We had a monumental quarter with revenue over $90 million, an adjusted EBITDA of $7.4 million, and we achieved positive free cash flow. These are all major milestones that confirm the success of our turnaround and, at the same time, firmly establish that the company has entered a growth and cash generation phase,” said Inseego Chairman and CEO Dan Mondor.

Ian Cooper’s Personal Position in INSG: None