Gambling stocks struggled in 2020 as companies with large physical casinos experienced dramatic declines in revenue and earnings due to the coronavirus pandemic. However, the sector has shown strength throughout 2021 so far, as a number of positive developments are coming into play.

While the advancements in coronavirus vaccine development have been a welcome relief to casino operators, the biggest switch in the industry was the move to online gambling as consumers sheltered at home. In fact, the global gambling industry predicts growth in this sector will reach nearly $650 billion by 2027—even accounting for the pandemic—with travel expected to rebound in 2021.

Additionally, lotteries are projected to post a roughly a 10% compound annual growth rate and total $210 billion by 2027. One company that benefits from both of these trends is International Game Tech (IGT).

The London based company was founded in July 2014 and engages in the design, manufacture, and marketing of electronic gaming equipment, software, and network systems. Additionally, IGT is also involved in the delivery of lottery solutions, while performing research and development for lottery-related products globally.

Despite difficulties in the overall sector over the past year, IGT has posted a profit in three of the past four quarters. Earnings have also topped analysts’ expectations by $0.47, $0.11, $0.05 and $0.07, respectively, over the same time frame.

The company’s next earnings release is expected in mid-May with analysts forecasting a profit of eight cents a share on revenue north of $873 million. For 2021, estimates are pegged for a profit of $0.71 on revenue of $3.7 billion.

Earlier this month, one analyst raised the price target on International Game Techfrom $22 to $25 22 while keeping an “outperform” rating on the shares. They noted the company’s lottery strength as revenue rose 11% and EBITDA was up 17%.

In January, another analyst also raised the price target to $25 from $16, while keeping a “buy” rating on the shares. They were impressed with the company’s sale of the Italy business, the potential for video game lottery expansions to fill budget gaps, and the domestic gaming expansion opportunities from new states coming online.

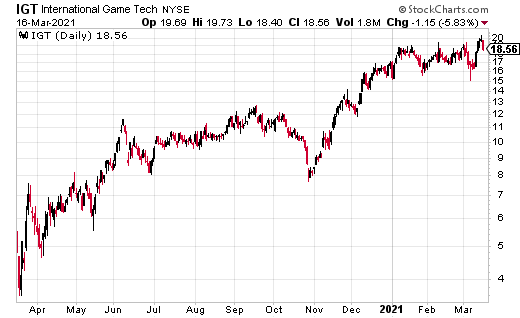

On a technical analysis, IGT shares are on the verge of a “triple-top” breakout after tapping a fresh all-time high of $19.57 last Thursday. This topped the prior early March peak of $19.41 and the February 9 high of $19.40.

If shares can clear and hold the $20 level, there is a good chance near-term momentum could lead to a run towards the $22-$24 area. Current support is at $18–$17.50 and the 50-day moving average on a pullback from current levels.