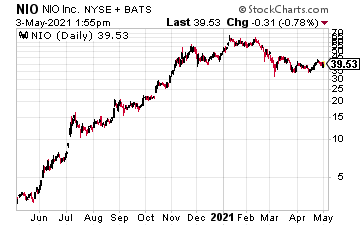

Electric vehicle stocks, like Nio (NIO) are accelerating with several key catalysts.

For one, the world is spending billions to cut emissions. The U.S. just pledged to greenhouse gas emission by nearly half over the next 10 years. Europe wants to cut CO2 emissions by up to 55% by 2030. China says it’ll stop releasing CO2 in the next 40 years.

That’s part of the reason countries all over the world are pushing for more EVs.

Two, by 2030, according to the International Energy Agency (IEA), the world could see up to 145 million electric vehicles on the road. By the end of the decade, we could see 230 million.

Three, even with semiconductor fears, NIO just produced blowout earnings.

- Deliveries of vehicles from NIO were 20,060 in the first quarter of 2021, including 4,516 ES8s, 8,088 ES6s, and 7,456 EC6s, representing an increase of 422.7% from the first quarter of 2020 and an increase of 15.6% from the fourth quarter of 2020, as reported by the company.

- Total revenues were RMB7,982.3 million (US$1,218.3 million) in the first quarter of 2021, representing an increase of 481.8% from the first quarter of 2020 and an increase of 20.2% from the fourth quarter of 2020.

“NIO started the year of 2021 with a new quarterly delivery record of 20,060 vehicles in the first quarter, representing a strong growth of 422.7% year over year,” said William Bin Li, founder, chairman, and chief executive officer of NIO. “The overall demand for our products continues to be quite strong, but the supply chain is still facing significant challenges due to the semiconductor shortage. In light of the strong momentum under a volatile macro environment, we expect to deliver 21,000 to 22,000 vehicles in the second quarter of 2021.”

Related: LTHM Stock Price Pullback Gives Traders An Opening Before the Next Big Move

Plus, in April, the company delivered 7,102 vehicles – a 125.1% increase year over year.

Despite a global chip shortage, “NIO still kept up with consistent market demand to deliver more than 7,000 cars in a month for the third time in 2021 and maintained growing momentum.”

In addition, according to Barron’s, “Mizuho analyst Vijay Rakesh called the results solid, noting that production is still holding steady at about 7,500 vehicles a month. He rated shares a Buy and has a $60 price target for the stock.”

At the time of this writing, Ian Cooper did not hold a position in the NIO stock.