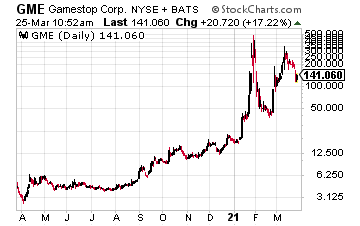

Gamestop (GME) released fourth-quarter results showing it missed on the top and bottom line, and the company may sell more shares to help fund its transformation. GME earned $1.34 per share on sales of $2.12 billion. The market was expecting EPS of $1.35 on sales of $2.21 billion.

“The highly anticipated 4Q20 earnings report from GameStop was a bit anti-climatic,” wrote Telsey Advisory Group analyst Joseph Feldman, as quoted by CNBC. “While EPS met the consensus, it was completely driven by a tax benefit that offset much worse than expected operating profit. Moreover, while everyone was expecting big news about some massive digital transformation in the mold of the new tech-oriented board members, nothing was said.”

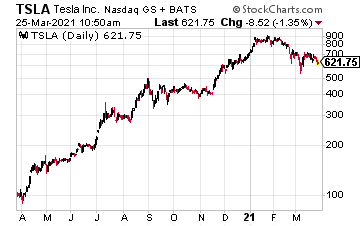

Tesla (TSLA) is accelerating again after Cathie Wood’s Ark Invest Management set a price target of $3,000. According to Bloomberg, “According to Ark’s new model, in the best case scenario, Tesla could reach $4,000 per share in 2025, and in the bear case, $1,500. The company forecasts Tesla’s unit sales to be between 5 million and 10 million vehicles in 2025, assuming increased capital efficiency.”

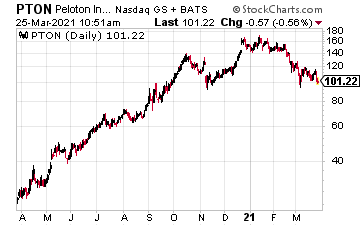

Peloton Interactive Inc. (PTON) is rebounding after recent accidents with its treadmills. However, according to Bloomberg, “Peloton equipment does not seem to be more prone to these types of accidents than other exercise machines used at home. That view was supported by data released Friday by the U.S. Consumer Product Safety Commission, which is investigating the Peloton incidents.”

Intel (INTC) is gaining traction after CEO Pat Gelsinger said the company is making a comeback. “Intel is back. The old Intel is now the new Intel,” Gelsinger said, as quoted by CNBC. “We have that confidence in our execution. That our teams are fired up. You know, if we said we’re going to do X, we’re going to do 1.1x every time we make a commitment.”

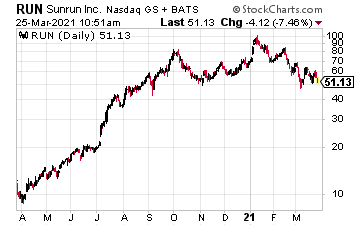

Sunrun (RUN) was recently upgraded by Goldman Sachs’ analyst Brian Lee, who now has a buy rating on the stock. As noted by The Street, he noted that, “given the company’s growth is accelerating, while absolute yields remain quite low, especially when considering the company’s potential to refi old debt.”

In addition, he says, “We believe U.S. solar demand is back to, if not actually trending above, prior expectations for growth before the onset of the pandemic in early 2020,” the analyst said. “Our ongoing channel checks with downstream distributors and installers also resonate with our expectations that demand heading into 2021 remains strong.”

At the time of this writing, Ian Cooper did not hold a position in any of the mentioned stocks.