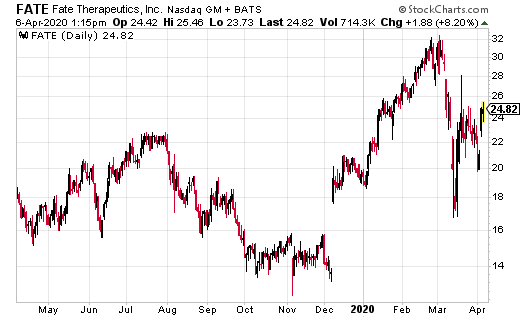

Just last week, the FATE finished up more than 8% at $22.94 after securing a $3 billion deal with Janssen Biotech, Inc, one of the Janssen Pharmaceutical Companies of Johnson & Johnson to develop four cancer treatments.

These treatments belong to a class known as immuno-oncology drugs, which help teach the immune system how to identify hidden cancer cells. Not only does this deal now validate FATE’s technology, notes Investor’s Business Daily, it removes cash flow concerns, and now adds another four potential cancer treatments for the company.

“The deal adds up to four novel CAR (chimeric antigen receptor) targets and brings execution capability of a major oncology company,” says SVB Leerink analyst Daina Graybosch.

According to Fate Therapeutics’ President and CEO:

“We are delighted to enter this strategic collaboration, which brings together Janssen’s scientific and global commercialization leadership, deep domain expertise in oncology and proprietary technologies for targeting and binding certain tumors and our industry-leading iPSC product platform to develop novel off-the-shelf CAR NK and T-cell cancer immunotherapies.”

“The collaboration strengthens our financial and operating position through a focused effort of developing cell-based cancer immunotherapies utilizing Janssen’s proprietary antigen binding domains, while enabling us to continue to exploit our deep pipeline of wholly-owned product candidates and further develop our off-the-shelf, iPSC-derived cell-based immunotherapies.”

Under the terms of the deal, FATE will receive an upfront payment of $50 million. Janssen will pay all R&D costs, as well. FATE may also receive another $1.8 billion in development and regulatory fees, and another $1.2 billion in commercial milestone payments. Fate may also receive royalties on all sales of any approved cancer treatments.

Fate Therapeutics Released Earnings in March 2020

As we’ve noted, FATE released earnings on March 3, 2020.

The company’s GAAP EPS loss of 37 cents beat estimates by two cents. Revenue of $2.8 million beat estimates by $1.1 million, and was up 68.7% year over year. “In 2019, we made tremendous progress in pioneering the clinical development of off-the-shelf, iPSC-derived cancer immunotherapy,” said President and CEO Scott Wolchko.

“Our FT500 program demonstrated that multiple doses of iPSC-derived NK cells can be delivered off-the-shelf to a patient in a safe manner without patient matching. Additionally, our FT516 program provided initial clinical evidence that engineered iPSC-derived NK cells may confer anti-tumor activity and deliver clinically meaningful benefit to patients. We also showed the unmatched scalability of our proprietary iPSC product platform, having manufactured hundreds of cryopreserved, infusion-ready doses of our iPSC-derived NK cell product candidates at a low cost per dose in our new GMP manufacturing facility.”

Ian Cooper’s Personal Position in FATE: None