Of the largest 20 stocks (by market cap) in the U.S., which one do you think has the best performance year-to-date? Is it Apple (AAPL), the world’s largest company my market capitalization? Is it electric vehicle powerhouse and crypto-investor Tesla (TSLA)? Given the semiconductor shortage that’s pushing up chip prices, maybe it’s NVIDIA (NVDA)?

Despite its size, AAPL is down 7% for the year. TSLA is down 19% year-to-date at the time of this writing. NVDA has done a lot better in comparison, up 30% for the year. However, it’s still not the top performer of the top 20.

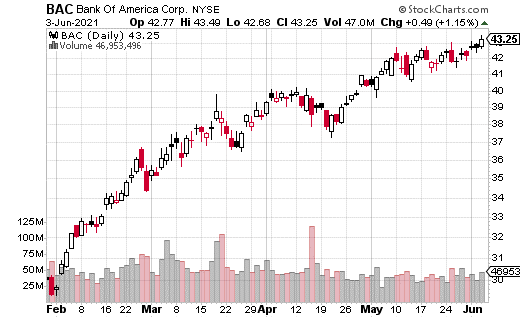

This may come as a shock, but the best-performing top-20 stock is Bank of America (BAC), up 43% so far this year. Even bitcoin (up 33% as I write this) hasn’t performed as well as BAC in 2021.

You read that right. The current best-performing stock is not a technology company or an electric vehicle company or semiconductor company. It’s a bank that’s leading the mega-cap charge. What’s more, BAC may still be undervalued, trading at just 13.9x projected earnings.

Adding BAC to your portfolio may seem like a reasonable proposition, even after its impressive run in 2021. But there might be a way to make owning BAC more attractive.

Right now, the dividend yield on the stock is only 1.7% annually. That’s not much to get excited about.

What if we add options to the mix? Is there a way to get exposure to BAC’s upside potential and also increase the income component of owning the shares? The answer, of course, is yes. You can accomplish this feat by buying a covered call.

A perfect example of such a trade occurred this past week. A trader purchased 330,000 shares of BAC at $43.25, while selling 3,300 of the June 17, 2022, 50 calls for $2.23. Buying the shares provides stock appreciation potential up to $50 a share (where the gains are capped due to the short call). The short 50 calls provide the income component of the trade.

Selling the 50 calls 3,300 times brought in a premium of $735,000 from the trade—about a 4.5% yield over the next year. Now, if you add in the 1.7% dividend, owning BAC shares will pay roughly a 6.2% yield over the following year. In this low-rate environment, that’s a very reasonable yield.

Moreover, the owner of the covered calls can still make an additional $6.75 in upside potential if BAC continues to climb. If you’re bullish on the stock and want to increase your yield, making a trade like this is the best of both worlds. It’s also a relatively low-risk trade (how much downside is there in BAC?) and can be easily executed in your account.