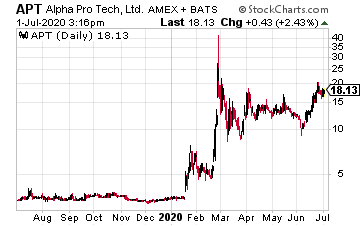

With the coronavirus still wreaking havoc, shares of Alpha Pro Tech (APT) ran from a low of $10 to $17.70 in recent weeks.

All as the coronavirus forces the world to demand more face masks.

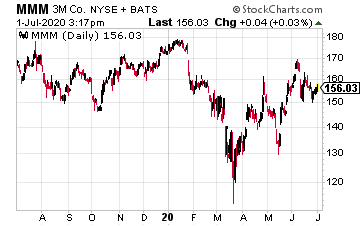

APT has been the “go-to” stock for investors looking for profits in the personal protection equipment (PPE) space outside of the larger integrated plays like 3M (MMM).

California Gov. Gavin Newson just tweeted, “Californians are now REQUIRED to wear face coverings in public spaces.”

We could see even more states following suit after Goldman Sachs said a “federal face mask mandate would not only cut the daily growth rate of new confirmed cases of Covid-19, but could also save the U.S. economy from taking a 5% GDP hit in lieu of additional lockdowns,” as noted by CNBC.

Related: Rising Coronavirus Numbers Boost This Company’s Stock Price

Jan Hatzius, Goldman’s chief economist added, “We find that face masks are associated with significantly better coronavirus outcomes. Our baseline estimate is that a national mandate could raise the percentage of people who wear masks by 15 (percentage points) and cut the daily growth rate of confirmed cases by 1.0 (percentage point) to 0.6%.”

FREE! Wanted to Try Options But Never Had Time? Download the New “Beginner’s Options Guide for Investors Who Have Never Traded Options But Want To” Manual. Click Here. [ad]

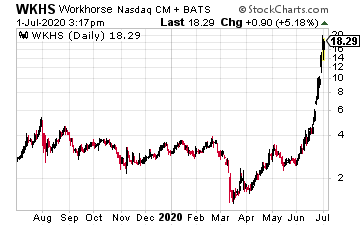

Workhorse Group Inc. (WKHS) gained big momentum after analysts at Cowen said it deserves a bigger valuation. The firm also increased its price target from $4.50 to $11.50. Not only did the company just announce its EV delivery vans passed government safety tests, it could soon produce its vans for Ryder and UPS. Better, with EVs only growing in popularity, WKHS could be one of the top beneficiaries.

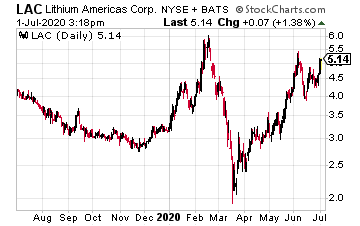

Lithium Americas Corp. (LAC) ran from $4.30 to $.07 in recent days, as lithium supply fears return. After pulling back, lithium is running into the same supply-demand problem all over again, and we’re quickly nearing another massive supply crunch.

In fact, according to Reuters, “A new demand surge is already looming in the form of the multiple ‘green stimulus’ packages as governments try and kick-start locked-down economies. You don’t have to be a market genius to see that another price boom is coming sooner or later as an under-powered supply chain has to catch up with the next demand surge.”

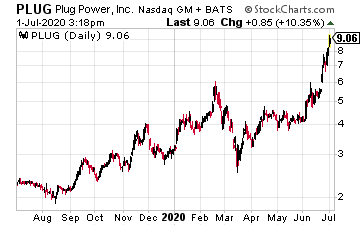

Plug Power Inc. (PLUG) is running after Canaccord Genuity reiterated its buy rating and raised its price target to $8.50 from $7.00, estimating that the acquisitions of United Hydrogen and Giner ELX will immediately add to Plug’s results.

Oppenheimer upped its target to $8 from $6, saying the acquisitions reflect continued “savvy” strategic decisions. “We believe these additions to the portfolio make Plug the clear global leader in providing cost-effective motive hydrogen solutions in the middle and last mile delivery as well as material handling.”

Estimating that demand for hydrogen from its current customers will reach 100 tons per day by 2024, these acquisitions are likely to help Plug meet it. Plus, California just passed regulations that will require all trucks to produce zero emissions by 2045. Starting in 2024, we’ll see a gradual phase-in through 2035, as well. This could be substantial news for a company like PLUG to expand into the trucking market.

Ian Cooper’s Personal Position in Any of The Stocks in This Article: None