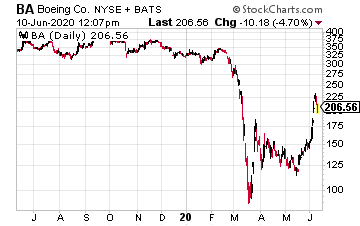

Since bottoming out at $89 in March 2020, shares of Boeing (BA) exploded to $204.

Analysts appear just as bullish on BA, with Seaport Global initiating coverage of the stock with a buy rating, and a target price of $277. Goldman Sachs also raised its price target on Boeing from $209 to $238 with a Buy rating.

Not only is BA rebounding with air travel demand, it’s running on news airlines are not cutting deliveries as much as Boeing is cutting production, says Goldman Sachs, as noted by Investor’s Business daily. “We are positively surprised to see these 30 customers have only revised their 2020 + 2021 plans by 17%,” they wrote. “This is less than the production cuts Boeing & Airbus have announced. And far less than we assume the market fears.”

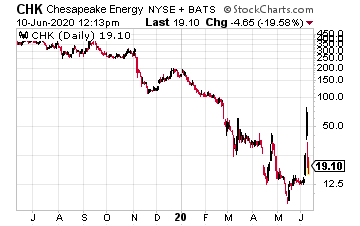

Chesapeake Energy (CHK)

After exploding higher earlier this week, CHK is again pulling back and could be headed to zero. All as the company prepares a potential bankruptcy filing that could hand the company over toe senior lenders, as noted by Bloomberg.

“The dwindling options for a powerhouse that once rivaled Exxon Mobil Corp. for title of king of American natural gas comes after Chief Executive Officer Doug Lawler’s 7-year effort to untangle the financial and legal legacies of Chesapeake’s late founder, Aubrey McClendon.”

Then again, this comes as no surprise.

The company said it was a “going concern” in U.S. SEC filings just last month, and said it was evaluating strategic alternatives including bankruptcy. Plus, it’s not as if the company could manage its $9 billion debt either.

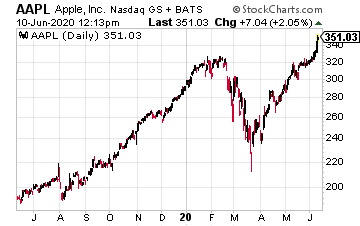

Apple Inc. (AAPL)

Shares of Apple have exploded to all-time highs of $351 after breaking above double top resistance at $325. From here, the stock could pop to $400 with solid momentum. According to Evercore ISI analysts AAPL has an “underappreciated” ability to create its own chips in house, as noted by 9 to 5 Mac. Analysts at Wedbush also reiterated an Outperform rating on the stock with a price target of $375.

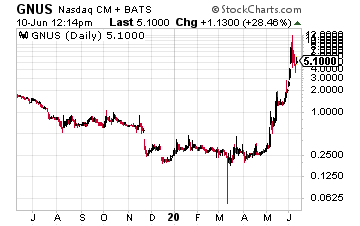

Genius Brands International Inc. (GNUS)

GNUS is again soaring, last trading at $5.29 after pulling back from a high of $11.73.

The company recently announced it entered into a securities purchase agreement with certain long-standing investors providing for the purchase and sale of 7.5 million shares of its common stock at a purchase price of $1.20 per share, priced ”at the market”’ under Nasdaq rules based on the average closing sale price for the previous five trading days, in a registered direct offering, resulting in total gross proceeds of $9.0 million.

The net proceeds of the financing will be used to grow its newly-announced digital network for children, Kartoon Channel! on demand and subscription free, launching June 15 and available in approximately 100 million U.S. TV Households and approximately 200 million mobile devices, to fund production of additional episodes of its series Rainbow Rangers, and repayment of certain outstanding debt, and for working capital.