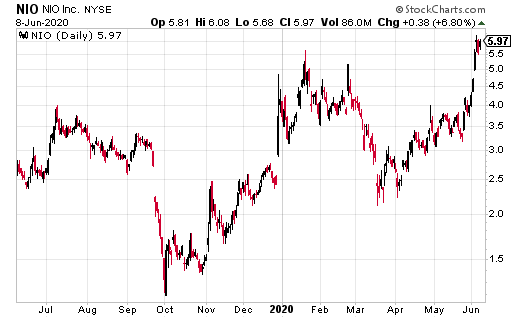

Shares of electric vehicle maker, Nio (NIO) have faced plenty of pressure this year.

However, it appears the EV stock has turned a corner after reporting another month of record deliveries. For May 2020, the company delivered 3,436 vehicles. That included the delivery of 2,685 ES6s and 751 ES8s. “In May, we achieved record-high monthly deliveries in our history,” William Li, founder, chairman and CEO of Nio.

That followed news April 2020 delivery numbers were also better than expected. In fact, deliveries were up to 3,155 for the month, a growth rate of 181% year over year, and 106% month over month.

And, according to Chairman and CEO, William Bin Li, “In April, we achieved record-high monthly ES6 deliveries since June 2019, and deliveries of the all-new ES8 had also been well on track. These results were mainly contributed by the recovering production and delivery capabilities. Meanwhile, we have witnessed strong order growth momentum driven by the increasing recognition of our competitive products, exceptional services, and particularly the battery swapping technologies by our existing and potential users.”

Better still, Goldman Sachs just upgrade the NIO stock to a buy rating.

All thanks to news liquidity risks “that were challenging Nio’s financial sustainability in 2019 have started abating,” said Goldman Sachs, as quoted by MarketWatch.

In addition, “likely has narrowed its cash burn thanks mostly to ‘the accumulation of demand strength,’ the Goldman analysts said. Moreover, the company’s year-to-date delivery volume, up 37% on-year between January and April, ‘has highlighted Chinese consumers’ growing recognition of this emerging auto brand.’”

Since bottoming out at $2.15 in March 2020, shares of NIO exploded to a high of $6.20. If it can maintain its record monthly deliveries, and put financial concerns to rest, the stock could potentially retest a prior high of $10.25 set in March 2019.

Ian Cooper’s Personal Position in NIO: None