During the course of the day when market is open Jay will post thoughts, updates, responses to subscriber questions, and more to this page.

Additionally, buy and sell alerts and adjustment notices will be posted here.

Go ahead and bookmark this. Please note that all dates and times below are eastern time.

August 13, 2024 - 5:59 pm

A week ago Monday, during the monthly Options Insider session, a few of you sold put spreads on USO (when the market was way down). Oil has pretty much gone straight up since then, so it’s probably safe to close that trade at anytime now. Most of the premium has probably vanished at this point. That timing worked out nicely!

July 11, 2024 - 2:15 pm

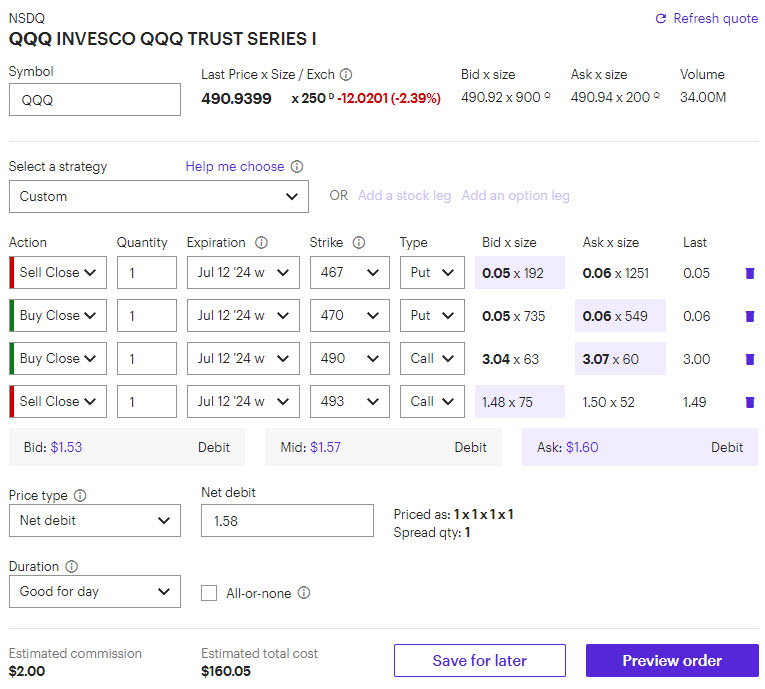

For those of you who are in the QQQ iron condor, we caught a break today. We were at max loss yesterday (with the trade expiring Friday), but the selloff today means we can close for around a 55-60 cent loss. That’s much easier to digest. Because we have no idea if the market will bounce back tomorrow, I think it makes sense to close here and take the much smaller loss (than yesterday). You can try to close the whole spread (as seen below) but it may be easier to just let the put spread expire and close the call spread separately.

July 9, 2024 - 2:43 pm

For those of you in the NVDA trade, it’s right around a 100% winner, so let’s close it now. I show below how to close the entire broken wing butterfly at once, but you’ll probably find it easier to close the short strikes first (buy to close the 130 calls) and then sell to close the 125 and 133 calls. You can always try to close the entire spread at your desired price (net credit) and if you can’t get filled, close it in parts. Regardless, we have nice profits on the trade and I believe it makes sense to close today.

June 28, 2024 - 2:34 pm

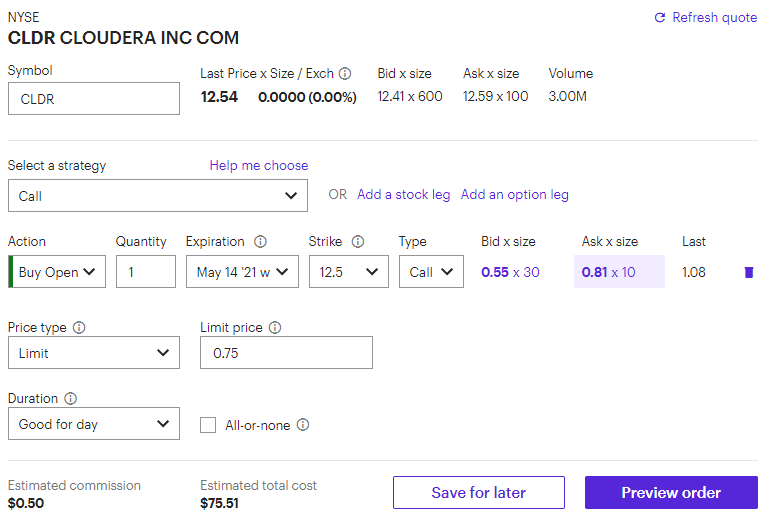

For those of you in the AAL broken wing butterfly, we are in the money, so we need to close the trade (to avoid assignment). We spent about 60 cents on the trade and we can close for around 25 cents. It will near impossible to close the entire trade at once at a reasonable price, so your best bet is to close the 12.5 calls first by buying them back at a penny. Then you can sell the 11 calls for whatever you can get (about 26 cents as I write this).

June 24, 2024 - 2:00 pm

In the live session today we traded a call broken wing butterfly on NVDA. This is a bullish trade that expires in 25 days. The net debit cost is around 85 cents. Trade details and the payout diagram can be found below.

June 3, 2024 - 1:46 pm

In the live session today, we purchased a broken wing call butterfly on AAL. This is a neutral to bullish position on AAL that expires in 25 days. The 11-12.5-13 broken wing fly cost is about 62 cents net debit. Trade details and the payout diagram can be found below.

May 31, 2024 - 2:04 pm

For those in the ABNB trade, it will finish out of the money. No action needed as it will expire for zero. I will be here next Monday, so we’ll add a new trade (but then I’ll be gone the following week). We are overdue for a winner, so let’s find something good!

May 24, 2024 - 2:17 pm

For those holding KWEB and SHOP positions – first off, SHOP will expire OTM so no action is needed. For KWEB, we are actually in the money – not enough to turn a profit, but we will get some of our capital back at least. We need to close KWEB so the 30 puts won’t get exercised. First off, we have to buy back the 28 puts for a penny (or 2 cents if you can’t get filled). Then we can sell out the 30 put for 12-14 cents. The 27 put you can let expire for zero. We just need to make sure the trade is closed by the end of the day today.

May 20, 2024 - 1:50 pm

In the live session today, we traded a broken wing call butterfly on ABNB. We placed the 146-148-149 call BWB for around 54 cents net debit. This is a neutral to bullish trade that expires in about two weeks. Trade details and profit and loss diagram can be found below.

May 13, 2024 - 1:48 pm

In the live session today we bought a bullish broken wing butterfly on SHOP. We placed the two-week (May 24th) 60-63-65 call broken wing fly for around a 50 cent net debit. Trade details and the profit and loss chart can be found below.

May 10, 2024 - 2:13 pm

For those of you in the SNAP trade, the stock finally started to sell off at the end of this week. Unfortunately, it’s too little too late for us as we needed the stock to drop below 15 before the end of today. It will expire for zero so no action is needed.

May 6, 2024 - 2:07 pm

In the live session today, we placed broken wing put butterfly trade on KWEB. It’s a moderately bearish trade that expires in about two weeks. It should cost around 49 cents. The profit/loss graph can be found below along with the trade details.

May 3, 2024 - 3:05 pm

For those of you still in XLV, we are right at the bottom strike so we need to make sure to close before expiration so as not to exercise the long 141 call and own the shares. In this case, it’s highly unlikely the entire spread (seen below) will get filled at a reasonable price. It’s easiest to buy back the short 144 calls for as little as possible (1 or 2 cents) and then sell out the 141 call for whatever you can get. In this case, you can ignore the 145 call and let it expire for zero. Just make sure it closed before the end of the day to avoid exercise.

May 1, 2024 - 2:27 pm

For those of you still in UAL, I think we are in a good spot to close here. I’m showing a credit of around 1.20-1.30. Anything in that range is a nice winner (even if the net credit ends up being closer to a 1.00, it’s still solid gains). Closing details are below. Just remember that you can close the trade in pieces if you can’t get filled all at once (as long as you buy back the short puts first before selling the long puts).

April 29, 2024 - 1:56 pm

In the live session today we bought a put broken wing butterfly on SNAP that expires in two weeks. We placed the 15-14-13.5 put broken wing fly for around 34 cents (net debit). This is a neutral to bearish trade on SNAP. Trade details and the profit/loss graph can be found below.

April 25, 2024 - 5:58 pm

Looks like I made a mistake on the UVXY closing trade. The one I sent out the Monday before last used 38-36.5-35.5 as our strikes (not 38-35.5-34.5). If you ended up doing the version that I sent out (I know there was some variations on what spreads people used) then be sure check your strikes and make sure they match your position. The prices are all crazy wide in the afterhours so it’s bit hard to know what the price is, so just try to use as close to the midpoint tomorrow as possible if you haven’t yet closed the trade.

April 25, 2024 - 3:22 pm

For those of you still in the UVXY trade, it’s in a good spot to close here. I’m showing about 1.50 – 1.60 closing price which is somewhere in the neighborhood of 60% gains. Closing trade details are below (and don’t forget that expiration is tomorrow – so be sure to close the trade). If you are having trouble getting filled, you can close the short strikes first and then the longs.

April 22, 2024 - 1:54 pm

In the live session today we placed a broken wing butterfly on UAL for a net debit of around 57 cents. This is a neutral to bearish position that expires in two weeks. Trade details and the profit/loss graph can be found below.

April 19, 2024 - 2:50 pm

We have SBUX and ROKU expiring today. ROKU got beat up when the market started selling off. SBUX hung in there pretty well, but didn’t quite make it above into our target range. We’ve had a few of these lately that were close but not close enough. Regardless, no action is necessary and you can let both trades expire out of the money.

April 15, 2024 - 2:04 pm

We made two trades today in the live session for Options Insider. First off we placed a put broken wing butterfly on UVXY (1.5x long VIX exposure). This is a two week play that volatility will settle down. We also did a three week call broken wing butterfly on XLV. This is a bullish mean reversion play on the healthcare sector. Both trades and P/L charts can be found below.

April 8, 2024 - 1:49 pm

In the live session today we placed a bullish broken wing butterfly on SBUX for about 48 cents (that expires in two weeks). Trade details and the payout diagram can be found below.

April 5, 2024 - 2:50 pm

For those in the GPS trade, we are so close to the stock dropping into our butterfly range. I don’t think it’s going to make it, but considering how far away we were earlier in the week, it’s amazing it got this far. For now, we can just let it expire for zero (no action needed). If for some reason the market drops during the last hour and this trade becomes in the money, I’ll send out another text with closing instructions.

April 2, 2024 - 10:26 am

For those of you in the FDX trade, the price has dropped into our profit zone. I’m showing about a 1.30 price for the spread, which is roughly a 45% winner. Let’s close here and take the profits. I usually try to close the whole thing at once first (as seen below) and if I can’t get a reasonable closing price, then I’ll close the short strikes first and then the longs.

April 1, 2024 - 1:59 pm

In the live session today we placed a moderately bullish broken wing butterfly on ROKU. It expires in two weeks and costs around 60 cents. Trade details and the payout diagram can be found below.

March 25, 2024 - 2:07 pm

In the live session today, we placed a broken wing butterfly (all puts) on FDX for around 90 cents. It expires on 4/5. We are expecting a bit of mean reversion over the next two weeks. The trade details and profit/loss graph can be found below.

March 22, 2024 - 1:48 pm

Looks like AAPL will close out of the money, so it will expire for zero. I should have closed it on Wednesday when it was a big winner. While Thursday’s news was unexpected, there was no reason to wait when profits were over 100% on Wednesday. (My reasoning at the time was that I didn’t want to rush a trade alert at market close and figured we had plenty of time on Thursday. In hindsight, it looks like a really bad decision.) Hopefully many of you closed early.

I think going forward I’m just going to suggest we always close at 100% or more and you don’t have to wait for my closing alert. Maybe for certain trades that number will be 50%. We can set automatic closing parameters on Monday when we make the trades. I still send closing alert texts, but having exit parameters can help since my timing can be off.

March 21, 2024 - 1:23 pm

AAPL shot up yesterday towards the close and my intention was to take profits today. So of course, today’s the day that the DOJ announces they are suing the company over an iPhone monopoly (causing a 4% drop in the share price). I think the market will brush off the lawsuit in the short-term, so let’s see if we get a rally into close or tomorrow – to the point where we can still close our trade for a profit. Stay tuned.

March 18, 2024 - 2:55 pm

In the live session today, we placed a broken wing put butterfly on GPS. This is roughly a three-week bearish trade on GPS. The trade details and profit/loss scenario can be found below.

March 15, 2024 - 2:31 pm

For those in the SNOW trade, you can let it expire for zero. The opportunity in SNOW melted away very early on and it was never able to accumulate enough higher moves to get near to our strikes. AAPL is down today but is a far more promising trade – and we still have a full week on before expiration. I’ll keep you posted on that position next week.

March 11, 2024 - 2:19 pm

Not sure if anyone is actually getting these texts (issues seem to have cropped up again). If so, this is the broken wing butterfly we placed today in the Insiders live session. It’s a roughly two-week bullish call broken wing fly on AAPL. Trade details can be found below, along with the profit/loss scenario.

March 7, 2024 - 1:11 pm

For those of you holding the TWLO broken wing butterfly, in this case, waiting paid off. The stock is right in the sweet spot with just a day to go before expiration. If we close here, the price should be somewhere around 1.85. That’s roughly a 113% return. Closing details can be found below. Remember you are closing for a credit. Also, if it doesn’t seem that you can get filled at a decent price, you can close in pieces by buying to close the short strike (61) first and then closing the longs (58,62).

March 4, 2024 - 2:05 pm

In the live session today we placed a broken wing butterfly (calls) on SNOW for around 85 cents (it’s currently trading for around 90 cents). It’s a two week bullish trade on the stock. Trade details are below, along with the payout graph.

March 1, 2024 - 12:47 pm

Our broken wing butterfly in NET expires today. It kept flirting with the top strike of our range, but ultimately it has moved out of reach today. We can let this one expire (no action needed). TWLO on the other hand, is in the money. My plan now is to wait until Monday to decide on closing, in order to capture the weekend premium. I’ll keep you posted on closing that trade (but certainly feel free to take profits if you are comfortable with the gains – it’s about a 32% winner last I checked).

February 26, 2024 - 2:39 pm

In the live session today, we bought a broken wing call butterfly on TWLO. Specifically, we purchased the March 8th 58/61 (x2)/62 spread for a net debit of around 90 cents. Trade details and the payoff graph can be found below.

February 20, 2024 - 12:38 pm

We talked yesterday about doing another broken wing butterfly in NET (once the markets opened back up today). NET is down about 3% today, but I still think this trade is a good idea. We’ll adjust the strikes a bit from what we discussed, but the shape of the trade remains roughly the same. We’re sticking with March 10th expiration which is about 10 days away. The net debit for the trade is around 62 cents (give or take a few cents in either direction). Trade details and the what-if chart can be found below.

February 19, 2024 - 1:00 pm

There is an Options Insider webinar today. I won’t send a trade until tomorrow, but we can still talk about strategy during the session. Sorry for the late notice!

February 14, 2024 - 12:45 pm

We have two trades in Insiders ready to be closed. I’m not going to make the same mistake of waiting too long like I did with GDXJ, so let’s take profits off the table in both ABNB and NET. For ABNB, we’re looking at roughly 75% gains. For NET it’s around 30-40% gains. If it doesn’t seem like you can get the entire broken wing butterfly filled at a reasonable closing price, you can try buying back the shorts first and then selling out the longs. Trade details can be found below for both.

February 12, 2024 - 3:03 pm

In the live session today, we traded a bearish broken wing butterfly on NET that expires Feb 23rd. Trade details and the profit/loss diagram can be found below.

February 9, 2024 - 2:42 pm

Let’s update the situation on the three open broken wing butterflies:

- GDXJ – I’m an idiot for waiting to close this one. We had a nice winner in it last week and I got greedy. Fortunately, many of you closed it without waiting for me. For those of you who didn’t, my apologies. It’s now worth zero and we’ll just let it expire. That’s 100% on me.

- DIS – This one became out of reach after earnings and we’ll just let it expire for zero..

- ABNB – It’s a winner right now but we definitely want to let the weekend go by and collect that time decay. We’ll look at closing it early next week (and I’ll try to avoid the mistake I made with GDXJ).

February 8, 2024 - 2:17 pm

Quick update on our 3 open broken wing butterflies:

- GDXJ is right on the edge of profitability, so we’ll look at closing tomorrow to give it a chance to move a bit higher

- ABNB is within our wings (outer strikes) so is currently set up to be profitable. Earnings and expiration don’t occur until next week so we have some time yet to decide what to do

- DIS investing 1.5 billion in Epic Games was totally out of left field and sent the stock soaring. That position we can let expire out of the money tomorrow

February 5, 2024 - 2:50 pm

In the live session today, we placed a bearish broken wing butterfly trade on DIS. Earnings are in a couple days and the trade expires at the end of the week. The price hasn’t moved at all since the live session. Details for the trade can be found below, along with the profit/loss graph for the strategy.

February 2, 2024 - 2:12 pm

For those in the UNH trade, it’s out of the money, so we can just let it expire for zero today. GDXJ and ABNB are both looking good though, and we may close early (next week) to take profits. Stay tuned!

January 29, 2024 - 3:09 pm

In the live session today we made a bearish broken wing butterfly trade on ABNB. Trade details and the payoff graph can be found below. The $ 1.00 net debit price may move around a bit because the markets are wide, and you may need to raise your limit order to get filled.

January 24, 2024 - 12:57 pm

Please ignore that last text – it was meant for Weekly Income Accelerator members.

January 22, 2024 - 2:26 pm

In the live session today we placed a bullish broken wing butterfly in GDXJ. We also closed our AAPL BWB for a profit. Both trades can be found below, along with payout/risk graph for GDXJ.

January 16, 2024 - 2:37 pm

In the live session today we made a bullish broken wing butterfly trade on UNH. The price hasn’t moved that much, so there’s still plenty of time to get in (it should cost 85-90 cents or so – don’t worry about the wide markets because it’s a low volatility stock). Trade details and the payoff graph can be found below.

January 12, 2024 - 2:36 pm

For those in the WBA trade, the stock stayed below 25 so we are locked in with our gains (25%-40% depending on what your purchase price was). Technically we can let the entire broken wing butterfly expire since everything is in the money, but it does look pretty messy in your brokerage when that happens. I prefer to close out the spread in these situations.

Trade details are below. You may need to close out the shorts first (buy to close the 26 puts) and then sell to close the longs (25 and 28 puts). The benefit of breaking it into pieces is you may get a better fill price. Regardless, this trade will be a winner for us.

January 11, 2024 - 3:11 pm

For those in the WBA trade – we’re up about 40% right now, which is the max we can make if the stock stays below 25. However, there’s no risk in holding until tomorrow, and if the stock rallies above 25, we can reach higher profit levels (but if it drops, we’ll still make our 40% or so). In other words, we can wait until tomorrow to close. I’ll send out a text with closing details during the trading day tomorrow.

For AAPL, we’re in the money by a small amount, but there are still a couple weeks left on the trade (so the price hasn’t really moved). We’ll revisit again next week but this trade likely won’t be closed until the following (expiration) week.

January 8, 2024 - 3:09 pm

In the live session today we placed a broken wing butterfly trade on AAPL that expires on the 26th for around 1.50 (it’s trading around 1.60 now). The trade details can be found below along with the profit/loss scenario. This is a moderately bullish position on AAPL. Just remember you can only lose what you pay for the trade since it’s a net debit situation and we are using all calls for this particular trade.

January 2, 2024 - 2:43 pm

In the live session today we placed a broken wing butterfly trade on WBA that expires on the 12th. The trade details can be found below along with the profit/loss scenario. This is a bearish/neutral trade on WBA. Just remember you can only lose what you pay for this trade since it’s a net debit situation. Also remember to use puts instead of calls. I’ll text out updates as to where we stand on this trade over the next two weeks.

December 28, 2023 - 12:40 pm

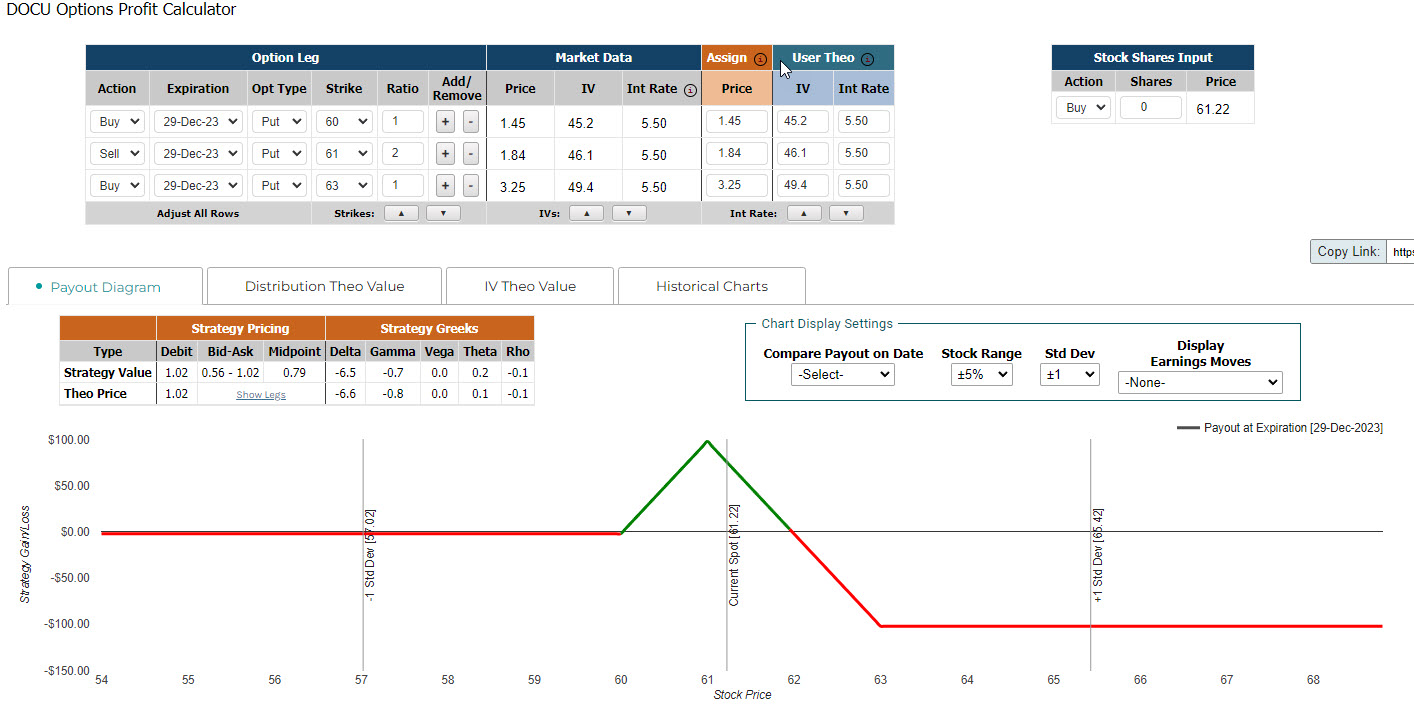

For those of you in the DOCU trade, let’s go ahead and close it here. It may be a tricky to close the whole thing at once because of the lack of liquidity today. In the trade details below, I used 1.15 as the net credit for closing. However, it probably will be easier to close the short strikes first (the 61 puts) and then close the longs (60 and 63). In that case you would buy to close the 61 puts and then sell to close the 60 and 63 (also probably easier to do in separate trades). You can always start by trying to close the whole spread for around 1.15 and see if the order will get filled before dividing the trade closing process into pieces.

Regardless, we should end up with a 40%-50% gain on this trade when all is said and done.

December 18, 2023 - 2:11 pm

In the live session today we placed a broken wing butterfly trade on DOCU that expires on the 29th. The trade details are below along with the profit/loss scenario. If you get close to midmarket price on this trade, there should be gains on the downside (despite what the P/L graph shows below). Just remember you can only lose what you pay for this trade since it’s a net debit situation. Also remember to use puts instead of calls. I’ll text out updates as to where we stand on this trade over the next two weeks.

December 13, 2023 - 2:16 pm

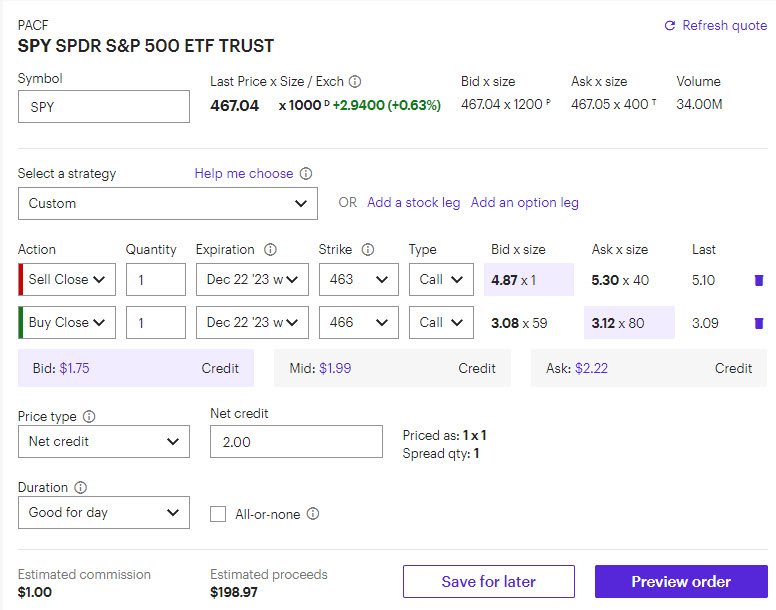

For those of you in the SPY call spread, after the FOMC meeting announcement, the stock has jumped over 467 (and above our call spread range). We can close it here for a credit of $ 2.00 (or higher). That’s a solid 79% winner in two days. See below for the closing trade ticket. You should be able to close the whole thing at once for a net credit, but if you decide to close in pieces, close the short strike first and then the long strike.

December 11, 2023 - 2:08 pm

In the live session today, we traded a SPY call spread. It’s a bullish trade that expires in about two weeks. The trade is still priced about where we made it during the session. The trade details and payout graph can be found below. I will send out a closing text if we’re going to close it early (maybe after CPI), and of course I’ll keep everyone posted if we’re going to hold longer (potentially to expiration).

December 8, 2023 - 3:22 pm

It doesn’t look like we’re going to get that GME rally today. For those in the GME broken wing butterfly, you can just let it expire out of the money.

December 8, 2023 - 1:44 pm

For those in the GME trade, we’re about a dollar away from a scenario where we’d need to close the trade. The stock did rally sharply into the close yesterday, so there’s still a chance our broken wing fly could come into play. If that happens, I’ll send out another text. For the time being, if the stock price stays below 17, we can just let our spread expire. I’ll keep you posted.

December 4, 2023 - 2:03 pm

In the live session today, we placed a broken wing butterfly trade on GME. The price hasn’t really moved so this trade is still good for those who want to take part. It’s a bullish play on earnings, which come out on Wednesday, while also taken advantage of how expensive the calls are. The trade expires Friday. Details on the trade entry and profit/loss can be found below. I’ll send out texts during the week for closing/expiration instructions.

December 1, 2023 - 1:23 pm

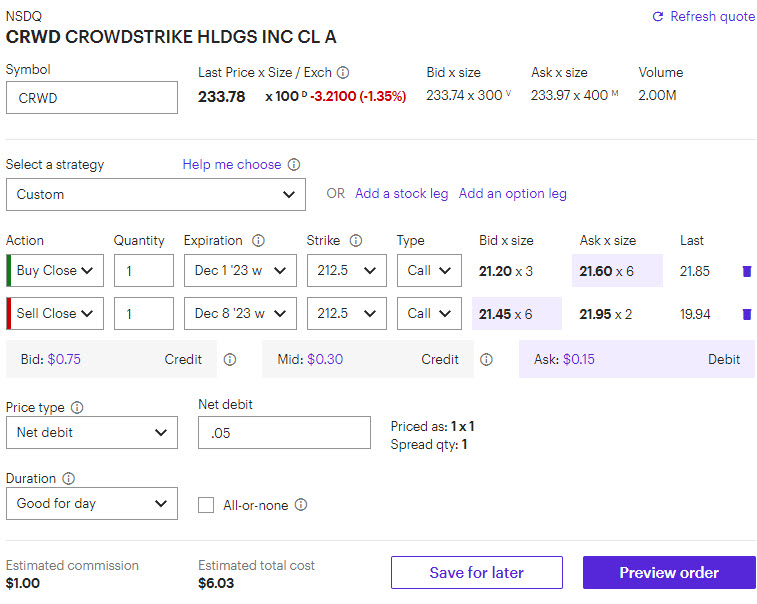

For those in the CRWD trade, our calendar spread isn’t really worth anything since the stock didn’t drop far enough towards our strike. We still need to close this trade (unless you want to hold the long call for some reason after the short call expires today). It may be difficult to close the spread all at once because it’s essentially worth zero, so your best may be to close each leg separately. In that case, you buy back the short call first and then sell out the long call. The goal is close for a net debit of zero or above. I show the trade details below.

November 29, 2023 - 2:10 pm

For those in the CRWD trade, it looks like the calendar is trading at about 40 cents right now. The stock jumped quite a bit this morning, but we could see some profit taking after that kind of move, before the end of the week. We’ll wait a bit longer before closing the trade to see if the stock pulls back a bit.

November 27, 2023 - 3:02 pm

In the live session today we placed a calendar trade in CRWD. Earnings for CRWD are tomorrow after close so the earliest we will close the trade is Wednesday and latest will be Friday. I’ll send out closing instruction via text. You can only lose what you pay for the trade – the estimated profit/loss graph can be found below. Trade details are below – be sure to make your trade look like the order entry below, especially if you’ve never placed a calendar trade before.

November 24, 2023 - 11:24 am

With an hour and a half until close, it seems highly unlikely that MDT will drop below 78 and into our butterfly range. As such, no action is necessary as the longs and shorts will cancel each other out on exercise/assignment at expiration.

November 22, 2023 - 12:57 pm

MDT is about 50 cents from our butterfly range, so we’ll give until Friday to see if it can fall into that profitable range. Remember, Friday is a half day, so if we end up closing, it will have to be earlier in the day than normal. I’ll be sure to send a text out with instructions.

November 21, 2023 - 12:36 pm

MDT is trading right around 78, which is right on the edge of our butterfly range. We want it to be under 78, preferably as close to 75 as possible. We’ll give it another day to see if it pulls back some. In theory, we could close it on Friday as well, but it’s a short day and liquidity will be more of an issue. Let’s see how it looks tomorrow and we’ll make a decision then.

November 20, 2023 - 2:01 pm

In the live session today, we traded a call butterfly on MDT. Earnings are tomorrow, so we are likely to close the trade tomorrow or Wednesday. Details are below, along with the profit/loss graph. I’ll send out a text tomorrow about what to do for closing.

November 17, 2023 - 2:56 pm

The HD and TGT butterflies will both finish deep in the money. However, the longs will cancel out the shorts, so no action is necessary.

November 15, 2023 - 10:46 am

After focusing primarily on bullish-leaning trades the past several weeks (without a lot of success) we switched to neutral butterflies on both TGT and HD… and of course both stocks skyrocketed higher on earnings. Go figure. On the bright side, we are nearly at max gain on our long ARKK condor, which we can now close. I’ve included the closing details below. You should be able to close for around 1.35 for the call spread. The put spread will expire for zero, so you don’t have to close that part. For TGT and HD, we’ll just sit on those until expiration. They both likely will expire OTM unless the market tanks. If ITM calls get assigned in either TGT or HD, my response is typically to close the remaining long options.

November 14, 2023 - 3:52 pm

We have three open trades this week: HD, TGT, and ARKK.

- HD blew past on our strikes on a combination of good earnings results plus the very bullish CPI report. There’s nothing to do for now, but if the market mean reverts by the end of the week, our call butterfly could still potentially be in play. There is some early assignment risk for the moment, but it’s not likely to happen this early in the week (and if it does, the best course of action is to close out the rest of the spread)

- ARKK is looking good right now and we could close for a decent winner. We’ll wait another day or two to let those short strikes decay a bit more and see if we can maximize our gains as much as possible.

- TGT is also in good shape, but we won’t look at closing until earnings tomorrow when the volatility comes out of the options.

In a nutshell, we may close both TGT and ARKK tomorrow, but HD will probably have no actions until Friday.

November 10, 2023 - 3:28 pm

For those of you who got into the JPM broken wing butterfly back in mid-October, it expires today. It looks like we’re going to fall a couple dollars short of our butterfly range, which means all the legs expire for zero. No action is necessary.

November 6, 2023 - 2:21 pm

In the live session today we bought a short-term iron condor in ARKK. Remember, we are buying the condor this time, so you can only lose what you pay (around 78 cents) and we want ARKK to move either direction by 11/17 expiration. Make sure it looks like the entry screen below (buying the inner strikes, selling the outer strikes). The payout diagram is below, so you can see your risk/reward characteristics. We’ll discuss this trade next Monday and talk about ideas for how to close.

October 30, 2023 - 2:35 pm

In today’s live session we placed a call butterfly in TGT. This is a direction-neutral trade over the next 3 weeks (although, if profitable we’ll look to close after earnings on the 15th). You can see the details below for the November 17th 103-109-115 call butterfly (trading around 1.10). The payoff diagram for the trade can also be seen below.

October 27, 2023 - 3:09 pm

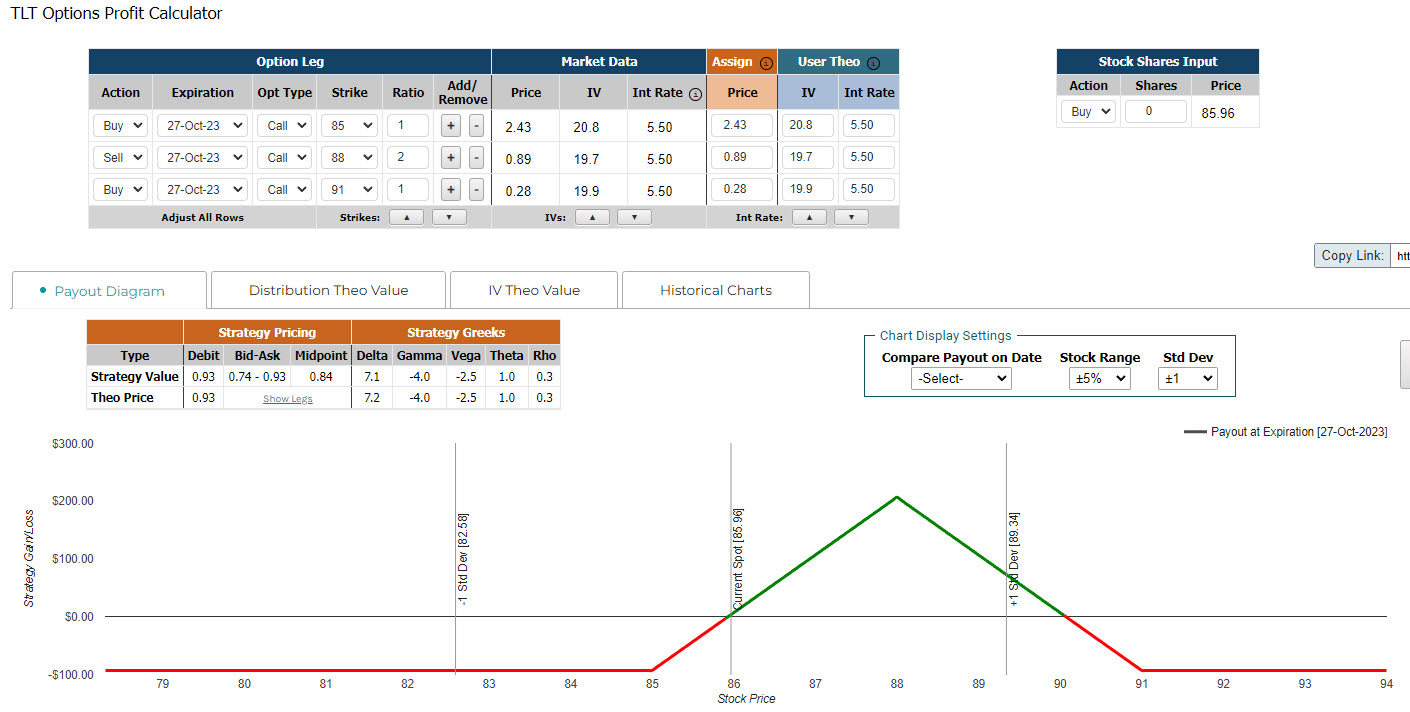

We have two trades expiring today if you’ve been following along with what we’ve been doing during the Monday live sessions. Some of you may have already closed TLT, but if not, it looks like it will expire just out of our butterfly range. You don’t have to do anything (unless we get a furious rally in the next 45 minutes) as whole fly will expire for zero.

For CSCO, the stock also dropped out of our spread range. The short call will expire for zero. The short put spread will expire in the money but the long and short put will cancel each other out on expiration. As such, no action is necessary.

October 20, 2023 - 2:53 pm

For those of you in the SQ trade from a while back, it expires today. The stock is well below where it was at the time of the trade, so no action is necessary as the spread will expire for zero.

October 16, 2023 - 2:13 pm

In today’s live session we placed a broken wing call butterfly in JPM. The trade is moderately bullish over the next 3 weeks. You can see the details below for the November 1oth 148-152.5-155 call butterfly (trading around 1.35). The payoff diagram for the trade can also be seen below.

October 11, 2023 - 3:43 pm

We placed a DKNG call spread (28-29.5) back in late September for around 58 cents. That call spread is now work about 1.20. We still have another week and half to expiration, but at roughly 100% gains, I think it’s worthwhile closing here. Details can be found below, but it may be easier to buy to close the 29.5 call first before selling to close the 28 call. If you don’t see this until after market close, that’s okay, closing tomorrow for around the same price is fine.

October 9, 2023 - 1:53 pm

The trade we made in today’s live session was a call butterfly in TLT. The strategy is moderately bullish on TLT over the next 3 weeks. The trade details and payout diagram can be found below.

October 2, 2023 - 2:11 pm

In the Insiders live session today we didn’t end up making a trade. We did a lot of analysis on TLT, but couldn’t find a suitably priced strategy. We’ll revisit bonds in the near future.

September 25, 2023 - 2:56 pm

In the live Insiders session today, we made a bullish trade on DKNG. We bought the October 20th 28-29.50 call spread for around 58 cents. The trade details and the profit and loss graph can be found below. A reasonable proxy for this trade if you can’t trade spreads in your account is buying the 28 or 28.50 call

September 22, 2023 - 3:03 pm

For those in the ASHR trade – as I suspected, the stock will end up between our two spreads. That means both spreads will expire for zero and no action is necessary. As a reminder, when buying a condor, you can only lose what you spend, which was around 35 cents in this case.

September 21, 2023 - 5:47 pm

For those in the ASHR trade that expires tomorrow, the most likely outcome will be no action. I’ll send out something tomorrow regardless, but we are likely to see the stock end up between our put and call spreads, meaning we can let them both spreads expire for zero. Keep in mind, we bought this condor, so the most that can be lost is the 35 cents or so you paid for the spread. You can ignore any crazy big numbers that are due to the bid/ask spread being really wide on some strikes.

September 18, 2023 - 2:45 pm

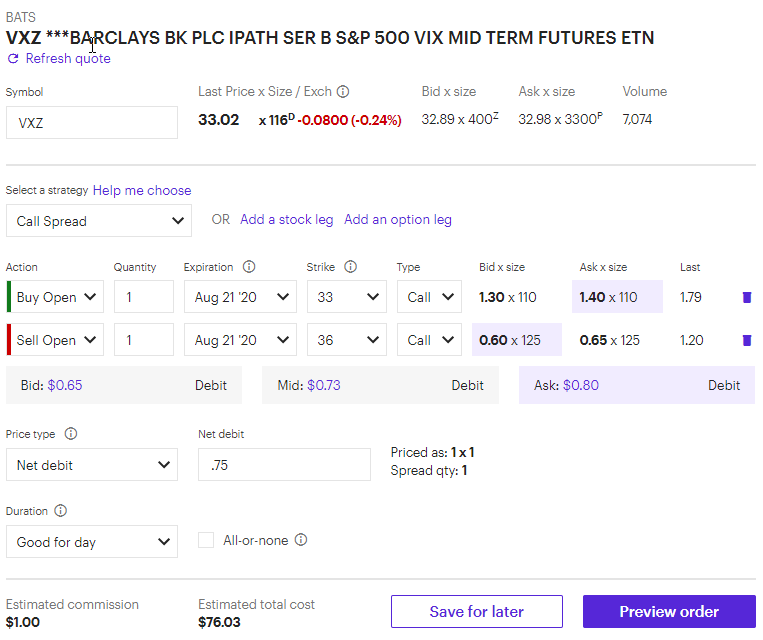

Here’s the trade we did today in the Insiders live session. It’s selling a put spread to finance (buy) a call in CSCO. It’s a very bullish trade, but really it’s based on the calls being super cheap (relative to where they’ve been in the past). Because this trade is focused on the calls, it’s okay if you want to skip selling the put spread and just buy the calls. Selling a put spread will require a margin account or a decent reserve of cash in a cash account (if you sell the 55 put first, it would just be a cash secured put and then you could buy the 53 put afterwards).

The trade details are below, along with the profit/loss graph. The expiration isn’t until October 27th. Keep in mind, this trade (with the put spread) will only cost about 25 cents, but max loss is about 225 if CSCO tanks (conversely, upside is unlimited). If you just buy the call, you can only lose what you spend on the call purchase.

Details:

September 15, 2023 - 2:33 pm

Closing Alert:

Both BITO and X are in the money, which means we need to close them in order to avoid exercise. I’ll show closing steps for both below:

BITO didn’t get quite get to the level we wanted, but it’s still in the money, so we’ll close it. You’ll have to do this as two separate transactions because the 15 call has essentially no value (but you can’t close the 13.5 until the 15 call is closed).

Here are the steps:

- Buy back the 15 call for a penny

- Sell the 13.5 call for whatever it’s worth (about 6 or 7 cents right now)

- Once you close the 15 call, you could theoretically hold the 13.5 call to see if it rallies towards close, but then you risk getting nothing for that call if the price drops

I show the X trade as roughly breakeven at this price level. You’ll also need to close it in parts, although you can completely ignore the 35 call.

Here are the steps:

- Buy back both 33 calls for a penny (for a total debit of 2 cents)

- Sell the 30 call for whatever it’s worth (about 75 cents right now)

- Ignore the 35 call

- We paid around 75 cents for this trade, so we should be right around that level for the closing price

September 11, 2023 - 2:15 pm

Insiders,

Here’s the trade we made today in the Insiders live session: We are buying the SQ October 20th broken wing call butterfly for around 1.22. We are buying the 55 call, selling two of the 60 calls, and buying one of the 62.5 call, all for a net debit of around 1.22. You can see the details below and the profit/loss graph that shows max gain, max loss, and the profit range at expiration. This is a bullish trade that SQ will rebound over the next 40 days or so. If you can’t make butterfly trades in your account, you can buy a 55-60 call spread or a 57.5-62.5 call spread as a decent proxy.

September 4, 2023 - 10:27 am

Please disregard the previous text message about today’s Options Insiders live trading room. It has been canceled for today. See you next week. Enjoy you Labor Day!

September 1, 2023 - 11:09 am

Insiders,

For those of you who didn’t get assigned on INTC, our broken wing put butterfly is now a winner and can be closed. It took a while to pay off, but on the position’s expiration day, the stock finally climbed into our profit zone. We paid 15-20 cents for the fly and it can be closed for around 1.00. You can try closing the entire spread (as seen below), but more likely you’ll need to close the shorts at the 37 strike first (buy them back) and then close the 39 long put after (sell to close). You can let the 34 strike expire for zero.

Details:

August 28, 2023 - 2:21 pm

Insiders,

Here’s the trade we did in the live session today. It’s buying an iron condor in ASHR that expires on September 22nd. We’re looking for a move in either direction in ASHR over the next 25 days or so (it’s a wide bid/ask spread but your fill price should be around 35 cents realistically). Trade details and the payout graph can be found below. This trade is really just buying two vertical spreads, so any level of spread trading permission should allow you to make this trade in your brokerage account. However, if you don’t have spread trading access, just buying the 25 put and 27 call is a decent proxy for the trade.

Details:

August 25, 2023 - 3:22 pm

Insiders,

For those of you placed the INTC broken wing put butterfly a few weeks back – it sounds like many of you have gotten assigned on INTC shares.

There are basically two choices now (in my opinion):

- Close the rest of the options and take what should be a small loss on the position

- Keep the shares (or half the shares), sell calls against them and turn it into a covered call trade (and close the remaining puts from the fly)

The second choice could be attractive (if you’re comfortable trading covered calls) because INTC seems a bit on the oversold side here. The call premiums aren’t great, but it will provide some cash flow while waiting for INTC to rebound.

Of course, if you didn’t get assigned, you can hold onto the put fly. (And if you didn’t make the trade, you can ignore this post!)

August 21, 2023 - 2:32 pm

Insiders,

We had some email issues so there wasn’t a reminder email for today’s live session (it should be rectified for next week). Keep in mind, Mark and I will now do these live sessions every Monday at 1 pm ET.

For those who missed, we bought a call spread today in BITO, expiring September 15th. Below you can find the trade details and Profit/Loss graph. It’s a wider bid/ask spread this time, so it may take a little longer to get filled on your order. If you can’t place vertical spread trades in your account, buying the 13.50 call by itself is a reasonable alternative.

August 14, 2023 - 2:59 pm

Insiders,

Here’s the broken wing butterfly we discussed in the Insiders live session today. As long as you have spread trading permission, you should be able to make this type of trade in a cash account. I’ve also attached the profit/loss graph below so you can see the payout structure. If you’ve never placed a butterfly trade before, the order entry screen shows exactly what it should look like. This is a roughly 30-day bullish trade in X. If you can’t do butterflies in your account, at the very bottom of this post I show the entry details for a 30-35 bullish call spread as an alternative trade.

Trade Details:

August 11, 2023 - 4:54 pm

Insiders,

Okay, I believe this is the last recap video before we switch fully to the new format for Insiders. Check out the video below for more details:

https://content.jwplatform.com/videos/68lXriW6-Bvib7p4n.mp4

August 4, 2023 - 5:44 pm

Insiders,

We have another week or two of recap videos before we transition to the new system. Here’s the video for this week:

https://content.jwplatform.com/videos/ZBxsMOGo-Bvib7p4n.mp4

July 31, 2023 - 2:29 pm

Insiders,

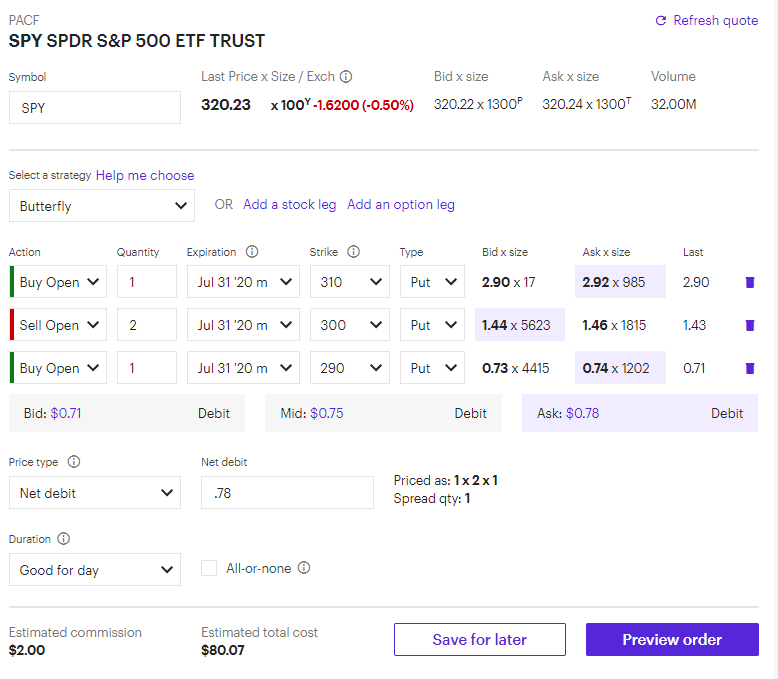

Here’s the broken wing butterfly we discussed in the Insiders live session today. As long as you have spread trading permission, you should be able to make this type of trade in a cash account. I’ve also attached the profit/loss graph below so you can see the payout structure. If you’ve never placed a butterfly trade before, the order entry screen shows exactly what it should look like. This is a 30-day bullish-neutral trade in INTC.

Trade Details:

July 28, 2023 - 4:57 pm

Insiders,

Big changes coming to Insiders on Monday! It’s all really good stuff. Check out the video for more details:

https://content.jwplatform.com/videos/m71xkAvr-Bvib7p4n.mp4

July 28, 2023 - 2:48 pm

Insiders,

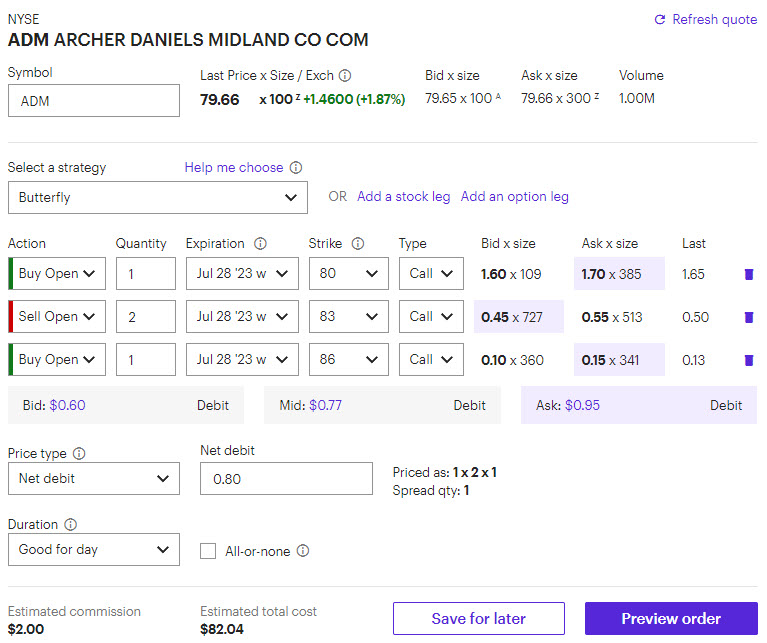

ADM is making it interesting. We want to close it if its under $ 86 so there’s no assignment, and the stock is sitting right above 86. We need to it go down to $ 85.50 or so to make money, but that doesn’t seem likely at this point. Regardless, we want to close this call butterfly in 3 parts in order to get the best fills.

First, you have to buy back the 83 calls. Remember, you have 2x of those calls to buy to close. At this point, you’ll probably pay about 3.15, but the lower the better.

Next, you’ll want to sell to close the the 86 calls for the highest price you can get. Currently we’re looking at about 20 cents.

Finally, you’ll sell to close the 80 call for the highest price you can get. It’s about 6.10 or so here.

Keep in mind, once you buy to close the 83 calls, you want the stock to go higher, so if you think it will ramp into the close, you can wait a bit to close the 80 and 86 calls.

July 17, 2023 - 2:14 pm

Insiders,

Our Insider trade from the live session this week is call butterfly in ADM. This is a slightly OTM butterfly meant to profit off of ADM moving higher after earnings next week. We are buying the July 28th call butterfly using the 80-83-86 strikes. It should cost around $ 0.80, which is the most you can lose on the trade. Max gain is $ 2.20 if ADM finishes at 83 on July 28th, although a more realistic target is 50%+ gains. We need ADM to finish between 80.80 and 85.20 for the trade to be profitable. Opening trade details are below, and so is the Profit/Loss graph. Remember, with a butterfly, the middle strike is sold x2 as seen in the details below.

July 14, 2023 - 5:00 pm

Insiders,

The weekly recap video is ready for viewing.

https://content.jwplatform.com/videos/neHwL0mW-Bvib7p4n.mp4

July 14, 2023 - 3:24 pm

Insiders,

We had a brief chance to get out of TSLA for around what we paid for the butterfly, but the stock quickly dropped back to around 280. Outside of a crazy rally at the end of the hour, we can let our call butterfly expire for zero. If for some reason the stock explodes above 285, just make sure you buy back the 295 calls before selling the 285. You can let the 305 expire for zero regardless of the outcome.

July 7, 2023 - 4:41 pm

Insiders,

The weekly recap video is ready for viewing:

https://content.jwplatform.com/videos/LI4foZBp-Bvib7p4n.mp4

July 6, 2023 - 1:32 pm

Insiders,

I promised you all a TSLA trade last Monday, so here it is! This is an OTM butterfly meant to capitalize if TSLA drifts higher into earnings. We are buying the July 14th call butterfly using the 285-295-305 strikes. It should cost around $ 1.20, which is the most you can lose on the trade. Max gain is $ 8.80 if TSLA finishes at $ 295 on July 14th, although a more realistic target is 100%+ gains. We need TSLA to finish between $ 286.20 and $ 303.80 for the trade to be profitable. Opening trade details are below, and so is the Profit/Loss graph. Remember, with a butterfly, the middle strike is sold x2 as seen in the trade details below.

June 30, 2023 - 4:46 pm

Insiders,

The weekly recap video is ready for viewing. Here’s the link:

https://content.jwplatform.com/videos/vjj0HXbe-Bvib7p4n.mp4

June 30, 2023 - 2:39 pm

Insiders,

A couple Fridays ago, we placed a PACW diagonal call spread that I really liked. It was the June 30th 8.5 calls (we sold) and the July 14th 8 calls (we bought) for around 55 cents. Well, the trade expires today and we are ready to close it for a profit. If you buy back the 8.5 calls (buy to close) and sell out the 8 calls (sell to close), you should get a credit of around 70 cents. I’m showing the trade details below for closing the trade as a spread, although it will be far easier to close using two separate trades (just close the short 8.5 strike first). Assuming you get around a 70 cent credit, we’re looking at a 2-week gain of roughly 27%, which is right in line with what I’d expect for this type of trade..

Closing Details:

June 29, 2023 - 2:46 pm

Insiders,

I strongly recommend checking out the webinar I’m hosting tomorrow with Cem Karsan concerning 0DTE options. Cem is a leading voice in the options industry and you won’t want to miss what he has to say. The link to register for the webinar is below (and don’t worry if you can’t make it, you’ll get a replay link).

https://us02web.zoom.us/webinar/register/WN_xXRPOv2GTein4x_W0YvLGQ#/registration

June 16, 2023 - 4:59 pm

Insiders,

Our weekly recap video is ready for viewing at the link below. On an administrative note, I’ll be out of town on a family trip next week so there won’t be a recap video, 48 Hour Income live session, or Coffee and Condors live session next week. Reminder emails should go out about the live sessions that aren’t happening. There will be a Monday live session for Insiders despite the market being closed. We’ll talk about the new PACW diagonal I sent our earlier today.

Weekly Recap Video Link:

https://content.jwplatform.com/videos/rsdGKCWc-Bvib7p4n.mp4

June 16, 2023 - 1:31 pm

Insiders,

The market is closed on Monday, so I’m going to send out our diagonal trade now that we’d normally make during the Monday live session. We’ll still have the Monday webinar, and we’ll talk about this trade then. It’s a call diagonal very similar to the one we just closed for a profit in MARA. I really like the payout range for the call diagonal in PACW (seen below). Just like with MARA, we are selling the shorter-term call (for this trade, expiring June 30th) and buying the further out call (July 14th). In this case, we are selling an OTM call and buying the ATM call. See details and Profit/Loss graph below. The trade should cost around 55 cents (which is the most you can lose on the trade). Max gain is undefined but we’re looking for 20%-40% gains in two weeks.

Trade Details:

Profit/Loss:

June 16, 2023 - 1:05 pm

Insiders,

The short call of our MARA diagonal spread expires today. We don’t want to hold past expiration as once the front month expires, it’s no longer a diagonal spread (saying nothing of assignment of shares and such). So, we’ll close the entire spread.

We’ exit the spread exactly the opposite of how we opened it, by buying to close the June 16th call and selling to close the June 30th call. See screenshot for details. You should be able to close for 70 to 75 cents. We paid 58 cents for the spread, so closing at 70 will result in two week profits of 21%.

Closing Details:

June 9, 2023 - 5:47 pm

Insiders,

Our weekly recap video is ready for viewing.

Here’s the link:

https://content.jwplatform.com/videos/K5NvsTtF-Bvib7p4n.mp4

June 9, 2023 - 4:00 pm

Insiders,

This is coming a bit too late, but there is no action necessary if you haven’t already closed the UNG or RIVN trades. They will expire out of the money.

June 5, 2023 - 4:49 pm

Insiders,

Here’s what I’m watching this week in the markets:

- With the Fed meeting not until next week and the debt ceiling resolved, this is about as slow as a news week as we’ll see (at least in terms of expected news). There are very few earnings results or economic data releases.

- For economic data, the closest thing we have to important data is consumer credit on Wednesday.

- Apple (AAPL) had its worldwide developer conference today and announced a new VR headset.

June 5, 2023 - 2:49 pm

Insiders,

Here’s the diagonal trade we made in the live session today. It’s a neutral-bullish trade on MARA. If you’ve never made a diagonal trade before, make it look like the screenshot below. You’ll need spread trading permission in your brokerage to make the trade, but it can be done in a cash account.

I’ve also attached a screenshot of the P/L graph for this trade. The max loss is the cost of the trade (around $ 55-60), but max gain can vary depending on what volatility does in the next two weeks. The P/L graph assumes static volatility, which is never the case. Typically I’m looking for a 20%-50% profit range on these types of trades. As always, I’ll send out a closing alert or message about how to handle the trade prior to expiration.

Details:

June 2, 2023 - 4:38 pm

Insiders,

Our weekly recap video is ready for viewing. Here’s the link:

https://content.jwplatform.com/videos/H7ZRGO5n-Bvib7p4n.mp4

May 29, 2023 - 4:05 pm

Insiders,

Here’s what I’m watching this week in the markets:

- It’s a short week with today being a holiday, but the market could open up big with a debt ceiling deal apparently in place (Congress still has to vote on it)

- The biggest economic news comes out on Friday with the May jobs number

- A few of the bigger earnings results this week include CRM, HPQ, and AVGO

May 26, 2023 - 5:26 pm

Insiders,

The weekly recap video is ready for viewing. Here’s the link:

https://content.jwplatform.com/videos/GLLEICem-Bvib7p4n.mp4

May 22, 2023 - 4:24 pm

Insiders,

Here’s what I’m watching in the markets this week:

- This is last week full trading week before we hit the debt ceiling (and next Monday is a holiday), so there could be some action around that scenario.

- Friday will see the release of PCE (inflation), durable goods (consumer spending), and consumer sentiment data. It could end up being a meaningful day for market movement based on economics data.

- There are some big earnings coming out this week including NVDA, COST, and LOW, along with some other smaller tech and retail names.

May 22, 2023 - 2:39 pm

Insiders,

Here’s the trade we did in the live session today. We’re buying a 3-week put in RIVN.

Details:

May 19, 2023 - 5:46 pm

Insiders,

Our weekly video recap is up and ready for viewing. Here’s the link:

https://content.jwplatform.com/videos/pFHAesFw-Bvib7p4n.mp4

May 15, 2023 - 4:11 pm

Insiders,

Here’s what I am watching this week in the market:

- This is probably the last meaningful week of Q2 earnings, with some big companies reporting. Some of the popular names include CSCO, WMT, TGT, HD, DE and BABA.

- Retail Sales (consumer spending) comes out on Tuesday and is likely going to be the most watched of the economic numbers for the week.

- Home sales/building data will also be released throughout the week and could provide some meaningful inflation info.

May 12, 2023 - 4:28 pm

Insiders,

Our weekly recap video is up. Here’s the link:

https://content.jwplatform.com/videos/R1ggqxgl-Bvib7p4n.mp4

May 11, 2023 - 11:50 am

Insiders,

Well, you get to see firsthand the challenges with making money buying straddles and strangles. With BROS, our 28 put is in the money, but not far enough for us to turn a profit. So, even though the stock moved nearly 5 strikes from where we bought the strangle, it still wasn’t enough. That’s why we generally prefer to sell options. That being said, I think it’s a valuable experience to see how options prices move during a volatility crush.

We’re going to salvage what premium we have left in the BROS strangle by selling to close the 28 put that expires tomorrow. You can let the 34 call expire for zero. You should be able to get around 50 cents or so for the 28 put.

Trade Details:

May 8, 2023 - 6:07 pm

Insiders,

Here’s what I’m watching in the markets this week:

- The big item this week is CPI, which comes out Wednesday. The market is going to want to see lower inflation numbers – or at least not higher numbers.

- PPI comes out Thursday (producer prices) which are also useful as potential leading indicators to CPI.

- Don’t forget that earnings season is still on with some big names reporting this week including DIS, TM, JD, RBLX, ABNB, and EA.

May 8, 2023 - 6:00 pm

Insiders,

This is the last one of these for Options For Income Pro before we switch over to 48-Hour Income.

Here’s the final pick:

SPDR S&P Regional Banking ETF (KRE)

Buy KRE and sell the June 9th 40 call for a net debit around 36.19. (The aggressive version uses the 38.50 calls, and the defensive version uses the 37 calls.)

I’m not using a buying range for this service – so use your discretion if the price changes, and feel free to change strikes as needed. Also keep in mind, I’m not tracking or managing these trades as part of the service. Don’t hesitate to email me if you have questions.

Trade Details:

May 8, 2023 - 1:55 pm

Insiders,

Our new topic this month is buying calls and puts. Today we’re doing a call trade on UNG. Nothing fancy going on – just buying a June 9th 6.50 call in UNG for around 49 cents.

Here’s the trade:

May 5, 2023 - 5:14 pm

Insiders,

I had a lot to discuss in today’s weekly recap (including next week’s new product launch), so check it out at the link below:

https://content.jwplatform.com/videos/WtRfgB5l-Bvib7p4n.mp4

May 5, 2023 - 1:47 pm

Insiders,

The RIG straddle hasn’t done what I expected, but we can still close out for a portion of our initial premium outlay. The straddle was briefly profitable after earnings (by a couple pennies), and it made sense at the time to let it ride (I was looking for 20% gains or higher). However, RIG rallied in the afternoon and we’ve basically been sitting on our hands since then waiting to see if the market selloff would bring RIG down further. Of course we’ve rallied today to make things more challenging. At this point, let’s close the put and recover about $ 38 in premiums. The call will expire for zero, so no reason to close it (just let it expire).

Trade Details:

May 1, 2023 - 4:42 pm

Insiders,

Here’s what I’m watching this week in the markets:

- For the first time in a while, we have a really busy week ahead. The biggest event is undoubtedly the FOMC meeting. The results are announced Wednesday with a quarter point hike expected by the market

- The March jobs report drops on Friday. ISM services PMI comes out on Wednesday

- It’s also a huge earnings week with several major companies reporting. This includes AAPL, QCOM, PFE, AMD, and SBUX, to name a few

May 1, 2023 - 4:01 pm

Insiders,

Here’s the Options For Income Pro trade for tomorrow.

KraneShares CSI China Internet ETF (KWEB)

Buy KWEB and sell the June 2nd 29 call for a net debit around 27.12. (The aggressive version uses the 28 calls, and the defensive version uses the 27 calls.)

I’m not using a buying range for this service – so use your discretion if the price changes, and feel free to change strikes as needed. Also keep in mind, I’m not tracking or managing these trades as part of the service. Don’t hesitate to email me if you have questions.

Trade Details:

May 1, 2023 - 2:07 pm

Insiders,

Here’s the trade we made today in the Insiders live session – the BROS May 12th 28-34 strangle for $ 1.25. There’s plenty of time to still place this trade if you’re interested. Earnings for BROS aren’t until next week and the price probably won’t change much before then. If you’ve never traded a strangle before, you can see how to place it in the screenshot below. Also, the profit/loss chart is shown as well.

Trade Details:

May 1, 2023 - 1:07 pm

Insiders,

The Insiders live session has started! I don’t think an email went out, so here’s the link to join:

https://us02web.zoom.us/j/84243148572

April 28, 2023 - 4:30 pm

Insiders,

The Weekly Recap Video is ready for viewing at the link below. Don’t forget we’ll have our live strategy session on Monday at 1pm ET.

Link:

https://cdn.jwplayer.com/videos/romQDr47-Bvib7p4n.mp4

April 24, 2023 - 10:55 am

Insiders, you may have seen a message earlier this morning about the Live Trading Room for today. That was sent in error. It was an automated message that had not been turned off. There is NO Live Trading Room today as I’m at the MoneyShow conference. It is rescheduled to next Monday, May 1.

I apologize for any confusion.

April 21, 2023 - 4:16 pm

Insiders,

I’ll be on the road to Las Vegas for the MoneyShow on Monday, so we’re moving the live trading session to Monday, May 1st at the usual time. The following session on Monday, May 8th will remain the same. In other words, we’ll have two weeks in a row with Monday live sessions and then we’ll back on track. I’ll keep you informed on the RIG trade via the Friday recap videos and texts (if needed).

Speaking of videos, I talk about RIG, among other things, in the latest weekly recap video linked below.

https://cdn.jwplayer.com/videos/l8mITtLM-Bvib7p4n.mp4

April 17, 2023 - 4:27 pm

Insiders,

Here’s what I’m watching in the markets this week:

- This week is light on economic data but heavy on earnings. This is the first full week of meaningful earnings data.

- Earnings to watch this week include (just to name a few): NFLX, TSLA, JNJ, PG, BAC, GS, UAL, and TSM.

- The only somewhat important economic news this week in the US is in housing data, with housing starts on Tuesday and existing sales on Thursday.

April 17, 2023 - 4:21 pm

Insiders,

Here’s the Options For Income Pro trade for tomorrow.

SPDR S&P 500 Bank ETF (KBE)

Buy KBE and sell the May 19th 39 call for a net debit around 36.59. (The aggressive version uses the 38 calls, and the defensive version uses the 37 calls.)

I’m not using a buying range for this service – so use your discretion if the price changes, and feel free to change strikes as needed. Also keep in mind, I’m not tracking or managing these trades as part of the service. Don’t hesitate to email me if you have questions.

Trade Details:

April 14, 2023 - 5:46 pm

Insiders,

The weekly recap video is ready for viewing.

Here’s the link:

https://cdn.jwplayer.com/videos/Buqkm9Vx-Bvib7p4n.mp4

April 10, 2023 - 4:34 pm

Insiders,

Here’s what I’m watching this week in the markets:

- After a couple somewhat slow weeks, things could pick up this week with the start of earnings season plus the CPI number.

- CPI comes out on Wednesday and will be the latest in inflation data (and will be watched closely by the markets).

- PPI (producer prices) comes out on Thursday and is more of a leading indicator of inflation.

- Retail sales (consumer spending) comes out on Friday.

- Friday is also the start of earnings season and kicks of with the big banks including JPM, WFC, and C.

April 10, 2023 - 3:47 pm

Insiders,

Here’s the Options For Income Pro trade for tomorrow.

ETFMG Prime Junior Silver Miners ETF (SILJ)

Buy SILJ and sell the May 12th 12 call for a net debit around 10.97. (The aggressive version uses the 11.50 calls, and the defensive version uses the 11 calls.)

I’m not using a buying range for this service – so use your discretion if the price changes, and feel free to change strikes as needed. Also keep in mind, I’m not tracking or managing these trades as part of the service. Don’t hesitate to email me if you have questions.

Trade Details:

April 10, 2023 - 2:07 pm

Insiders,

Our strategy for the month is the straddle (or strangle). The trade we came up with during the live session today was the May 5th 6.5 straddle in RIG. The trade details and profit/loss graph can be found below.

Details:

April 7, 2023 - 4:12 pm

Insiders,

The market is closed but the show must go on. Check out the new Insiders Weekly Recap video at the link below.

https://cdn.jwplayer.com/videos/933YaeTE-Bvib7p4n.mp4

April 3, 2023 - 6:16 pm

Insiders,

Here’s what I’m watching this week in the market:

- It’s a short week with the markets closed on Friday (for Good Friday).

- OPEC’s planned production cut sent oil soaring today. Let’s see what energy prices do the rest of the week.

- ISM non-manufacturing PMI comes out on Wednesday and will give some insight into the strength of the service sector.

April 3, 2023 - 6:00 pm

Insiders,

Here’s the Options For Income Pro trade for tomorrow.

Global X Uranium ETF (URA)

Buy URA and sell the May 5th 21 call for a net debit around 19.57. (The aggressive version uses the 20.50 calls, and the defensive version uses the 19.50 calls.)

I’m not using a buying range for this service – so use your discretion if the price changes, and feel free to change strikes as needed. Also keep in mind, I’m not tracking or managing these trades as part of the service. Don’t hesitate to email me if you have questions.

Trade Details:

March 31, 2023 - 6:04 pm

Insiders,

The weekly recap video is up. Here’s the link:

https://cdn.jwplayer.com/videos/eGj6fIRB-Bvib7p4n.mp4

March 31, 2023 - 3:36 pm

Insiders,

Okay, we’re cutting it close with the FRC trade, so let’s close it here. It’s worth around 55-60 cents at the moment, so not quite a winner. The best thing to do here is buy back (buy to close) the 16 strike for as little as you can get (1 or 2 cents). Then separately, sell to close the 13.5 call. You can let the 18.5 call expire for zero. You’ll want to do the two trades above in separate transactions to make sure you get the best price possible. Make sure you close it in the next 25 minutes (before market close) so you don’t exercise the 13.5 calls into stock.

March 31, 2023 - 2:39 pm

Insiders,

For those of you who attended the live session on Monday and placed the FRC call butterfly, it’s in the money, so we’re going to close it today. It’s not quite profitable at these levels, so let’s give it another half hour or so and then I’ll send out closing details.

March 27, 2023 - 5:04 pm

Insiders,

Here’s what I’m watching in the markets this week:

- With the banking crisis seemingly on the mend, it could be a much calmer week than we’ve seen in a while.

- The big economic data point comes on Friday in the form of PCE, the Fed’s preferred measure of inflation.

- Case-Shiller home price index comes out on Tuesday, a popular method of tracking real estate levels.

- There are a few scatted earnings this week including MU, LULU, and WBA.

March 27, 2023 - 5:00 pm

Insiders,

Here’s the Options For Income Pro trade for tomorrow.

Transocean (RIG)

Buy RIG and sell the April 28th 7 call for a net debit around 6.02. (The aggressive version uses the 6.50 calls, and the defensive version uses the 6 calls.)

I’m not using a buying range for this service – so use your discretion if the price changes, and feel free to change strikes as needed. Also keep in mind, I’m not tracking or managing these trades as part of the service. Don’t hesitate to email me if you have questions.

Trade Details:

March 24, 2023 - 4:47 pm

Insiders,

The weekly recap video is ready for viewing. Here’s the link:

https://cdn.jwplayer.com/videos/qfTKprZy-Bvib7p4n.mp4

March 23, 2023 - 4:26 pm

Insiders,

Regarding our WFC butterfly, unless we have a big rally tomorrow, it’s very likely to expire out of the money. In that case, no action is necessary and you can just let the options expire.

March 20, 2023 - 5:15 pm

Insiders,

Here’s what I’m watching this week in the markets:

- Normally I’d say this could be a very quiet week, except we have one on the most important FOMC meetings in memory occurring Tuesday and Wednesday. The Fed’s rates announcement will come on Wednesday.

- Besides the Fed meeting, we’ll see if the global/regional banking situations settle down now that biggest issues appear to have been dealt with.

- New homes sales for February come out on Thursday.

- Durable goods orders are released on Friday.

March 20, 2023 - 4:54 pm

Insiders,

Here’s the Options For Income Pro trade for tomorrow.

Financial Select Sector SPDR ETF (XLF)

Buy XLF and sell the April 21st 32.50 call for a net debit around 30.67. (The aggressive version uses the 31.50 calls, and the defensive version uses the 30 calls.)

I’m not using a buying range for this service – so use your discretion if the price changes, and feel free to change strikes as needed. Also keep in mind, I’m not tracking or managing these trades as part of the service. Don’t hesitate to email me if you have questions.

Trade Details:

March 17, 2023 - 4:29 pm

Insiders,

It’s been quite the week. Our weekly recap video can be found at the link below.

Link:

https://cdn.jwplayer.com/videos/Txt92AqM-Bvib7p4n.mp4

March 13, 2023 - 6:31 pm

Insiders,

Here’s the trade I recommended in the live session today. It’s the March 24th 39-42-45 call butterfly in Wells Fargo (WFC). You can adjust the prices/strikes as needed at open tomorrow, but the general trade format should look like the screenshot below. Below that is the profit/loss diagram for the trade. It shows max gain, max loss (which is just the cost of the trade), profit range, and breakeven points.

Details:

March 13, 2023 - 5:33 pm

Insiders,

Here’s what I’m watching this week in the markets:

- It goes without saying that all eyes will be on the regional banking crisis and how it unfolds. Expect plenty of volatility this week, especially in the financial sector.

- As if the banking crisis wasn’t enough, we have CPI (Tuesday) and PPI (Wednesday) coming out this week. The Fed is already under pressure to halt rate hikes given the issues with regional banks. These numbers may push the issue even further (one way or the other).

- Retail sales are released on Wednesday, which is yet another economic growth/inflation data point to watch.

- Just for fun, we have earnings coming out in ADBE, FDX, and DG.

March 13, 2023 - 4:58 pm

Insiders,

Here’s the Options For Income Pro trade for tomorrow.

VanEck Junior Gold Miners ETF (GDXJ)

Buy GDXJ and sell the April 14th 37 call for a net debit around 34.12. (The aggressive version uses the 35.50 calls, and the defensive version uses the 34 calls.)

I’m not using a buying range for this service – so use your discretion if the price changes, and feel free to change strikes as needed. Also keep in mind, I’m not tracking or managing these trades as part of the service. Don’t hesitate to email me if you have questions.

Trade Details:

March 10, 2023 - 4:32 pm

Insiders,

Our weekly video is up. Check it out here:

https://cdn.jwplayer.com/videos/E3WrPSDN-Bvib7p4n.mp4

March 10, 2023 - 3:33 pm

Insiders,

In case you missed it, we had an excellent presentation last Wednesday about Defined Outcome Investing. Given the volatility in the market today, utilizing proper risk management is more important than ever (which is a lot of what Pat talks about regarding defined outcome positions).

Check out the replay here:

https://www.investorsalley.com/options-for-income-guest-speaker-video/

March 10, 2023 - 11:30 am

Insiders,

The selloff in stocks today means our CVNA put spread is now in the money. We paid about 45 cents for the spread and it’s currently trading for around 25-30 cents (although it was over 50 cents earlier this morning). You’ll definitely want to close the spread to avoid exercise and reclaim some of our capital. You can wait to see if the position will become profitable again, but there’s a risk in that scenario that the market bounces back and you get nothing.

Regarding closing, I’ll show how to close the entire spread below, but you may get a better price by closing the legs separately. In that case, you must buy back the 6.5 put first and then sell the 8 put (to avoid a naked short position). Remember, you are buying to close the 6.5 put and selling to close the 8 put. If you do both legs at once, you are closing for a net credit.

Trade Details:

March 8, 2023 - 7:49 pm

Insiders,

Just about 10 minutes to go until the guest webinar tonight! Details below.

Defined Outcome Investing is a unique approach to portfolio management that gives you an alternative to the passive 60/40 stock/bond allocation. Through using a combination of exchange traded options and U.S. Treasuries, you’ll achieve greater certainty with how your portfolio will perform, ultimately providing a much more reliable framework than diversification. Guest speaker Patrick Hennessy will show you how defined outcome investing is a reliable alternative to the tired strategies that no longer work, especially in current market conditions.

Use this link to attend:

https://us02web.zoom.us/j/

March 7, 2023 - 2:45 pm

Insiders,

It’s time to close our PINS call spread for a profit. We could wait a bit longer to let the 27 call decay to increase our gains. However, that will expose us to potential downside in the stock (and the market has been selling off). Besides, if we close here we should be locking in around 90%-100% profits.

Regarding closing, I’ll show how to close the entire spread below, but you may get a better price by closing the legs separately. In that case, you must buy back the 27 call first and then sell the 25 call (your broker most likely won’t let you have a naked short call – hence closing the short side first). Remember, you are buying to close the 27 call and selling to close the 25 call. If you do both legs at once, you are closing for a net credit.

Trade Details:

March 6, 2023 - 4:31 pm

Insiders,

Here’s what I’m watching in the markets this week:

- It’s a bit slower week than usual, but we do have the jobs report for February coming out on Friday.

- Powell testifies before Congress on Tuesday and Wednesday as part of his normal semi-annual reporting to Congress.

- There’s not much in the way of earnings this week except for ORCL.

March 6, 2023 - 4:26 pm

Insiders,

Here’s the Options For Income Pro trade for tomorrow. I like the aggressive or defensive strike this time around as the standard doesn’t pay much of a premium.

iShares Global X Robotics & Artificial Intelligence ETF (BOTZ)

Buy BOTZ and sell the April 21st 26 call for a net debit around 23.90. (The aggressive version uses the 25 calls, and the defensive version uses the 23 calls.)

I’m not using a buying range for this service – so use your discretion if the price changes, and feel free to change strikes as needed. Also keep in mind, I’m not tracking or managing these trades as part of the service. Don’t hesitate to email me if you have questions.

Trade Details:

March 3, 2023 - 4:08 pm

Insiders,

The weekly recap video is ready for viewing.

Here’s the link:

https://cdn.jwplayer.com/videos/E6f0iR2N-Bvib7p4n.mp4

February 27, 2023 - 5:04 pm

Insiders,

Here’s what I’m watching in the markets this week:

- Not as much going on in the market this week, so it wouldn’t surprise me to see volatile decline a bit.

- Major retailer earnings are still coming out including TGT, COST, and LOW all this week.

- Some other important earnings include CRM, AVGO, and ZM.

- ISM manufacturing data comes out on Wednesday with the more important ISM non-manufacturing number coming out on Friday.

February 27, 2023 - 4:57 pm

Insiders,

We had our second live session today for Insiders. I forgot to send out the new vertical spread immediately after, so here it is below. You may have to adjust the price/strikes a bit tomorrow if the market moves a lot on open, but the trade is still good.

The trade theme for the month is vertical spreads, so this time around we’re doing a put spread in Carvana (CVNA). We think CVNA could go down in the next couple weeks, but it’s a volatile stock. As such, the options are expensive even though the stock is only around $ 9. In order to reduce costs, we are using a vertical spread strategy.

We are buying the March 10th 6.5-8 put spread for around 0.45 (buying the 8 put, selling the 6.5 put). If you’ve never placed a put spread, just make it look like the screenshot below. You can do this spread in a cash account as long as you have spread trading permission. You can only lose what you spend (around $ 45), which is the max loss if CVNA is above $ 8 at March 10th expiration. Max gain is at $ 6.5 or below at expiration and is the difference in the spread width minus the premium cost (150 – 45) or $ 105 in this case. If you can’t trades spreads, buying the 8 put is a reasonable, albeit more expensive, substitute.

February 27, 2023 - 4:35 pm

Insiders,

Here’s the Options For Income Pro trade for tomorrow:

Paramount Global (PARA)

Buy PARA and sell the March 31st 23 call for a net debit around 21.26. (The aggressive version uses the 22.50 calls, and the defensive version uses the 21 calls.)

I’m not using a buying range for this service – so use your discretion if the price changes, and feel free to change strikes as needed. Also keep in mind, I’m not tracking or managing these trades as part of the service. Don’t hesitate to email me if you have questions.

Trade Details:

February 24, 2023 - 4:22 pm

Insiders,

Don’t forget, we have the new Insiders live session on Monday. We are discussing vertical spreads for one more session and then we’ll move on to a new topic in March.

Also, the weekly recap is ready to view. Here’s the link:

https://cdn.jwplayer.com/videos/Bsryl5eZ-Bvib7p4n.mp4

February 20, 2023 - 5:32 pm

Insiders,

Here’s what I’m watching in the markets this week:

- It’s a short week due to the holiday today, but there will still be some meaningful items hitting the wire.

- Earnings include WMT, HD, BABA, NVDA., and EBAY.

- FOMC minutes come out on Wednesday and occasionally will move the market.

- PCE comes out on Friday, which is the Fed’s preferred gauge of inflation.

February 20, 2023 - 5:25 pm

Insiders,

Here’s the Options For Income Pro trade for tomorrow:

iShares MSCI Brazil ETF (EWZ)

Buy EWZ and sell the March 24th 30 call for a net debit around 28.06. (The aggressive version uses the 29 calls, and the defensive version uses the 28 calls.)

I’m not using a buying range for this service – so use your discretion if the price changes, and feel free to change strikes as needed. Also keep in mind, I’m not tracking or managing these trades as part of the service. Don’t hesitate to email me if you have questions.

Trade Details:

February 17, 2023 - 4:31 pm

Insiders,

The weekly video recap is up! The link is below. Don’t forget that Monday is a holiday and the markets are closed. Enjoy the long weekend!

https://cdn.jwplayer.com/videos/CkEMVLjH-Bvib7p4n.mp4

February 13, 2023 - 5:19 pm

Insiders,

Here’s what I’m watching in the market this week:

- The big number this week is CPI, which comes out Tuesday. Inflation is still the primary concern for the Fed (and thus for investors).

- PPI comes out on Thursday, which tends to be a leading indicator for other inflation metrics (like CPI).

- Some important earnings will be released this week including KO, CSCO, DE, AMAT, and ABNB.

February 13, 2023 - 5:03 pm

Insiders,

Here’s the Options For Income Pro trade for tomorrow:

iShares China Large Cap ETF (FXI)

Buy FXI and sell the March 17th 32 call for a net debit around 30.06. (The aggressive version uses the 31 calls, and the defensive version uses the 30 calls.)

I’m not using a buying range for this service – so use your discretion if the price changes, and feel free to change strikes as needed. Also keep in mind, I’m not tracking or managing these trades as part of the service. Don’t hesitate to email me if you have questions.

Trade Details:

February 13, 2023 - 3:00 pm

Insiders,

The trade theme for the month is vertical spreads, so we’re kicking off with a new trade in Pinterest (PINS). PINS missed earnings and the stock dropped sharply, so we’ll use a call spread as an affordable way to play a mean reversion. In other words, we think the stock may be oversold, but we don’t want to spend too much money on our rebound thesis. For this purpose, we are using a call spread to reduce the premium cost. We made this trade during the live session today at slightly different prices, so if you want more details on using vertical spreads, check out the video replay.

We are buying the March 10th 25-27 call spread for around 0.72 (buying the 25 call, selling the 27 call). If you’ve never placed a call spread, just make it look like the screen shot below. You can do this spread in a cash account as long as you have spread trading permission. You can only lose what you spend (around $ 72), which is the max loss if PINS is below $ 25 at March 10th expiration. Max gain is at $ 27 or above at expiration and is the difference in the spread width minus the premium cost (200 – 72) or $ 128 in this case. If you can’t trades spreads, buying the 25 call is a reasonable, albeit more expensive, substitute.

Trade Details:

February 10, 2023 - 4:51 pm

Insiders,

The weekly recap video is up. Here’s the link:

https://cdn.jwplayer.com/videos/Kt6GqajS-Bvib7p4n.mp4

February 10, 2023 - 3:23 pm

Insiders,

Don’t forget, our new live trading room feature starts on Monday! Our theme this month is vertical spreads. We’ll discuss them and put on a trade live during the session. These live trading chats will happen every other week, with a new theme each month.

You can join Monday at 1 pm ET. Here’s the link:

https://us02web.zoom.us/j/84243148572

February 6, 2023 - 4:00 pm

Insiders,

Here’s what I’m watching in the markets this week:

- It should be a calmer week after the news-heavy week we saw last time, but there are still some big data points on the radar.

- In earnings we have a moderately active week with DIS, PEP, TM, and UBER leading the way.

- In economics news, we’ll get the latest consumer sentiment reading on Friday.

February 6, 2023 - 3:52 pm

Insiders,

Here’s the Options For Income Pro trade for tomorrow: