Options Floor Trader Pro

Vol. 3 Issue 22

Analyst’s Note:

In every issue of Options Floor Trader Pro, I remind you that if you don’t hear from me on a particular trade between issues, it means that I’m still recommending a hold. I’ll also tell you that, of course, my lack of a recommendation doesn’t mean you can’t take profits (or cut losses) with your risk tolerance in mind.

It’s good to reiterate this again today, as there may be some adjustments to DBX and GLNG that take place before the next issue of Options Floor Trader Pro comes out. Be sure to keep an eye out for any emails from me with action items.

Euan Sinclair’s article this week is his first in a series that explains the options Greeks (analytical metrics). He breaks down how delta works, which is a very useful thing to understand.

Speaking of Euan, he has another premium webinar coming up on January 4,all about directional options trading. Despite it being the most basic way to trade options, investors still make plenty of common mistakes when using options to bet on the direction of the underlying stock. Euan will discuss these mistakes and how best to overcome them in order to get the most of your directional options trading strategies. Click here for details and to sign up.

Finally, my new service, Profit Wheel 360, will be coming out in beta December. It will be very different from Options Floor Trader Pro, as we will focus on selling options to collect premiums. More info should hit your inbox soon!

The Trade

You would be hard-pressed to find any earnings calls from this quarter that don’t mention the global supply chain bottleneck. The issues with both the manufacture and delivery of raw materials and finished goods are causing significant supply and demand imbalances in multiple industries.

One overlooked industry that has been hurt by lack of supply is the paper industry. Everything from envelopes to greeting cards has been much harder to buy in bulk than under usual circumstances.

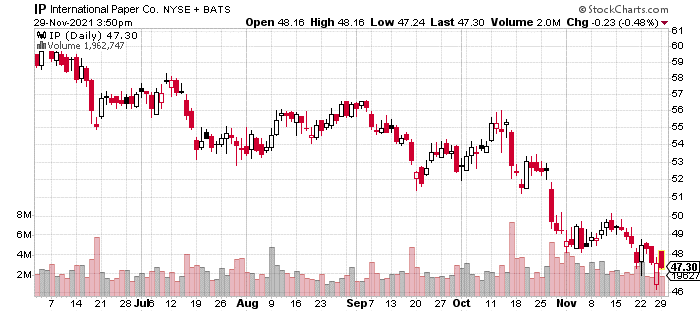

The industry leader in this space is International Paper (IP), a $19 billion giant that makes paper and packaging goods, along with hygiene products. The company’s shares have sold off in recent weeks after missing earnings due to, you guessed it, supply shortages.

I like this company for a rebound because demand for paper goods should remain robust after the holiday season is over. In other words, when the supply finally arrives, there still should be demand. What’s more, the company has been active in repurchasing shares and debt—something all shareholders like to hear.

We’re going to buy January calls.

Trade Recommendation:

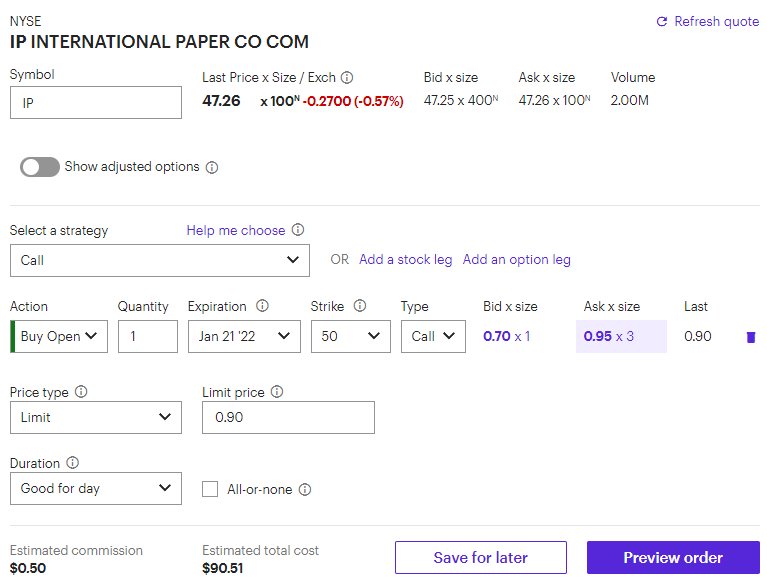

Buy to open International Paper (IP) January 21 50 calls for a price of around $0.90

IP is currently trading at $47.26. I’m setting the buy-up-to-price for the calls up to $1.30. Of course, it’s also okay to buy if the price is lower than $0.90. Try placing your limit order as close to the midpoint of the bid/ask as possible to start with. You can always move the price until you get filled.

Don’t forget to refer to the checklist if you are new to trading options. For example, step #5 looks at whether the option type is a call or a put. Make sure you are choosing the 50-strike call for January 21.

At expiration (in 52 days), our breakeven point is $50.90. I’m looking for a move to $52 or higher in the next several weeks. We don’t necessarily need the option to get to the breakeven point to take profits if the stock makes a sharp move up (it will boost the put premium in a hurry). The most we can lose on the trade is whatever you pay for the premium ($90 per contract at the current price). Every dollar above the breakeven point is worth $100 to us at expiration per contact owned.

Remember: try to get filled at the midpoint of the bid/ask spread and then move the price up from there. And, don’t forget to follow the steps in the checklist, and especially double-check all the trade details before you send your order in (step #10). The price may change quite a bit due to market conditions, so be sure to check the bid/ask spread before you enter your order. Keep in mind, I may send extra trade alerts that don’t coincide with the date of one of our biweekly issues.

Trade Screenshot:

Chart:

Open Trade Review:

Golar LNG Limited (GLNG) December 17 15 Calls

Buy price: $0.95

Current price: $0.10

Days to expiration: 17

My thesis hasn’t changed, but we’re likely going to need more time for our GLNG trade to work out. The macro picture for the company still looks extremely bullish. As it gets closer to expiration, we’ll look at rolling this trade out to January or February.

Dropbox (DBX) December 17 27 Calls

Buy price: $0.90

Current price: $0.60

Days to expiration: 17

Like GLNG, nothing has changed regarding my thesis on DBX. The added volatility (and sell-off) in the broad market means we may have to buy more time on the trade. As we get closer to expiration, we’ll look to roll this into January.

Discussion Topic: Why We Buy Options

All investment assets offer a tradeoff between risk and return. For instance, the return you get from buying a Treasury bond will be low because there’s almost no risk involved; on the other hand, if a small-cap stock offers a dividend yield of 10%, there’s undoubtedly some risk that you’ll be unable to collect that dividend indefinitely.

Buying options also has its own risk/reward characteristics. One advantage to buying or going long options is we know what our risk is right from the start. We can only lose what we spend on the price (premium) of the option. If you spend $150 to buy an option, that’s all that you can lose no matter what happens. Please note, you don’t ever have to exercise an option if you don’t want to own (or sell short) the underlying shares. You simply close the option prior to expiration, and it’s a done deal.

On the other hand, the potential return from buying options is very high—in some cases, unlimited. You can spend $150 on an option, and if the underlying stock moves in your favor, you could turn it into $300, $500, or more. Now, massive returns aren’t the likely scenario, but they are possible due to the leverage of options (one contract is the same as controlling 100 shares of the stock).

As a tradeoff for leverage, there is a time limit on your trade. You have until the option expires for the stock to move in the direction you want (and in the magnitude you want). The time limit on options is the real risk to buying options in the first place. As we all know too well, timing the market is extremely difficult. With long options, you either have to nail the timing or spend a lot more money on long-term options (which can get pricey).

That’s why buying options is generally a low probability trade in terms of success. The key is to hit big winners when you get the trade right, which helps make up for times when your timing doesn’t work out. However, regardless of your success rate, buying options is the best way to break into options trading. Learning how options work is best done with limited risk and the potential for high returns.

While buying options can be more expensive in times of volatility (like now), the added volatility also means it’s more likely the options will end up in the money. Generally, at times like these, it’s worthwhile to spend the extra money to buy options.

The Greeks

Guest column from Euan Sinclair

“The Greeks” is a collective term for the derivatives (in the mathematical sense) of the option price that describe an option’s dependency on various variables and parameters. There is a common misconception that knowing the Greeks is a source of edge. This isn’t true. Knowing the Greeks won’t give edge any more than knowing the price will. Nonetheless, the Greeks do explain what is going on in the moment. Trading options without them is like driving a car with no instruments. It can be done, but it isn’t optimal.

Delta

Delta is the amount an option’s value changes if the underlying stock moves by one dollar. So, if a call has a delta of 0.5 (also referred to as “50 delta” or “50% delta”), it will increase by $0.50 if the stock goes up by a dollar, and drop by $0.50 if the stock moves down by a dollar. Calls have positive deltas (because they are bullish bets) and puts have negative deltas. Options that are a long way out of the money have low deltas because they aren’t worth much to start with and this continues to be the case even if the stock moves a bit. Options that are deep in the money have deltas of one for calls and negative one for puts, because they behave just like long or short stock positions respectively.

When we are using options to bet directionally, we are “trading delta.”

But even when using options in the simplest possible way, we need to be aware of some things that might be counterintuitive.

It might seem that an at-the-money call would have a delta of 0.5, because it is halfway between the stock and being worthless. This is not true: it doesn’t matter whether we use the stock price or its forward price to choose the ATM strike, because of the way returns compound. Think of a stock that starts at $100, goes up 10% (to $110) then up another 10% (to $121). Compare this to what happens when the price drops. A $100 stock that has two consecutive 10% down moves will only drop to $81. The up moves have taken us further in dollar terms.

Delta is the option’s exposure to stock moves, and the $100 call does have greater exposure to up moves, hence its delta will be greater than 0.5.

Because this effect is due to compounding, it is more pronounced for higher volatility stocks (to see this, replace the moves in our example with ones twice as big). Finally, as we saw last time, time has the same effects as volatility, so this effect is also magnified for options with long times to expiration.

This isn’t just theoretical. A lot of people got confused when trading meme stock options. When GME was around $300, the volatility was over 1,000%. The one-month ATM calls had a delta of 0.93. The 800 strike had a delta of 0.86. This makes it very difficult to get positive delta exposure from spreads, or to sell a delta-neutral strangle. But it isn’t a mathematical oddity, and it isn’t an example of the model breaking—it is an accurate reflection of how stocks and options change price.

Join me and Jay for a live presentation and discussion called “Getting the Most from Your Directional Trades.” This is the fourth of webinars that have been growing in popularity. This time I’ll show you the common mistakes you might be making with your without even realizing it and importantly, tested corrective actions you can take now. Click here for details and to sign up.