When investors think about the returns on their stock investment, they often think of dividends and how much they would get for holding the stock. Yet returns could also come from capital gains: buying low and selling higher.

Your capital gain is the profit from selling shares at a price above what you paid to buy. And capital gains yield (CGY) tells you how much the share price went up from the time you bought the stock to when you sold it.

We’ll explain what capital gains yield is, how it’s calculated, and how it’s related to dividend yields and total return. We’ll also discuss capital gains tax and show you how to create your own CGY calculator.

What Are Capital Gains and Capital Gains Yield?

Before we dive into calculations, it’s useful to remind ourselves of what a capital gain is.

Capital gain is the profit you earn when you sell an asset at a higher price. The asset could be anything: stocks, bonds, houses, coins, equipment, cars, etc. And the higher price comes from either buying at a discount and flipping it or from price appreciation.

With stocks, unlike with most other assets, you don’t need to hunt for bargains to make capital gains. In the long term, when companies successfully invest in their business, they become more valuable and their share prices rise.

Capital gains yield is the percentage that tells you how much the price appreciated since you bought the stock.

The Capital Gains Yield Formula

The formula for capital gains yield, or CGY, is simply the difference between two prices divided by the original price (and you can multiply by a hundred and add a percent sign to convert decimals to a percentage):

Capital gains yield = (P1 – P0)/P0

P0 is the original purchase price paid to buy shares of stock or any other security.

P1 is the current market price or the price of the security at the time you sold it.

To give a basic example, imagine that you’ve bought shares of ABC Corp. for $100. A year later, the price went up to $110, and you sold your shares. By subtracting $100 from $110, you get $10. That is your capital gain. Then, simply divide this by the original purchase price of $100, and you’ll get 0.1, or 10%. That is your capital gains yield.

As you can see, the formula shows the past return for the security for some period.

Yet the capital gains yield doesn’t actually tell us anything about the valuation or the future of this specific investment.

CGY is sometimes used in corporate finance and financial modeling, but for regular investors, it’s more important to understand how it relates to dividends and the total return.

Dividend Yield vs. Capital Gains Yield

The capital gains yield should not be confused with the dividend yield. The easy way to remember is that capital gains only come from the difference in market prices while dividends are paid by the company. However, even though they are different, both contribute to your investment’s total return.

Dividend Yield

The dividend yield is calculated by dividing the dividend per share by the stock price you’ve paid (if you already hold this stock) or the current price (if you’re just considering investing).

While it will fluctuate with the share price, the dividend yield is more predictable, as it’s based on the company’s dividend policy.

Ideally, a company’s dividend policy is tied to something related to business performance. For example, for Altria Group (MO), the dividend payout ratio is 80% of adjusted earnings per share.

Capital Gains Yield

Capital gains yield, however, is based solely on the company’s market value, so it’s more volatile.

The company’s valuation can change due to things that aren’t directly tied to its business and ability to pay dividends, including:

- Macroeconomic changes (such as foreign exchange rates, interest rates, etc.)

- Investor confidence in the economy or the company’s sector

- Fund flow (e.g., index funds’ mandatory buying or selling when the stock is included in an index)

So even if you’re confident that the price of the stock is lower than it should be, it might take time before the market catches up to it and rewards you with capital gains.

Total Return

When you combine the capital gains yield and the dividend yield, you’ll get the total return of the common stock. Price appreciation and dividends are the two ways to make money with stocks.

While it would be great to have both, there is usually a trade-off, as you can see from the following examples.

Capital Gains Yield Examples

The easiest way to understand the link between capital gains yield, dividends, and total return is through examples.

CGY Example One: Amazon

This is clearly a positive CGY or capital appreciation story. Like many tech companies, Amazon (NASDAQ:AMZN) has never paid a dividend, and its stock return has come solely from price appreciation.

Growth stocks usually don’t pay dividends because they see a high growth rate in their main business and reinvest their profits. Amazon even successfully invested in new businesses, such as hardware and cloud infrastructure.

But after the dot-com crash, the market continued to dismiss Amazon’s growth model for years.

An investor who bought it 50% below its 1999 high still had to wait until 2007 just to get to 0% capital gains yield.

If the same investor held until 2021, the CGY would be a four-digit percentage. Yet spotting a tech company poised to become “the next Amazon” is easier said than done, especially because companies now generally go public much later.

CGY Example Two: AbbVie

If you’d bought AbbVie (NYSE:ABBV) in January 2018 at around the $120 high, you would have a negative CGY (below 0%) as of May 2021. This is also known as capital loss or depreciation.

As of May 2021, the price is at $115, still below the original purchase price of $120. This means the CGY is -4.1%.

Throughout this time, however, the company continued to pay a relatively high dividend, which totaled nearly $15 per share.

So the dividend yield for the same period would be 12.5% ($15 divided by $120).

This means the total stock return would still be positive at 8.4% (-4.1% plus 12.5%).

CGY Example Three: Procter & Gamble Co.

Since 2018, Procter & Gamble Co. (NYSE:PG) has had a positive CGY and a positive dividend yield.

For example, if you’d bought the stock for $90 per share in January 2018, at the May 2021 price of $135, the capital gains yield would be 50%.

In addition, during the same period, P&G paid out nearly $10 in total dividends, so the dividend yield would be 11%.

So combining both yields together, the total return is 61%.

It would be nice to always have both!

Yet in reality, outside of a strong bull market, this would be fairly unusual.

That’s because when a company pays a dividend it uses up the cash flow that it could have otherwise reinvested in growth. As a result, growth would be slower, and that should be reflected in the share price.

In general, fast-growing companies reinvest all their earnings, while established, matured businesses pay out up to 75% of their earnings. Outside of special situations, companies would never pay out all their earnings because they still need to invest in their business to maintain it.

Capital Gains Tax

Another trade-off between capital gains yield and dividends has to do with taxes.

When you sell a security for a higher price than what you paid, you’ll need to pay a capital gains tax.

If you held the stock for more than 12 months, the long-term capital gains tax would be applicable. The rate depends on your income bracket and is up to 20%.

Short-term capital gains tax applies if the stock was held for less than 12 months and is the same as your ordinary income tax rate, so it could be up to 37%.

The tax rate for dividends depends on whether dividends are “qualified” or “ordinary.” If they are qualified, then dividends are taxed like long-term capital gains at a rate of up to 20%. Ordinary dividends are taxed as ordinary income at up to 37%.

In short, dividends are qualified if:

- The company paying it is based in or trading in the U.S.

- The receiving investor held shares for the minimum holding period.

In general, dividends and long-term capital gains are taxed at lower rates than short-term capital gains.

The idea is to encourage companies to pay dividends instead of hoarding cash and to give investors a reason to hold stocks for longer terms instead of maximizing capital gains yield.

Of course, this is not tax advice, and you should talk to an accountant before making any decisions.

Capital Gains Yield Calculator

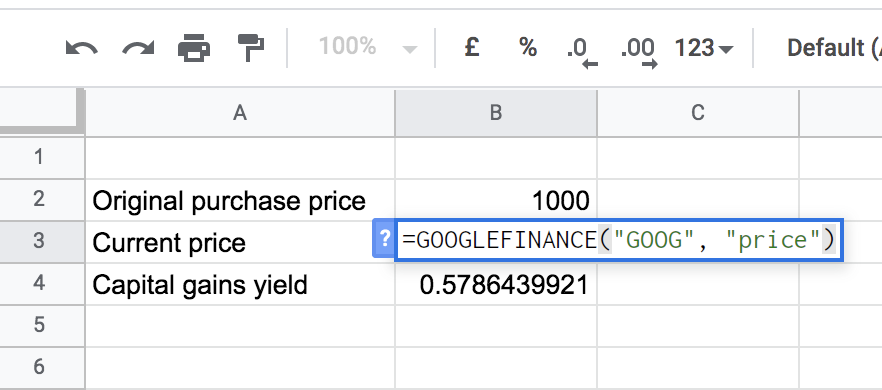

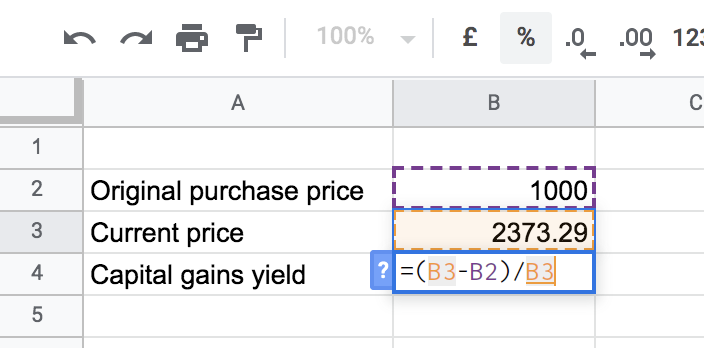

If you need to calculate CGY, here’s how you can easily build your own capital gains yield calculator in Google Sheets using the following steps:

1. In column A, list out “Original purchase price,” “Current price,” and “Capital gains yield” in three separate cells. If you want to follow along with our example, you can put “Original purchase price” in cell A2, “Current price” in cell A3, and “Capital gains yield” in cell A4.

2. In cell B2, next to “Original purchase price,” enter the original price you paid for the stock.

3. In cell B3, next to “Current price,” enter the formula =GOOGLEFINANCE(“GOOG”, “price”), replacing “GOOG” with the ticker for your stock. That will give you the latest price of the security with that ticker. Or instead of this formula, you can just type the share price for which you’ve sold the stock.

4. In cell B4, next to “Capital gains yield,” enter =(B3-B2)/B3 and click the “%” button in the toolbar above to get the capital gains yield as a percentage.

That’s it! The math will be done for you.

Get Your Yield — Be It Capital Gains or Dividends

In this article, we’ve reviewed what capital gains yield is, contrasted it to the dividend yield, and reviewed how together they make the total stock return.

As we’ve seen from real-life examples, there is usually a trade-off between price appreciation and dividends.

And tax implications typically favor long-term capital gains and dividends over short-term capital gains.

To learn more about stocks that pay high dividends and could become the backbone of your retirement, subscribe to Investors Alley’s “Dividend Hunter” newsletter.