URGENT ACTION REQUIRED: You should own this stock by the market close on Monday, February 13, 2023 to collect the dividend that the end of this month.

American Financial Group

I became aware of American Financial Group (AFG) when subscriber Roger suggested I take a look. AFG will be a great addition to the Monthly Dividend Multiplier portfolio.

Overview

Here is an overview from the company website:

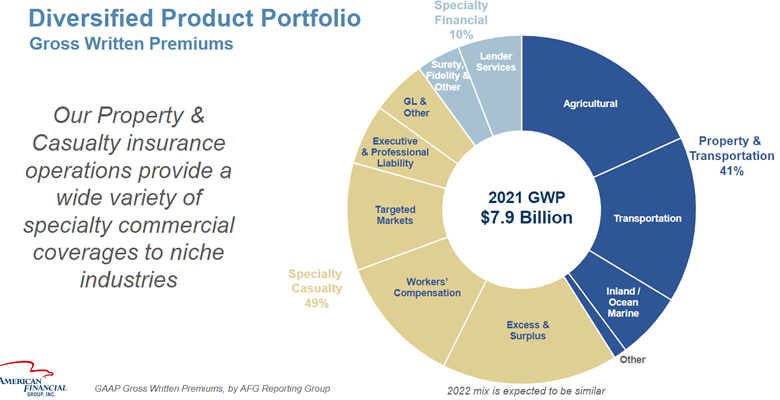

American Financial Group, Inc. is a holding company based in Cincinnati, Ohio, and founded in 1959. Our insurance roots go back to 1872 with the founding of Great American Insurance Company. Today, through the operations of Great American Insurance Group, AFG is engaged in property and casualty (P&C) insurance, focusing on specialized commercial products for businesses. We are proud to provide insurance products that help businesses manage their unique financial risks and exposures.

AFG’s Specialty P&C Group is comprised of over 30 diversified businesses offering a wide range of specialty commercial coverages in three major groupings: Property and Transportation, Specialty Casualty and Specialty Financial.

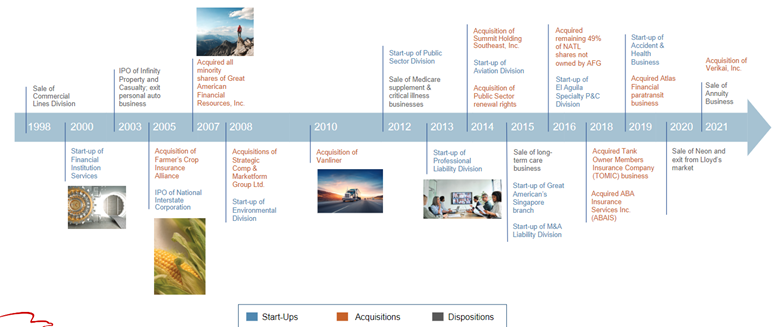

American Financial Group has a strong history of starting new divisions, acquisitions, and business sales.

The history of acquisitions and dispositions has left the company with a number of profitable niche insurance lines.

American Financial Group is run by brothers and co-CEO Carl H. Lindner III and S. Craig Lindner. Their father, Carl H. Lindner Jr., formed American Financial Group (AFG) in 1959. The elder Carl used AFG as a holding company for a wide range of purchases, including investments in broadcast and media companies, banks, food producers, and the Cincinnati Reds baseball team.

Under the brothers, especially Carl III, the company repositioned its focus toward diversified, specialized insurance niches. These areas include environmental, public sector, professional liability, aviation, and mergers and acquisitions liability. Craig has also focused on annuity and investment operations. The non-insurance-related investments have been sold off.

Out of the twelve largest property and casualty insurance companies, AFG has posted the highest pretax P&C returns for the last one, five, 10, and 15-year periods.

Investment Considerations

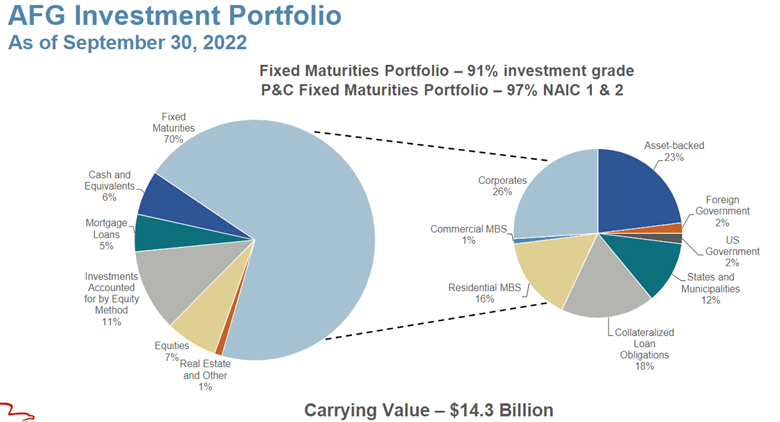

Written P&C premium should continue to grow steadily, and renewal rates will be up by 5% for 2022. What excites me most is the potential for higher returns from the investment portfolio.

AFG’s fixed-income investments have (as of 9/30/22) an average maturity of 2.7 years, with an annualized yield of 3.73%. A December 1 presentation states the company currently reinvests matured securities at around 6%. For the 2022 third quarter, AFG reported net income from fixed-rate investments increased by 35% year-over-year. We should see that or higher investment income gains in 2023.

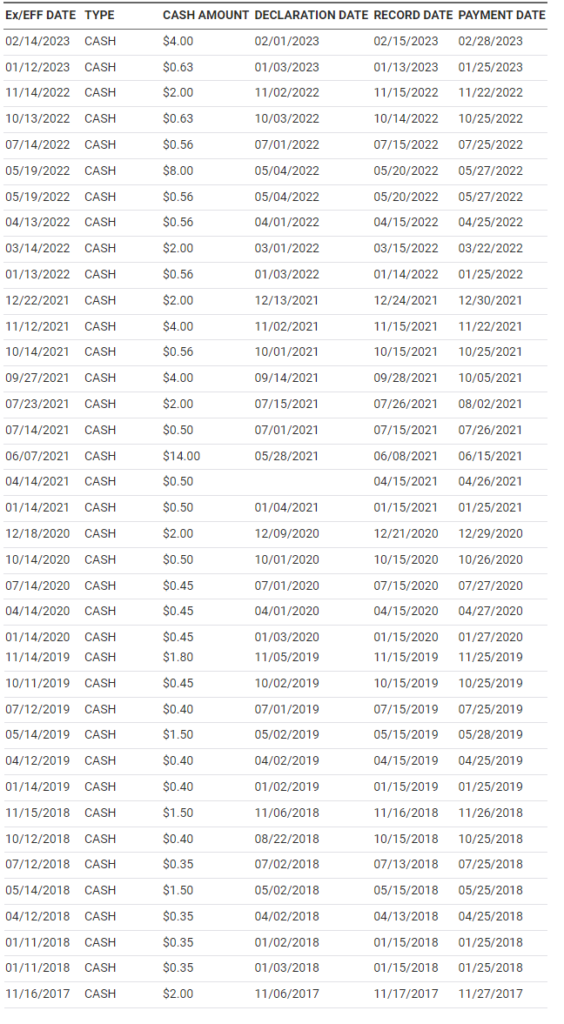

American Financial Group has grown its regular dividend by 12% annually over the past decade. The dividend has grown for 17 consecutive years. The dividend increased by 12.5% in October. The current yield on the regular dividend is 1.8%.

The company also pays special dividends. Three dividends totaling $12.00 per share were declared in 2022. AFG paid five special dividends totaling $26.00 per share in 2021.

The chart below shows you the frequent massive dividends paid out several times a year for at least the last five years. Even during the worst of the pandemic AFG continued to pay dividends and even shared a couple of large ones with investors.

As you’ll see, even if you missed the most recent ex-dividend date for a bonus dividend, AFG regularly pays them out and you’ll be able to cash in on the next one.

I have added AFG to the Monthly Dividend Multiplier portfolio with a 4% position weight.

Editor’s Personal Position: Long AFG