3 Proven Options Trades to Profit from Market Volatility

– Jay Soloff, Lead Options Analyst, Investors Alley

Generally speaking, the arrival of a new calendar year shouldn’t have much of an impact on the performance of the stock market. That is if the stock market is in a bull market at the end of the previous year, is there any reason to believe it will stop being in a bull market once the New Year arrives? Certainly, the fundamentals aren’t going to change just because we write “2017” instead of “2016” on a check (assuming you even still write checks anymore).

However, there is something about 2017 which differentiates it from many other calendar years… the start of a new administration. Because 2016 was an election year – and the election results were dramatic – there’s likely going to be a lot of changes in the US this year. And when it comes to the stock market, change can often mean uncertainty.

Here’s the thing…

Investors hate uncertainty. In fact, uncertainty is often the most common predictor of market volatility. We’re more likely to see a sustained period of higher market volatility based on future uncertainty than we are from an actual negative event.

So what can we as investors do to prepare for what could be the most volatile year we’ve seen since the Financial Crisis of 2008-2009? More importantly, is it possible to profit off of uncertainty and volatility?

When it comes to preparing for higher levels of volatility, I strongly prefer options trading strategies. With that in mind, here are three options trades you can make right now to take advantage of the coming market volatility.

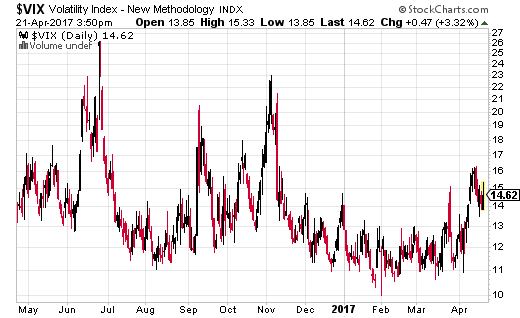

Buy VIX 15-20 Front Month Call Spread

There isn’t a more straightforward way to trade volatility (uncertainty) than by trading options (or futures) on the VIX. The CBOE’s S&P 500 Volatility Index (VIX) is the most common indicator of market volatility and often referred to as the investor fear gauge.

Being an index, the VIX itself is not a tradable product. There are multiple ETFs which attempt to emulate the VIX, but most are extremely flawed. As such, I typically recommend VIX options as the go-to method for trading volatility. (It’s important to note that VIX options are based on VIX futures and not on the VIX spot price. I don’t recommend trading VIX futures themselves as they’re not for the faint of heart.)

The VIX call spread I recommend is not just a one-time trade, but an ongoing strategy you could use throughout the year. Basically, anytime the VIX drops below $14, I’d take a close look at the front month 15-20 call spread. I’ll get to the logic behind the trade in a minute. First, let me explain what I mean by front month and call spread.

In options or futures, the front month refers to the month with the nearest time to expiration. For this particular trade, I’d make sure to go about four weeks out. Since the VIX has weekly options, there should be no trouble finding a spread that’s always around a month to expiration.

A call spread means you’d buy the 15 strike and simultaneously sell the 20 strike. By selling the 20 strike, you are significantly reducing the amount of capital needed to make this trade. What’s more, the VIX doesn’t often breach the 20 level… and when it does, the stay is usually very brief.

Essentially, this ongoing trade strategy can give you decent protection against an upswing in volatility without breaking the bank. For example, with the VIX around $14.50, the 15-20 call spread with about 4 weeks to expiration will only cost you around $1. That’s your max risk on the trade, with the max gain at $4. Breakeven at expiration occurs with VIX at $16. Paying $1 to make $4 is a smart way to benefit from a volatility increase without risking too much.

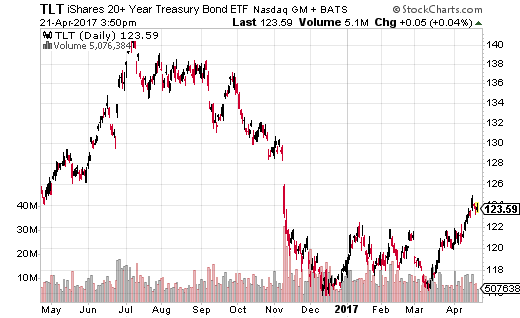

Buy TLT July ATM Straddle

The stock market isn’t the only thing that’s likely to be volatile in 2017. Interest rates could also be in for quite the ride. And if interest rates are going to move, then so are bonds.

Since most of the action in bonds is on the longer-term side of the yield curve, the most popular way to trade bonds is with iShares 20+ Year Treasury Bond ETF (TLT). If you not familiar with TLT, the price of the ETF goes up when long-term bond prices go up (and interest rates fall).

Given the ultra low rates of the last several years, TLT has been trading at historically high prices. However, that could change substantially this year depending on the new administration’s fiscal policy, and how the Fed reacts to it. Depending on how the central bank and investors weigh the impact of new policies on the US economy, TLT could be in for quite a bit of movement in the coming months.

There’s no better way to trade expected volatility (i.e. lots of movement) than by buying a straddle. An options straddle is when you buy the at-the-money call and put at the same time in the same expiration period. For example, if TLT is trading at $124, buying the ATM straddle for July is done by purchasing both the July 124 call and put combined for around $6.

By July, we should have a good idea of what policies the new administration will be trying to push through – and how the Fed may respond in turn. A $6 straddle means the trade makes money above $130 and below $118, both very reachable levels over the next three months. Moreover, you could theoretically make money on both sides if rates see-saw (and you sell out your call/put on a big move in either direction).

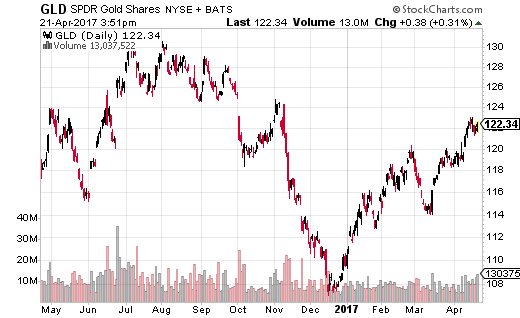

Buy September OTM GLD Calls

We’ve discussed an options trade related to stock market volatility, and one related to bond/interest rate volatility. Now, let’s look at a simple gold trade to round out the trifecta.

Gold is almost always a strong investment in times of uncertainty. The precious metal serves as an alternative to currencies when there are economic concerns on the horizon. A poor economy will often (but not always) cause the local currency to fall. Gold, as a currency alternative, is an excellent hedge against a falling domestic currency.

In the US, the dollar could be quite volatile in the coming months due to new policies from the administration and subsequent Fed actions or communications. This scenario could definitely drive investors into the safety of gold.

An easy and effective way to trade gold is through SPDR Gold Shares ETF (GLD). GLD is based on physical gold holdings, so you don’t have any of the issues that plague ETFs based on futures. Without getting into too much detail, futures-based ETFs are notoriously inconsistent at tracking the spot price of the underlying asset. ETFs based on physical holdings, like GLD, completely eliminate this complication.

GLD is down from a high of around $130 in the summer of 2016 to $122.50. That corresponds to a move in spot gold prices from roughly $1,350 per ounce to around $1,275. With all the geopolitical uncertainty we’re seeing around the globe, the $130 level is one we could easily reach in the second half of 2017.

With that in mind, you could buy the September $125 GLD calls for just $3.50. Breakeven is at $128.50, but the upside is unlimited. We can afford to buy out-of-the-money (OTM) calls because we have five months for gold to move up to our expected level of $130 or higher.

There you have it…

Three very different options trades you can make right now to take advantage of coming uncertainty and volatility in 2017. Using options strategies in stocks, bonds, and commodities allows you to diversify your risk across different asset classes. Or, pick your favorite of the three strategies and focus your effort on the asset class you’re most comfortable trading.

I hope you enjoyed the report! I write for Investors Alley every Monday in “The Market Cap” and am working on some exciting projects for Investors Alley that we will be announcing soon, so keep an eye on your inbox.

To read some of my other articles just CLICK HERE.