Thank you.

Your special report is on its way right now. In the meantime, please enjoy this new research on how to protect and grow your portfolio even in current market conditions.

Are You Prepared For…

The Pump and Slump of 2016?

If you’re invested in ANY Blue Chip today, YOUR money on the line.

In this report you’ll discover:

– Why we’re in the most dangerous time since the Great Depression…

– How insiders are already dumping shares on unsuspecting individual investors at an alarming rate… the past few months are just a glimpse of what’s to come…

– How to uncover the 9 stocks you need to drop IMMEDIATELY (or risk losing 78% of your investment)…

– And the only group of stocks I’m confident will grow your money over the next 5 years — “Prosperity Growth Leaders”…

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

Fellow Investor,

One group of shameless ‘money men’ has been cheating you.

And not for the first time either.

I’ve seen this scandal play out twice in the last 15 years… and both times led to catastrophic losses for investors.

Retirements were looted. Savings pillaged. And investments plundered.

And it’s happening again. Which is why, in this report, you’ll discover exactly how to insulate and protect your portfolio over the coming months… and how to beat the market year-after-year.

In fact, by the end of this report you’ll have the chance to identify exactly which stocks are worth investing in, and which ones you need to dump yesterday.

Let me briefly introduce myself…

Chief Equities Analyst

My name is Bret Jensen. I’m the Chief Equities Analyst with Investors Alley.

If I’ve learned one rule over 2 decades of investing it’s that you invest in a solid business first. And strong numbers second.

Why? Because a solid business will make money, year after year. But numbers can easily be exploited, manipulated, made to show things that aren’t true.

And that’s exactly what’s happening today.

A group of money men are doing everything they legally can to lure you in to investing in certain large stocks. Stocks that are due to collapse as much as 78% over the coming year.

How do I know? Because this same situation happened before the dot com bubble of 2000.

Companies were able to IPO and on the same day ride the excitement to double their stock price.

But by the time retail investors jumped on board, the money men took their money and were gone…

This was the time of the dot com bubble, and the market slumped 78%. Dreams of retirement, vacation and enjoyment were shattered practically overnight.

Then it happened again in 2008…

This time housing prices were inflated. Banks — and their money men — were handing out cheap credit to anyone who applied, no matter if they could pay it back or not.

The economy started to look like it was booming… pumping stocks up. And so, retail investors piled in again…

Only to have the rug pulled out from under them. And we both know how that felt.

Today we’re in the same position.

I’m calling it “The Pump and Slump Scandal of 2016.”

We’re being cheated into buying — and pumping — equities.

But by who? I’ll tell you…

Activist Investors who only care about increasing their share price. We’ve both seen them calling for more “money to be returned to shareholders,” even if that means sending the company into debt-fuelled buybacks and dividend payments. But you can be sure that when the chickens come home to roost, the activists will be long gone…

The Fed: they know the only way to keep the markets “strong” is to keep interest rates as low as possible and the money flowing. Notice they didn’t raise again just recently? Don’t confuse them as “do-gooders” saving the economy with low interest rates. Each dollar of debt issued under their watch is rotting the foundations of the market…

Corporate and Wall Street Insiders who promote and pump stock son a whim, only to bail leaving investors like you to pick up the bill…

The Government which has added over $8 trillion worth of debt since the 2008 crash and gave the nod to the Fed to keep printing new money and pumping up the stock market.

Talking heads on CNBC, Bloomberg, and other networks: they’re the perpetual bulls. They’ll tell you the market is fine and only going up. But, of course, they don’t tell you how much money they have in the market! For all we know, they could have already gotten out. Trust them at your own risk.

Now, let me make it clear…

Cheap credit has made it easy for these ‘money men’ to pull the wool over our eyes and inflate the market.

And this has been happening since late 2009.

But the crash countdown has started. These past few months with a 10% correction look to be only the start. They can only keep inflating the market as long as cheap credit’s on tap. But as we all know, the Fed wants to hike rates…

“Federal Reserve prepares tools for higher rates”

— Financial Times

“U.S. consumer prices edge up, supporting Fed rate rise” — Reuters

“The Fed must increase rates, but there will be costs”

— The Wall Street Journal

Put simply, it’s only a matter of time before rates are hiked. The pressure is mounting on Janet Yellen. When they are, the money men will no longer be able to inflate stock prices — and they’ll leave. Indeed, many already have. At this point, the “Pump and Slump Scandal” is going to hit investors hard — especially investors using their savings or retirement money.

That is — unless you invest a group of stocks I’ve coined “Prosperity Growth Leaders.” They’re investment plays that I’m confident will insulate you from the ‘money men’ and help you grow your money too.

I’ve assembled a portfolio of them to give you today — and an urgent bonus report on 9 well-known stocks that will murder your portfolio, unless you dump them now. We’ll get to these shortly.

First I need to make it clear…

It’s About to Get MUCH Harder to

Book Any Meaningful Returns

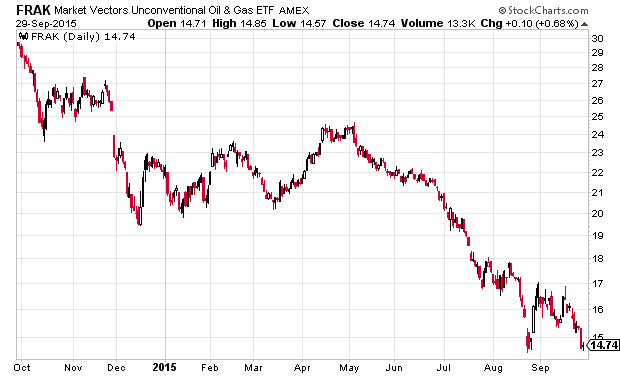

I want to show you an example of how entire sectors can collapse without credit. Take FRAK, an ETF which tracks the Global Unconventional Oil & Gas Index.

At $120 a barrel, energy stocks looked good. Banks and investors were willing to finance them. But that changed when oil slumped to $46 a barrel.

Investors ran for the hills. And credit dried up.

Take a look at what that did to the stock price:

This is just one example of how credit can create a boom — and then a bust.

But many stocks have had their boom.

The same “trendy” stocks that produced good returns for you over the past 5 years, aren’t going to offer you the same gains over the next 5.

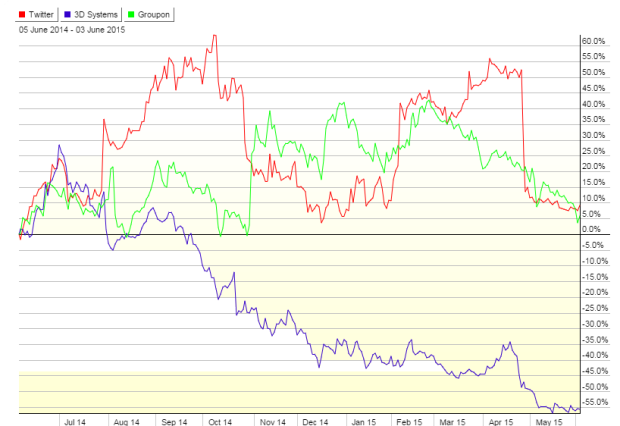

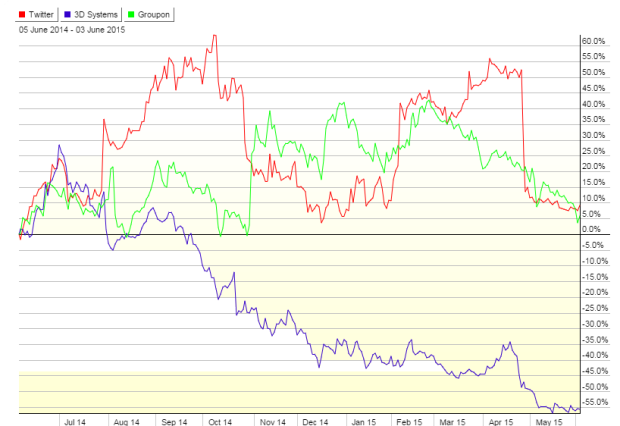

Take 3D systems for example. A market darling for investors and stock promoters, which has yet to recover and will likely go nowhere, along with Twitter, Groupon, and many others…

The bull market is shaky, and unless you’re proactive over the coming months, you’re going to be resigned to gains in the single digits, at best. At worst, you could end up having your own savings and retirement money ransacked by the same ‘money men’ who keep inflating markets. A true scandal, that they’re trying to make you the victim of.

I know that goes against what most other analysts are saying.

They’re likely still talking about investments that could 2-times, 3-times or even 10-times your money. And frankly, I’m still looking at a few myself — for a small percentage of my investments. I always keep a hand in play in what I see as the stocks with the most explosive upside…

But putting too many eggs in that basket will kill your portfolio.

Here’s what I know…

We’re on the verge of plunging returns, and a “slump.”

Some have had the rug pulled out from under them. Many more are about to.

All because the rate hike will cause the “free money” to dry up.

Those stocks offering the largest upside just 5, 2, even 1 year ago are going to be the most vulnerable. Many of these took on obscene levels of debt to finance their growth, or bribe investors with unsustainable dividends and share buybacks. And they’re likely to fall as quickly as they climbed.

Let me give you an example of just 1 of 9 stocks I’ve identified as money holes…

Tesla. The company has grown 1,329% over the last 5 years. But in the recent earnings call, Elon Musk announced they had missed the mark on sales, earnings and cash flow and guidance. The company is already carrying a ton of debt, and now they have a negative $455 million cash flow. What happens when they’re not able to cheaply finance their operations? I can only see them tumbling downhill and taking uninformed investors money with them.

This is the reason I’m proud to invest in a group of stocks — called Prosperity Growth Leaders — that have beat the market every year, for over a decade…

The way I see it, there’s no reason not to invest in stocks that are as close to a “sure-thing” as you can get.

In fact, I’m predicting that this group of stocks will beat the market again this year, and grow by as much as 23%. And I wouldn’t be surprised if one or two stocks doubled your investment this year. I’ll show you examples of this shortly.

First, I want to make it clear that I understand that number isn’t eye-catching.

I know ten-baggers are what grab attention. But I’m not willing to let my readers be seduced by a false promise and see their investment vanish in front of their eyes.

And that includes you.

I don’t want you to suffer from the “slump” and lose money that could otherwise go towards your retirement, vacations, family or whatever you have in mind.

There’s a reason Warren Buffett has never grown his wealth by more than 100% per year. He looks for steady out-performers, not home runs. Stocks that will consistently return him money — year after year — and NOT stocks that have a greater chance of being a strike-out than a home run.

The truth is, in such uncertain times, you can’t afford to NOT invest like this.

First, there’s something very important you need to hear…

What the Market (and Most Companies)

Don’t Want You to Know

I’ve told you the Fed, activist investors, Wall Street insiders and others are cheating you into buying their stock. But I haven’t explained specifically how.

It’s important for you to know this, because it will help you identify companies you need to dump — before they slump.

To most investors, these companies look like solid investments. Their stock keeps going up, beating the S&P year after year.

But their “fortunes” are coming to an end.

You see these companies are taking advantage of our low-interest world. They’re using this cheap debt to “artificially” pump their share price.

How? By issuing billions worth of debt to repurchase stock, pay unsustainable dividends and any other way they can squeeze their stock price higher and keep the fat-cats on Wall Street happy.

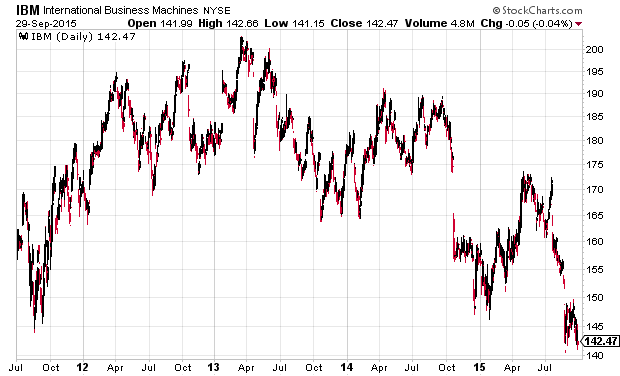

I’ll give you an example: IBM.

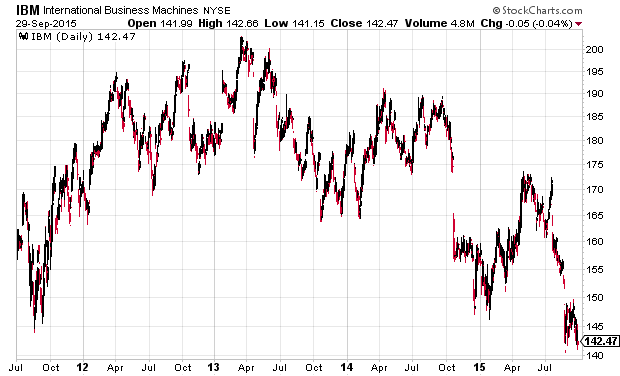

The stock looks good, it keeps going up. From just over $110 a share a few years ago, to a peak of $212 in 5 years. And even with the slight pull-back in the past 2 years any investor wouldn’t think twice about booking a gain like that and congratulations to anyone who has, but…

When you look under the hood, you can see just how fake these numbers are. And how risky it is for your money.

Using stock repurchases, the number of IBM shares dropped by 20%. This was financed by virtually every penny of their $100 billion net income.

But they also distributed over $20 billion in dividends.

That’s around 120% of their actual net income.

How did they finance this? With over $40 billion in super-cheap debt.

Let me put this as clearly as I can: they used debt, not growth, to prop up their stock price. When the debt becomes more expensive, as it will after the first Fed rate hike in nearly a decade, their house of cards will crumble, the share price will collapse and investors will see their portfolios wiped out very, very quickly.

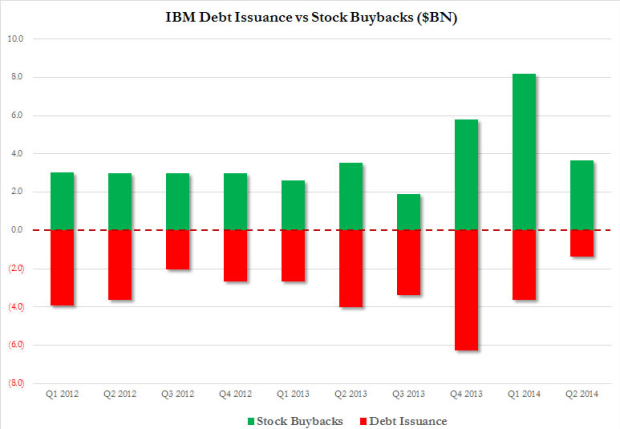

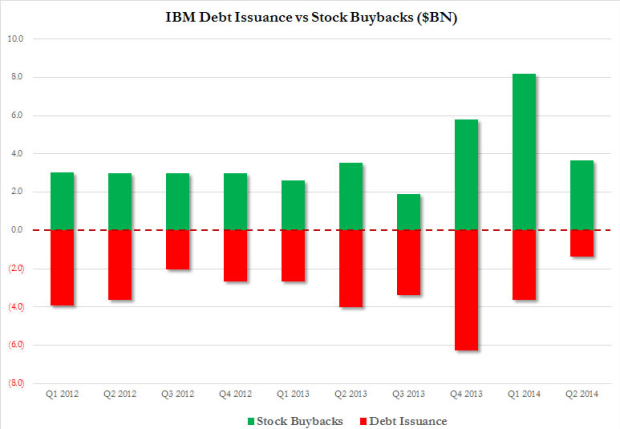

Even more telling is this chart showing the companies debt issuance and stock buybacks…

The correlation is too much to ignore.

But it’s not just IBM…

Stock buybacks are near all-time highs… the only other time they were higher is before The Great Recession:

And Goldman Sachs reports that buybacks are expected to jump 18% this year.

It should be clear by now that companies are propping up their stock prices with debt. In fact, US companies alone are piling on debt around 3x as fast as they’re generating cash.

Since March 2009, US non-financial companies have added $1.6 trillion in debt. While they’ve only added $570 billion to their cash pile.

Remember, the last time a major group in the US piled on a ton of debt led to the Great Recession, and $16 trillion in lost wealth for American households. Today, it’s your money on the line.

Here’s the truth…

Too Many Companies Are

Overpriced to Invest Blindly

Zero interest rates and quantitative easing have made it easy for companies to pump up their elevated stock prices.

It lasted for 7 years — and if you got in on one of these companies at the right time, you would’ve enjoyed year-on-year gains.

But the fun is over.

The Fed is preparing to hike rates… very, very soon.

And that’s going to trigger the Pump and Slump Scandal of 2016 and any gains these companies have made.

Once the money begins to dry up, 2007/08 may well start to look like a pleasure cruise.

Back then, folks who took out adjustable rate mortgages were hit hardest. Many couldn’t pay it back. Credit markets started to tighten. And the economy fell into the worst recession since the Great Depression.

The same thing is going to happen when the Fed begins to hike rates. The companies pumping up their stock with cheap-debt are going to struggle to even afford the debt they have. They won’t be able to ‘fake’ their earnings per share anymore.

The illusion will end. And the “slump” will begin.

That’s why you can’t afford to invest blindly. You need to invest in stocks that haven’t piled on debt. Stocks that will remain strong as rates rise. Stocks that can shrug off any market slump and bounce back to new highs. Stocks that are great businesses with management that won’t use debt to inflate their share price.

And I’m going to tell you how to uncover them — Prosperity Growth Leaders — now…

The #1 Blindspot Most Investors Miss

When looking at stocks, investors tend to look at earnings per share, price to earnings, dividend payout ratios and few other indicators.

And I do too.

But they’re missing a crucial bit of data that has allowed me to pick Prosperity Growth Leaders which beat the market, year after year.

You see, these stocks are ‘hidden in plain sight’ among equally large companies.

They share ranks with the likes of McDonalds, Tesla, and many other stocks I wouldn’t invest in now.

But there’s a blindspot for most investors that I use to separate Prosperity Growth Leaders from the herd.

Put simply, I look for companies that are Cash Cows.

And that’s not cash from the cheapest credit market in history.

That’s cash from a strong business model with long-term growth potential.

But it’s also important to be a company with a low debt ratio. The cash has to be doing more than balancing out mammoth levels of debt.

The reason I look for Cash Cows is because they have a lot to work with when it comes to moving their share price higher. They’re not pumping their stock.

Naturally, as a growth investor, I like to see that money invested in the company. It could be on a new product line, innovations in R&D, smart acquisitions, broader market, and well-calculated expansions. As long as it’s being used to create more money within the short-medium term, I like it.

On top of this, Cash Cows are able to LEGITIMATELY repurchase stock, pay dividends and acquire competition. They’re not taking out any debt to do it, rather they pay with cash on hand… cash that they’ve earned… cash they don’t need to repay at a later date from future earnings.

But most importantly… having lots of money on the books insulates them from the credit market turning expensive.

Let me underline that…

Prosperity Growth Leaders have to be flush with cash to qualify.

They could be great businesses, but if they’re shackled down by debt then that’s going to slow their growth — and even cut their stock price down when rates begin to rise.

It’s not just the rates rising that having lots of cash protects them from. Their stock does not need to be “artificially” boosted by money men. Their abundance of cash protects them from the Pump and Slump Scandal of 2016.

Now, let me make it clear…

Prosperity Growth Leaders are

THE BEST in Their Industries

And it wouldn’t be a stretch to say that these companies are the best in the world.

These are companies that investors will love, rain or shine, because of their competitive advantage.

They’re the businesses that will provide safe, consistent gains and stay shielded from market pullbacks.

Take Apple for example…

Around 24 months ago, Apple was getting a lot of attention…

Barclays had just lifted its price target by $60 a share. Barron’s magazine had ranked it #1 for stellar operating performance. And the stock was only selling at around 7x forward earnings.

But the real difference — the real proof — that made me confident of it producing a safe gain over the S&P 500 was the Cash Cow.

It could “print” money at will.

With products like the iPhone, iPad, MacBooks sitting on top of the mammoth revenue it pulls from being the largest seller of music both online and offline I could see it had long-term potential to produce huge sales.

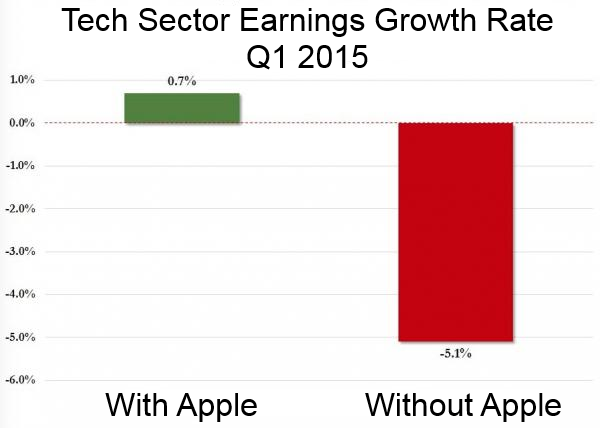

And I was proven right, just take a look at this recent chart showing tech earnings with and without Apple…

Clearly Apple is the Cash Cow of the industry.

It went on to grow from $62.45 to $125.95. An increase of 101.65%. Good enough to turn $5,000 into $10,082.

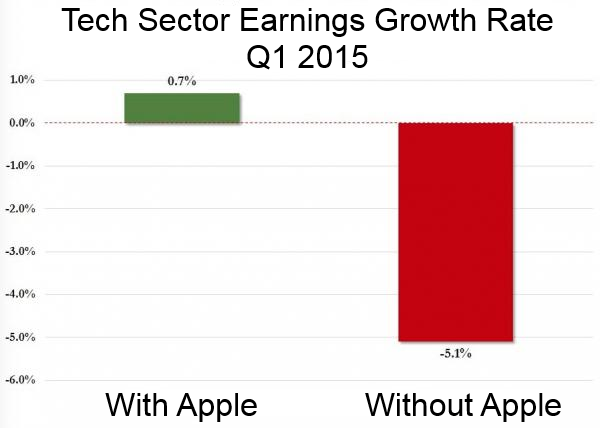

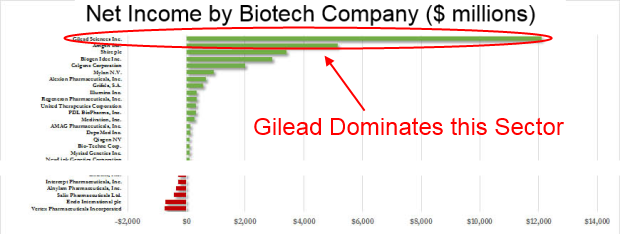

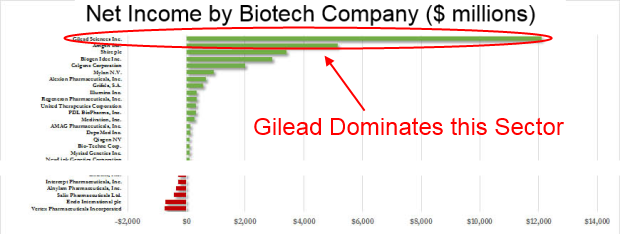

Another example is Gilead Sciences…

Around the same time as I took up a position on Apple, Gilead Sciences qualified itself as a Prosperity Growth Leader.

Just like Apple it had solid data behind it…

Shares came in 60 cents above consensus. 13x forward earnings. An increase in sales.

But it was also a Cash Cow.

It had two very successful — and very profitable — drugs lines. One for HIV, the other for Hepatitis C.

On top of this, the company was clearly the best investment in biotech…

While most other companies were chalking up losses, Gilead continued to make millions in profit.

This moved it from $80.03, to $104.82. An uptick of 30.98%.

Your $5,000 would have become $6,549.

By now you’re seeing how Prosperity Growth Leaders can protect — and grow — your money. These are just two examples of the same type of stocks I want to give you shortly. But first let me make something clear…

Prosperity Growth Leaders Offer You the Chance to Maximize Gains by up to 2,323%

There’s a second source of income you get from Prosperity Growth Leaders, on top of the returns you book, year after year.

I’m talking of course about dividends.

Many of the companies in this group are large enough — and profitable enough — to pay dividends to investors… dividends they can afford to pay from real cash flow, not by taking on ever increasing amounts of debt.

This is good news for you, because it’s another safety net against any rate hike or market pullback.

But on top of that…

It gives you a way to maximize your gains by up to 2,323%.

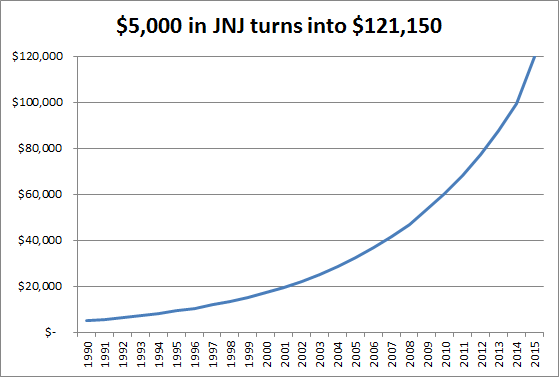

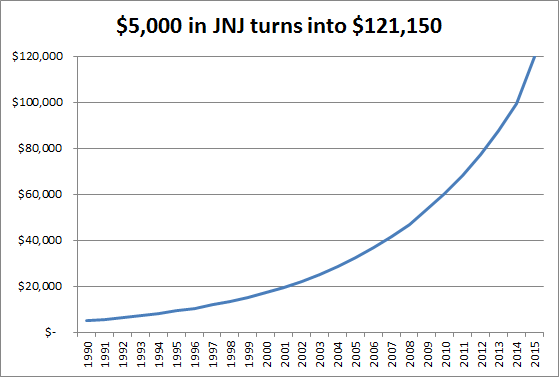

Just look at what would’ve happened if you had invested $5,000 in Johnson & Johnson in 1990…

That $5,000 has turned into $121,150. A 2,323% return.

What you’re seeing are real numbers from compounding dividends. Every time a stock pays out a dividend, you reinvest in new stock. This leads to your $5,000 not only growing with the stock, but growing with every dividend payment.

Let me show you another example…

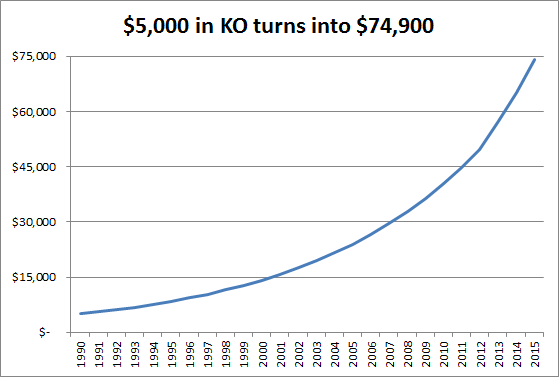

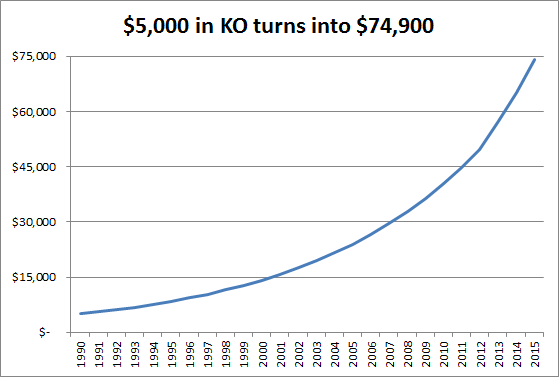

If you had invested $5,000 in Coca-Cola at the same time you got in with Johnson & Johnson, you would be sitting on $74,900 today…

A return of 1,398%.

Similar numbers can be shown for well-known stocks like Procter & Gamble, Colgate-Palmolive, Lowe’s and many others.

Of course, you may not hold these stocks for this long — though the nature of Prosperity Growth Leaders means we’re investing in incredible businesses — but I wanted to give you a clear example of what you could potentially book from this group of stocks.

Now…

Let Me Show You Two More Examples…

I’m about to reveal to you 5 of my strongest plays to insulate yourself from the Pump and Slump Scandal of 2016, but before I do, I want to show you two more examples of past Prosperity Growth Leaders.

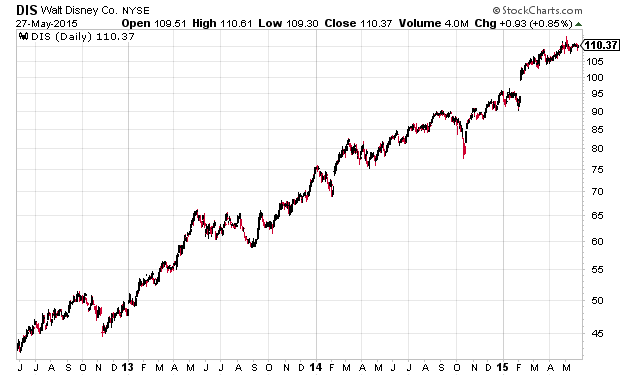

We’ll start with Disney…

Just like Apple, in 2011 Disney was investing in its future.

Most interestingly, they were already moving into Russia, China and India.

At the time it was estimated each of these countries would make it in to the top 10 of world-wide middle class consumption by 2020.

So the investments began to pay off quickly, as earnings were up 30%. Operating income in both the network divisions (Disney Channel, ESPN, ABC, etc.) and theme parks increased by 20% or more. They beat earnings by 4 cents a share. And were showing good growth overall.

But even more importantly, Disney was a Cash Cow. And they were using that earned cash to reward investors. And continue to do so to this day.

In 2012, Disney spent $3 billion on stock repurchases. In 2013 that number bumped up to $4.1 billion. And last year, it increased again to $6.5 billion. That’s a total of $13.6 billion in repurchases. In the same period of time, their debt only increased by $1.43 billion.

Now, a level of debt is expected in any business. Even a cash giant like Apple takes on debt. What I look for is what debt is spent on and how much cash the company is generating.

In the case of Disney, it was clearly producing cash faster than it could spend it.

From the date I recognized Disney as a Prosperity Growth leader in 2011, the stock has since gone from $36.70 to highs of $109.66. A 198.8% return.

A $14,940 from an investment of just $5,000.

Another is Celgene…

This biotech company, headquartered in New Jersey was a clear Cash Cow.

Their net product sales confirmed this. They had grown from $2.6 billion in 2009, to $6.4 billion in 2013. A compounded annual growth rate of around 25%.

Even more impressive is that they did this while keeping costs under control.

They clearly had a solid product line, but I wanted to make sure I knew where that money was going. So I dug deeper and found out that this company…

Has around 30 Phase III trials underway or planned for news drugs and/or indications. It’s one of the deepest drug pipelines I’ve ever seen: a sure sign that this company was investing for the future.

Altogether, this company has returned 36.04% to investors since it qualified as a Prosperity Growth Leader. Good enough to turn $5,000 into $6,802 in just 6 months.

Remember, it’s companies like these that are going to withstand (and grow from) the Fed raising rates and the coming “slump” of major stocks.

Now, let me tell you something important…

Prosperity Growth Leaders are the ONLY Group of Stocks I’m Confident Will Survive (and Prosper from) the Money Men “Pump and Slump”

Over the next 5 years, we’re going to see a shake-up of stocks of all sizes. I can only see prosperity for one group of stocks… the group I’m showing you today.

Which means small, mid and even some large caps pose a real danger to your portfolio… even if they’ve been growing fast for the last few years.

When the Fed hikes rates, the gains you’ve made over the last few years could be wiped out completely.

That’s why I’ve compiled an urgent report of 9 popular stocks — some may have a position in — that you need to drop right now.

Now that’s not to say that these stocks don’t have a place in your portfolio. In fact, they always have a place in mine. But for the foreseeable future, I’m keeping them to a small percentage of my overall portfolio.

Remember, it takes a 100% win to make up for a 50% loss.

It’s vital that you’re packing your portfolio out with stocks offering safe, consistent returns — and limiting losses.

So now you’ve seen 4 examples of how this group of stocks has protected and grown my money over the last few years…

It’s Your Turn to Profit From

Prosperity Growth Leaders

As I mentioned early on in this special report, I have assembled a portfolio of stocks to help you beat the market, year after year.

These are 5 cash-heavy plays. 5 investment plays I’m confident will protect and grow your money over the coming months and years.

So I have one question…

Can I send you these recommendations today?

Here Are 5 of My Top Picks

to Survive (and Prosper from)

the Pump and Slump Scandal of 2016

Each of the plays I’m about to show you are Prosperity Growth Leaders taken directly from my ‘Blue Chip Gems’ service. Investors have already paid as much as $199 to access them, but you won’t. You’ll get them free, today.

Of course it would be unfair to these paying subscribers to reveal the tickers here. Instead immediately after taking you through each investment opportunity and my own credentials, I’ll show you how to access them for free.

Let’s get into it…

Prosperity Growth Leader #1:

First, the Apple of the banking industry… benefiting from the rate hike…

This company is following the “Apple Blueprint”… bringing a wave of technology into their industry.

Just like how Apple was the first company to create the first mass-produced personal computer affordable to the general consumer, this bank is one of the first to start adopting a key technology to grow their customer base.

This technology has already been used by thousands, if not millions, of other businesses around the world. It’s already proven to work exceptionally well — and the banking industry is just on.

And this one company in particular is leading the charge — and my predictions estimate this banks will add a wave of new customers… leading to future growth.

On the business side of things, expenses should be about $2 billion lower in 2016 than their base level in 2014.

I’m confident this stock will continue to rise — and given long enough, I can see it doubling. For now, I recommend compounding the 2.6% dividend yield back into stock repurchases

But that’s just one of the 5 stocks I want to give you today…

Prosperity Growth Leader #2:

Next we have one company using its cash to increase dividends by 45%…

This company is a perfect example of how safe and profitable Prosperity Growth Leaders are.

As the credit around this energy company began to dry up, the entire sector pulled back. Other companies around went bankrupt. But this company — this Prosperity Growth Leader — took just a small dip, before rebounding to all-time-highs.

And the reason for that is simple…

Despite the energy sector getting beaten down, this company continued to generate a ton of cash.

In recent years this company has added capacity to its operations, built up other arms to their business (including a thriving ethanol business) and further upgraded facilities.

With future years of growth covered, it’s gone on to use its abundance of cash to increase dividends by 45% and accelerate stock buybacks. With that said, this company looks set to keep moving upwards, and the resurgent sector can only help.

Another…

Prosperity Growth Leader #3:

A company boasting 20 straight quarters of significant revenue and earnings growth… in partnership with giants like Nike…

This company is another clear Cash Cow.

Why?

2 reasons.

- Strategic partnerships with industry giants like Nike and the NBA…

- Their next closest competitor has almost 2,500 fewer stores…

To add to this, they recently announced another 100 stores before the end of the year.

And this, having just raised its dividend by 14% and upped its stock buyback program by $1 billion.

This is just one of the investments you’ll pick up free in my new report, 5 Prosperity Growth Leaders for Any Market Condition, first…

Prosperity Growth Leader #4:

The blue chip leader no one is talking about… with the most important sector of its business growing at 32% per year…

This large-cap immediately qualified itself as a Prosperity Growth Leader… and it’s not hard to see why.

This company is a true Cash Cow.

It’s currently growing the most important sector of its future business at 32% per year. This area of the business ensures they stay dominant over their competitors.

On top of that, last year they spent $5.5 billion on R&D. An amount almost no other company can match. They’re clearly a top company.

You, as an investor, can expect more rewards over the coming year. This company has just raised their dividend by 14% and plan to put $15 billion into stock repurchases.

All in all, when a company is heavily focused on keeping their competitive edge and is readily rewarding investors like this, it begins to look like a sure thing.

The last stock I want to give you is…

Prosperity Growth Leader #5:

A company taking over the largest gambling center in the world (and it’s not Vegas)…

The largest gambling hub in the world is in the city of Macau: a tiny region of China that until 1999 was a sleepy backward vestige of the Portuguese Empire. Much has changed in the last 16 years.

Today it’s being dominated by one American multinational that is taking 25% of gaming revenue.

But that’s not all, you see this company offers high-end retail property too: estimated to have a real estate value between $10 billion and $12 billion.

The money generated by both operations has let them issue $400 million in dividends and buyback $300 million in stock.

And those numbers are going up — the dividend is increasing by 30% and another $2 billion is being pumped into stock repurchases.

Now…

I expect all 5 of these stocks to protect and grow our money — even when the Fed rate hike comes and other companies find their stocks being “slumped.”

And I’m going to give you them in 5 Prosperity Growth Leaders for Any Market Condition, along with my Blue Chip Gems newsletter.

But to survive the Pump and Slump Scandal of 2016, you need my next report.

You’ll Also Receive my

“9 Blue Chip Stocks

to Sell Now”

On top of giving you my 5 top Prosperity Growth Leaders, I also want to help you identify which stocks you need to sell now.

Now-a-days it’s hard to trust the same large companies you felt secure about putting your money into.

They’ve taken your trust and used it to bolster their share price using smoke and mirrors.

Which is why it’s vital you know exactly which companies to exit.

That’s what you’ll discover, for free, in my 9 Blue Chip Stocks to Sell Now report.

Just moments from now, you could discover that 1 or 2 (or even more) stocks you own are about to collapse as part of the ‘Pump and Slump Scandal of 2016’.

I want you to take a moment to consider that.

What if you could avoid thousands of dollars’ worth of financial losses, by getting your hands on this free report?

All you need to do is get your hands on my 9 ‘Money-Men’ Blue Chip Stocks to Sell Now report.

I’ll show you how to access it shortly.

I Want to Take a Moment to Introduce Myself…

Chief Equities Analyst

As I said earlier, my name is Bret Jensen.

I’ve been an investment analyst for over 20 years, and over those years I’ve experienced a lot. In fact, 3 crucial experiences stand out — and they’re the reasons why I’m confident advising you on what stocks can protect and grow your wealth…

- I recently was ranked in the top 1.61% of investors by an independent financial audit. That’s among investors from prestigious investment houses like Piper Jaffray, Deutsche Bank and JP Morgan…

- I’ve operated and managed the investment selections in my own profitable hedge fund. Other investors, similar to you, paid me a minimum of 2% of their portfolio to manage and grow their money. For example, someone with a $1 million portfolio would pay me a minimum of $20,000 to manage their investments. And it was worth it. Under my management, the hedge fund consistently ranked in the top 5% of all long/short hedge funds (as found by an independent audit)…

- I have regularly contributed to well-known and respected investment news sources like Seeking Alpha and Real Money Pro… providing insights and investment advice for thousands… with one of the fastest growing followings with both outlets.

You could call these ‘credentials’, but the real proof comes with the gains I’ve been able to consistently deliver for my readers of my publications here at Investors Alley and my reports elsewhere.

So let me take this opportunity to show you just some of the gains my readers and I have booked…

- 296% on Eagle Pharmaceuticals…

- 101% on Apple…

- 215% on Avanir Pharmaceuticals…

- 31% on Gilead…

- 124% on Agenus…

- 198% on Disney…

- 22% on Chicago Bridge and Iron…

- 36% on Celgene…

- 36% on Greenbrier…

Its returns like these that have led to my readers writing to me with their results…

– Spence A.

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

– Jay R

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

– Paul W.

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

– M.B.

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

– Vince N.

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

But there’s one more important reason why I’ve been trusted to give over 19,771 readers investment advice…

I Invest My Own Money Alongside You

on Every Recommendation I Make,

Unlike So Many Other Advisors

When I share my investment research and recommendations with someone like you, it’s exactly that… sharing.

But as I’ve discovered, many analysts are not invested in the stocks they recommend.

They say it’s because it’s the right thing to do. They “don’t want a conflict of interest.”

To that I say…

BALONEY!

Sure, they can pretend to do this for you… but in my opinion, the real reason is that they’re scared of losing money on recommendations they’re all too happy to give you.

It baffles me how some analysts are able to play the expert yet can’t stand behind their suggestions. Especially in such dangerous times for your money.

In my eyes, the only way YOU can truly trust an analyst is if he puts his own money where his mouth is — and AFTER giving you enough time to take a position first.

And that’s why, from day one, I’ve always invested in every stock I’ve recommended. Without exception. That’s how you know that I’m always confident my picks will make money, for both of us.

Now, here’s how to get your hands on my new report, 5 Prosperity Growth Leaders for Any Market Condition…

Get Your Copy of 5 Prosperity Growth Leaders for Any Market Condition and 9 Blue Chip Stocks to Sell Now by Taking Blue Chip Gems for a “Trial Run”

All I ask is that you take a no-risk, trial-run “test-drive” of my ‘Blue Chip Gems’ investment newsletter.

The newsletter focuses on finding the Prosperity Growth Leaders and delivering them, monthly, to investors all over the world. The aim is to help investors like you and me, to grow our portfolio without the level of risk that comes with ‘money men’ and their Pump and Slump scandal.

So let me clarify what you’ll receive today.

Inside your 5 Prosperity Growth Leaders for Any Market Condition, you’ll find my latest research on the Prosperity Growth Leaders I mentioned earlier. You’ll discover how each company is a Cash Cow and how each business meets every standard needed to qualify as a Prosperity Growth Leader.

And on top of receiving your 5 investment recommendations and my urgent report on which 9 stocks you need to drop today, you’ll also receive the next two issues — that would be the July and August issues — of my Blue Chip Gems newsletter delivered to you free. Where you’ll receive…

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

Plus you’ll receive your own copy of 5 Prosperity Growth Leaders for Any Market Condition and 9 Blue Chip Stocks to Sell Now.

This is your chance to decide if you want 10 more issues, each filled with more firsthand research on Prosperity Growth Leaders.

Regularly, I would ask you for $199 to cover your subscription, research costs and exclusive access to my work.

But today I just ask that you put down a discounted deposit for new subscribers only of just $99 a year… that comes out to just $8.33 an issue.

Should you choose to continue on with me for 10 more issues, you won’t have to pay a penny more.

I’ll also extend my iron-clad guarantee…

My Promise: No-Risk to Your Money

for 60 Days

In that time you’ll have full access to all of my research and special reports.

You’ll have my top recommendations for growing your money in these uncertain times. You’ll receive the next 2 issues – that would be June and July. I want you to take advantage of everything I produce.

And then if you still feel you can’t sleep soundly at night by investing in these great stocks… then I want you to ask for your money back.

You’ll get a full, prompt and courteous refund when you call or email my office within your first 60 days. No run-around, no hard feelings, and absolutely no risk for you.

Let me spell that out that…

If, for any reason, you would like a refund of your money during the 60 day trial period… then all you have to do is say the word. I’ll promptly refund all of your money… every cent.

Sound good?

Then just click here to request your free copy of 5 Prosperity Growth Leaders for Any Market Condition and sign up for your 60 day trial of Blue Chip Gems.Now, one last thing…

You Need to Invest Now:

And Here’s Why…

The Tech Wreck of 2000 and the Great Recession in 2008 weren’t just “market cycles.”

The money men had pumped the markets up for their own profit, only to duck out before things got bad, leaving investors like you to bear the brunt of it.

Both times retirement dreams were shattered. Savings were pillaged.

And it’s going to happen again.

The activist investors, Wall Street Insiders and talking heads have gorged themselves on cheap credit to pump stock prices higher.

But that credit is about to get a whole lot more expensive. This will trigger the “slump” and is the reason you need to be protected.I’m offering you today the chance for protection with Prosperity Growth Leaders.

Remember, these are a group of stocks that have outperformed the market every year, for the past 20 years. Through bull markets and bears, through major corrections and minor blips, through low rates and rate hikes.

And they’re the group that have delivered returns like you’ve already seen… 198.8% on Disney, 30.98% on Gilead and 36.04% on Celgene.

Today you can invest in the same stocks — just click the button below and submit your details to receive my 5 Prosperity Growth Leaders for Any Market Condition and your 60 day trial to Blue Chip Gems.

See you on the other side,

Bret Jensen

Editor

Blue Chip Gems

P.P.S. Victim or Winner?

Your subscription to Blue Chip Gems is only $99, a 50% discount off the normal rate. That’s our Charter Member introductory rate. Your subscription will renew at that same rate. I would expect that the returns you’ve made over the course of the year would more than cover the subscription cost. Your satisfaction is guaranteed. If you are dissatisfied with Blue Chip Gems at any time during your first 60 days just call or email to request a 100% refund of all your money. And you may cancel any time later and never be billed again. Now that you’ve taken time to read the details and see how good this truly is, let’s get started with amazing stock research and build some wealth for you. Click here to start.

[ExitPopup exitpopupurl=”http%3a//www.investorsalley.com/amember/signup/3Hnk70iA” exitpopupcookiexpdays=”0″ exitpopsplash=”***************%20PLEASE%20WAIT%20***************%5Cn%5CnDon%5C%27t%20let%20the%20money%20men%20win%20this%20time.%5Cn%5CnProtect%20and%20grow%20your%20wealth%20with%20Prosperity%20Growth%20Leaders%5Cnlike%20the%20ones%20we%27ve%20been%20talking%20about%20in%20this%20important%20briefing.%5Cn%5CnFor%20a%20very%20limited%20time%20I\’ll%20take%20off%20another%20$20%20so%20you%20can%20start%20a%20%5Cnsubscription%20for%20just%20$79%20–%20that\’s%2060%25%20off%20the%20normal%20list%20rate.%5Cn%5CnJust%20Click%20the%20Stay%20on%20Page%20button%20below%20to%20continue.%5Cn%5Cn” ] [/ExitPopup]